Aussie inflation indicator shocks economists

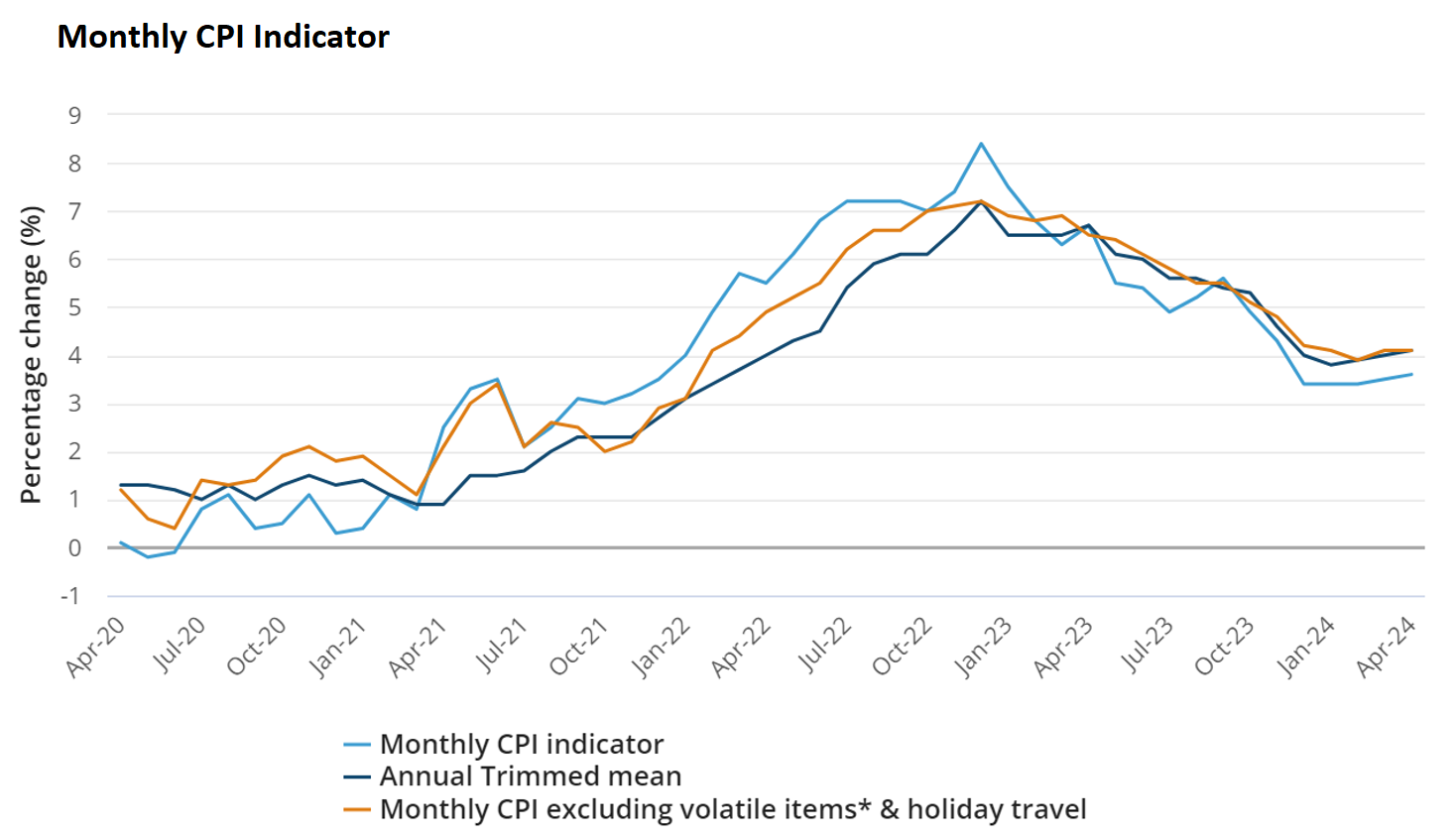

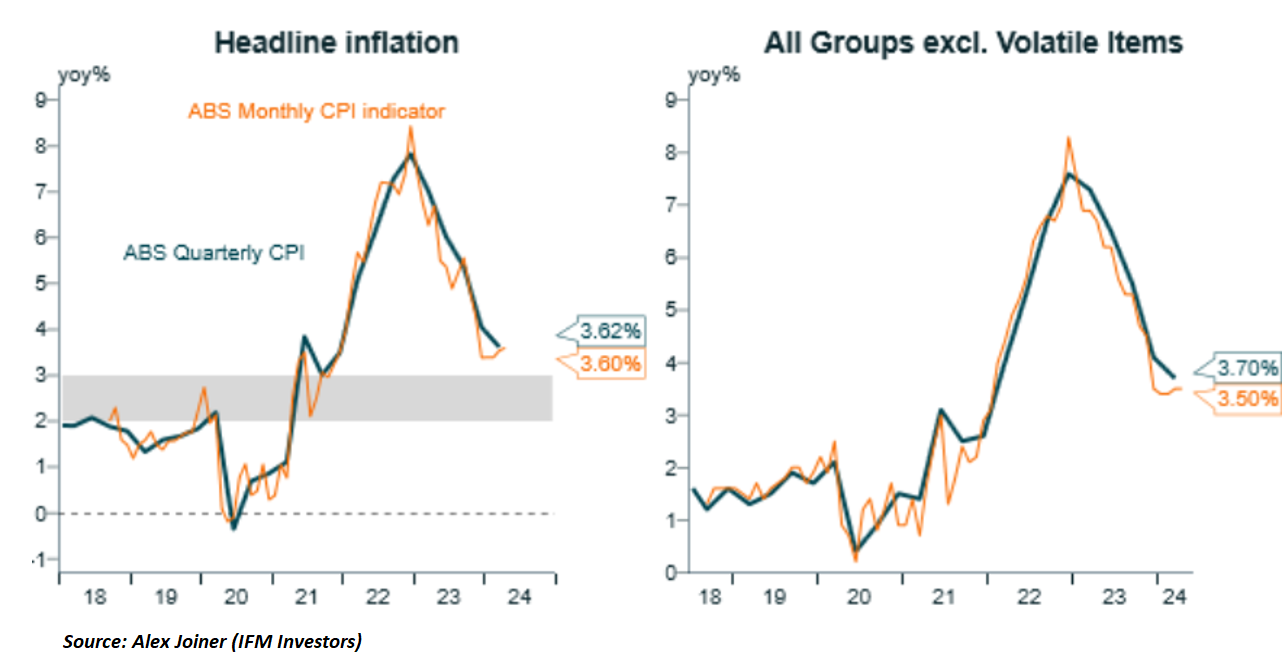

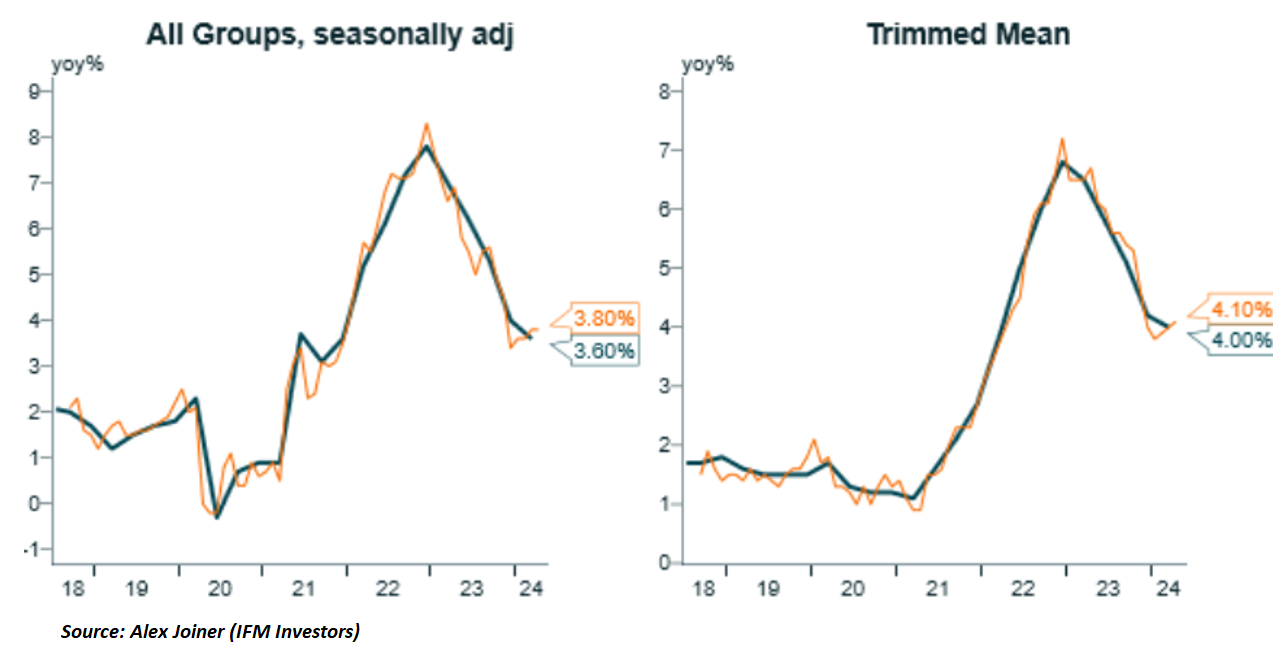

Australia’s monthly CPI indicator printed at 3.6% in April, up from 3.5% in March and higher than economists’ expectations of 3.4%.

Trimmed mean inflation was 4.1% y/y (4.0% prior).

The outcome was driven by higher petrol prices, less household goods discounting, the annual lift in health insurance premiums, stamp price rises, and a lift in food and non-alcoholic beverage prices, and alcohol and tobacco prices.

Advertisement

Looking ahead, we should see smaller CPI prints for Q3 24 owing to federal and state government electricity rebates.

As CBA economist Stephen Wu noted last week, the introduction from 1 July 2024 of the $300 electricity rebate for all households, combined with $1000 for Queensland households and $400 for Western Australian households, will weigh on the July CPI indicator.

Wu estimated that these rebates could conceivably see inflation temporarily dip below 3% annual growth in Q3 24 to be within the RBA’s inflation target.

Advertisement

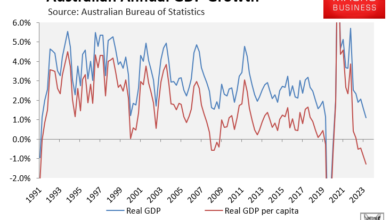

Regardless, this stronger than expected read, combined with weakening broader economic data, suggests that interest rates will remain on hold for the time being.

Rate cuts have been pushed out. But there is no trigger for hikes.

Advertisement