China’s growth tipped to slow on shaky recovery

China’s economy expanded at a 5.2 per cent annual pace in October-December, compared with 4.9 per cent in the previous three months, as the slow post-pandemic recovery showed signs of improvement, the statistics office said. However, this was below economists’ fourth quarter growth projections of 5.3 per cent.

Despite the subdued outlook and a sharp fall in property development last year, China’s imports of Australian iron ore held up well as steelmakers continued to stockpile the commodity despite mounting losses. China’s iron ore imports hit a record 1.18 billion tonnes last year, although analysts said that level of demand could not be maintained.

Mr Xi’s No. 2, Premier Li Qiang, earlier revealed the economic growth numbers at the World Economic Forum in Davos, using an address to pitch China as being open for foreign business and a driver of the global economy.

“The Chinese economy can handle ups and downs in its performance. The overall trend of long-term growth will not change,” Mr Li said. “The Chinese economy is making steady progress and will continue to provide strong impetus for the world economy.”

Economists already sceptical of the official Chinese government data were less optimistic. Many are warning China faces its toughest year in decades as years of robust expansionism give way to a new era of hardships where growth will remain respectable but decline year-on-year for the foreseeable future.

Property was the biggest worry as investment in real estate development fell 9.6 per cent in December. Economists have warned China’s high local government debt is another risk to growth as income from new land sales dries up. Unlike the rest of the world, China has also been hit by deflationary pressures as low consumer confidence sends prices down.

Economists expect China’s growth to fall below 5 per cent this year, as Mr Xi struggles to fix the country’s property crisis, along with declining exports, rising unemployment and falling foreign investment. A US-led push for global investors to diversify away from China is also leaving the country more isolated economically than it has been for years.

ANZ’s chief economist for greater China Raymond Yeung said he expected China’s GDP growth to slow to 4.2 per cent in 2024.

“China’s economic recovery will mainly depend on the timing of property recovery. Property investment contracted 9.6 per cent in December 2023. The timeline of property market stabilisation remains uncertain,” he said.

A Reuters poll found growth was expected to slow to 4.6 per cent in 2024 and 4.5 per cent in 2025.

Markets in Asia fell after the GDP data was released. The benchmark S&P/ASX 200 Index fell 0.3 per cent, or 21.7 points, to 7393.1. Chinese property stocks listed in Hong Kong fell sharply, while markets in Shanghai and Shenzhen were also lower.

China’s retail sales, a gauge of consumption, rose 7.4 per for the year, compared with 8 per cent forecast by analysts and 10 per cent growth in November. However, they outstripped a 4.6 per cent growth in industrial output.

Michael Pettis, a finance professor at Peking University, wrote on X that this suggested a narrowing of the gap between GDP and consumption which the government was hoping to achieve, although that was just reversing the gap that emerged during the pandemic.

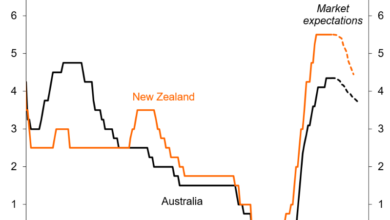

With Beijing tipped to keep its annual growth target at 5 per cent this year, economists said more aggressive stimulus would be needed to hit that goal. The People’s Bank of China held its policy rate steady this Monday despite expectations for a 10 basis point cut.

So far, China’s slowdown has not affected demand for key Australian commodities such as iron ore, although miners expect this will decline over the medium term as growth keeps shrinking.

Customs data released last week showed China’s iron ore imports again surprised on the upside, surging 6.6 per cent in 2023 from a year earlier. This was good news for Australia, the world’s biggest iron ore exporter to China, as the increased demand came despite a softening property market.

Mr Xi’s economic headwinds at home are also expected to affect how he seeks to engage with Australia and the rest of the world this year.

At the World Economic Forum, Mr Li followed up his speech with a private lunch involving the top Wall Street bank CEOs, including JPMorgan’s Jamie Dimon, Bank of America’s Brian Moynihan, Standard Chartered’s Bill Winters and Blackstone boss Steve Schwarzman.

Chinese Premier Li Qiang speaks at Davos. AP

On the podium, he vowed that Beijing would keep opening up and reforming its markets, creating “favourable conditions for the world to share in China’s opportunity”, which included an expanding talent base and a growing middle class.

“Choosing the Chinese market is not a risk but an opportunity. We embrace investment from all countries with open arms,” he said. “We hear the views of foreign businesses regularly, and for the reasonable concerns we will take active steps to address them.”

But Mr Li was less sanguine about the global economy, saying discriminatory trade measures were increasing, and fragmentation would “only leave the world economy more fragile”.

China’s ambassador to Australia, Xiao Qian, said on Wednesday he could not put a date on when China’s final trade sanctions against Australian exports would be removed, just hours after Prime Minister Anthony Albanese declared his confidence that wine tariffs would be lifted by the end of March.