Ingore the lies, Australians are in recession

In this week’s episode of the Treasury of Common Sense, I unpacked Wednesday’s Q1 national accounts release from the Australian Bureau of Statistics (ABS) and explained how Australians are experiencing a deep recession.

I also explain why commentary on the economy is wrong because the media and policymakers concentrate on the wrong thing: aggregate GDP rather than per capita outcomes.

Edited Highlights:

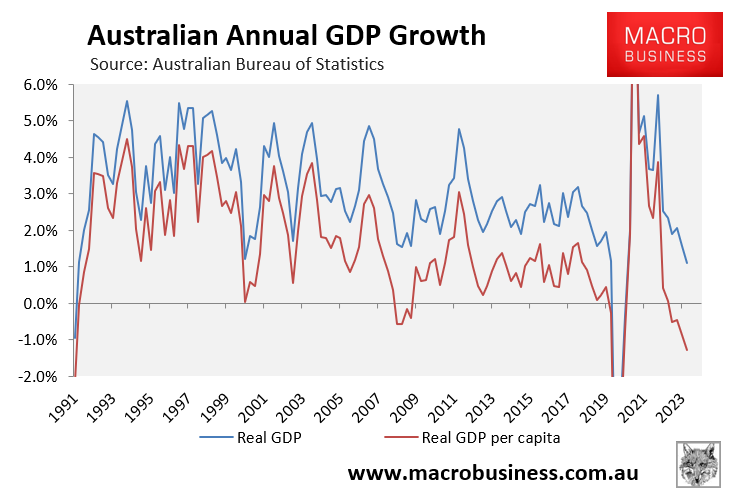

Wednesday’s national accounts were an absolute stinker. GDP growth slumped to its lowest level since the early 1990s recession, outside of the pandemic.

Advertisement

The economy grew by 0.1% over the quarter to be only 1.3% higher year-on-year. The result was worse than what economists and also the RBA had expected.

The RBA’s latest forecast suggested that we were going to get 0.3% growth. Instead, we got 0.1%. So it missed by a fair margin.

Advertisement

But more importantly for you and me, all the other listeners out there, whether or not the economy grows is not really that important, in my view.

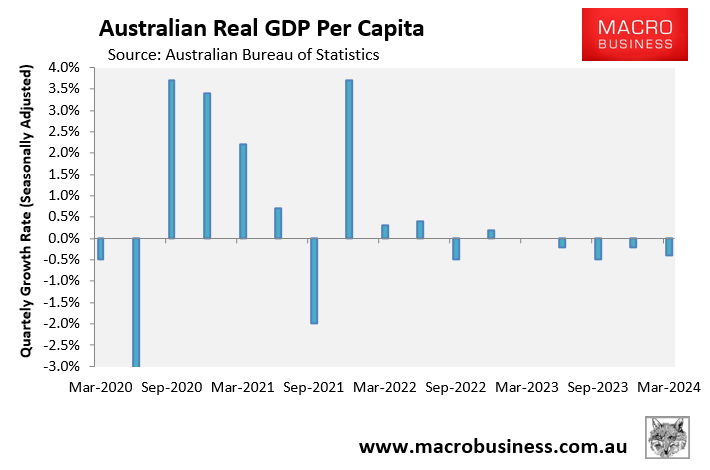

What really matters is what our slice of the pie is, i.e., per capita GDP. It actually fell by 0.4% to be down 1.3% over the year.

Advertisement

That was also the worst per capita GDP result since the early 1990s recession. And what makes this even worse is that the overall economy decelerated for five consecutive quarters. It’s gotten slower and slower over the last five quarters.

If you actually take the six-month annualised pace of GDP growth, it shows that the economy in total only grew by 8% annualised compared to population growth of 2.4%.

So what that tells you is that the economy is contracting very quickly in per person terms, which is obviously what matters.

Advertisement

The overall economy is still growing very modestly, but the average size of that slice of the pie that you and I and everyone else in Australia are getting is shrinking. And it has shrunk for five consecutive quarters.

It is a deep per capita recession and the strange thing is that RBA governor Michele Bullock told Senate estimates on Wednesday that she didn’t think the per capita recession was very relevant, which, to be quite honest, made me flabbergasted.

I would like to see a world where every time the ABS reports the national accounts, and every time the media reports it, they report the GDP per capita number. They don’t report the overall GDP because, to be quite frank, it is irrelevant.

Advertisement

Australia could have a population growing by 5% a year and sure enough, the economy would grow fast. But what matters is what is happening to our standard of living.

All this national accounts release shows is that the economy is only being kept out of recession by historically strong population growth.

It is a ridiculous economic model. We just bring in heaps of people, those people spend and work in the economy, and that keeps the economy ticking over.

Advertisement

But once you divide that growth with the additional people, we are all going backwards.

I thought it was a bit flippant of the RBA Governor just fob off the per capita recession and say that it doesn’t really matter. Because it does matter. It matters to all of us.

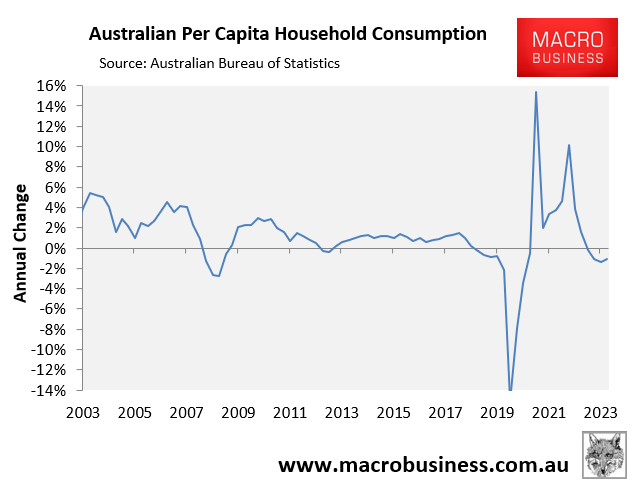

It has been the household sector that has driven the economic decline.

Advertisement

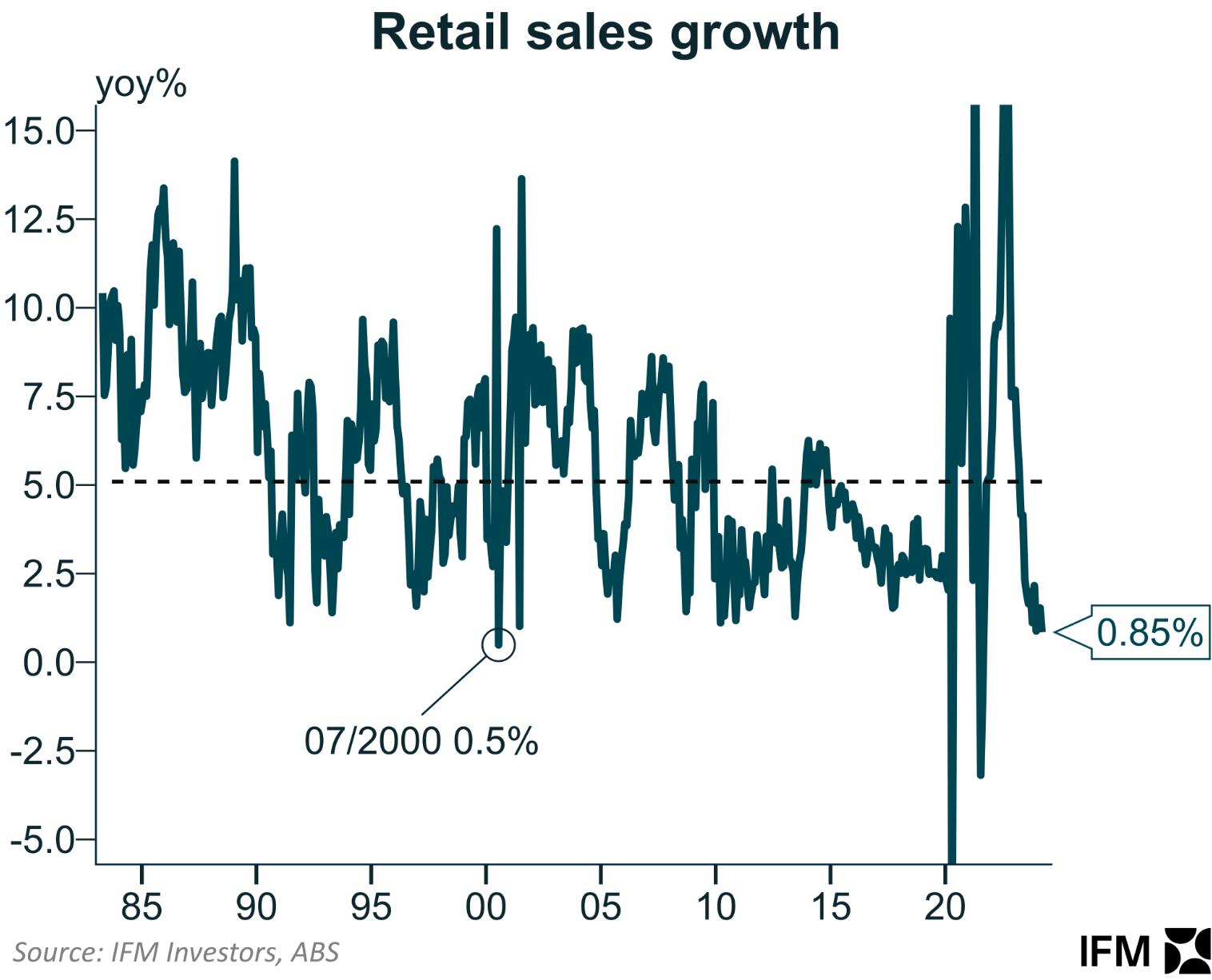

Real consumer spending has fallen for five consecutive quarters, which was also reflected in the latest retail sales, which were also the weakest in 30 years outside of the pandemic and crashed in per capita terms.

Advertisement

Normally, this sort of decline would be associated with a large negative shock and full blown recession. But we’re not getting that because of the high population growth.

Real household disposable income per capita also fell by 0.3% over the quarter and sits 0.4% lower over the year. So incomes are falling.

It is a consumer-led per capita recession that we have and it is hitting households the hardest.

Advertisement

That is the reason why the economy is in a hole. And what it means is that the unemployment rate is going to keep rising because GDP tends to lead employment, and ergo unemployment.

We are going to keep seeing rising unemployment for the rest of the year, which means we are going to have lower wage growth.

Wages are already down significantly in real terms. They have collapsed to about 2010 levels.

Advertisement

We are also likely to get further real wage falls from here. And this basically paints a picture of a really sick economy where per person living standards, which is what matters, are deep in the red.

However, it doesn’t mean a lot for interest rates at this stage. Because, while the economy is weakening faster than the Reserve Bank expected, unfortunately, inflation is a little higher than they expected.

Advertisement

So, the RBA has got a tug of war going where they’re trying to balance two things: the inflation side of the equation, which is a little bit worse than what they wanted, with an economy that is worse than what they want.