No sign of ‘outright price gouging’ as ASX companies report mega profits, analyst says

There was quite a bit of pessimism among Australia’s largest companies ahead of the February reporting season, which has just wrapped up.

After all, their profits were under threat from higher costs (particularly wages and utility bills), the possibility of another Reserve Bank rate hike, a slowdown in consumer spending, rising unemployment, and a potential recession.

Despite those risks, most publicly-listed companies managed to report “better than feared” financial results, as one market analyst put it, which has helped push the Australian share market to new record highs.

“You will see the economy slowing down this year,” said Jun Bei Liu, portfolio manager at Tribeca Investment Partners.

“But the share market will continue to head higher, mainly because investors are always looking 12 months ahead.

“And our economy should be in a much better place, with interest rates at least steady, if not lower, tax cuts, immigration continuing to be very strong, and hopefully China’s economy turning around.

“That’s why investors are very bullish at this point.”

Although 81 per cent of the companies listed on the ASX 200 earned a profit, that was the lowest result in nearly four years, according to analysis from CommSec economists Craig James and Ryan Felsman.

They also observed it had become harder for companies to make money, with total profits falling 35 per cent in the half-year to December 2023.

In spite of that, shareholders of Australia’s largest 200 companies will be paid $33.9 billion in dividends in the coming months — which is a slight (0.2 per cent) decrease from last year.

“The fact that many companies are prepared to continue to pay reasonable levels of dividends points to the health of the Australian economy, and the confidence that CEOs and boards have for the earnings outlook,” said Andrew Tang, co-head of investment strategy at Morgans.

Consumer discretionary the surprise winner

To the surprise of many analysts, retailers in the ‘consumer discretionary’ sector like Lovisa, Nick Scali and Harvey Norman posted better-than-expected earnings (and saw big increases to their share price).

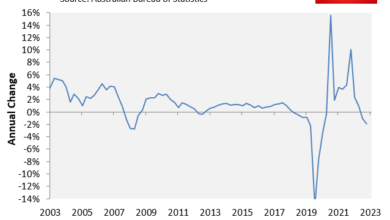

Admittedly, expectations were quite low given the latest Australian Bureau of Statistics (ABS) figures indicate consumers are feeling poorer after 13 interest rate hikes and are seriously reducing their non-essential spending.

“They’re probably one of the top performing sectors, just simply because things aren’t as bad as people expected,” Ms Liu said.

However, supermarket giant Woolworths fared worse-than-expected, with a 2.5 per cent rise in underlying half-year profit (or a $781 million statutory loss, depending on how one wants to dissect the results), and a 13 per cent fall in its share price since the year began.

“I think going forward, it’s going to be a lot more difficult for them to outperform,” Mr Tang said. “Particularly given the government’s view that they’re perhaps taking a little bit more from the Australian consumer than then they’re entitled to.”

Woolworths chief executive Brad Banducci brought forward his retirement (much earlier than many had anticipated), following his disastrous walk-out from a Four Corners interview last month.

Insurers surge amid lack of competition

Insurance companies were also regarded as some of the biggest winners of the February reporting season, with the likes of QBE announcing its annual profit had more than doubled.

“It’s a sector that’s done uniformly, regardless of their management skills,” said Hugh Dive, chief investment officer of Atlas Funds Management.

“They’ve had a combination of good underwriting, high interest rates and increasing premiums.”

Mr Dive noted that Suncorp and QBE reported “their best results in decade or so”, and the industry benefited from a lack of major competition.

“On the east coast, you’ve got two very large brands — IAG and Suncorp, and their subsidiary brands — that have a market share of around 80 per cent,” he said.

“There are some smaller brands that are creeping in. But there are bigger brands like QBE, which operates globally, and they’re therefore big, nasty, very difficult competitors.”

He also said insurers’ profit margins were bolstered by a “lower level of catastrophes” (or natural disasters) — so their payouts to customers were not as high as expected.

The ABS says the price of insurance jumped 16.2 per cent in the year to December, its biggest price hike in 23 years.

It was far higher than the annual increases in rent (7.3 per cent), electricity (6.9 per cent), quarterly inflation (4.1 per cent) and wages (4.2 per cent).

“A lot of companies are able to offset the rising costs by pushing up prices,” Mr Tang observed.

“But in terms of outright price gouging, it’s very difficult to ascertain from some of the results that we’ve seen.”

Looking ahead, Mr Tang believes it may be harder for insurers to maintain their strong performance.

“Given the political environment which we’re in — where inflation is looking to be a little more persistent than expected — I think companies in the utilities, energy retail and insurance space, are likely to come under the microscope a bit more,” he said.

“So it’s going to be a lot more difficult for those type of companies to really see profit margins expand.

“And it could be a more challenging for them just to stay out of the political spotlight.”

Miners underperforming

On the flip side, Australia’s mining sector generally reported earnings which fell below expectations.

“One of the bigger losers in this reporting season was South32, hit by the trilogy of rising labour and unit costs, falling commodity prices and production issues,” according to Mr Dive.

In mid-February the diversified miner reported its half-year profit had plunged 92 per cent to $US53 million, and its share price is down 13 per cent since the year began.

Commodities that are used to make electric batteries have fallen sharply over the past year. Nickel is down nearly 30 per cent, while lithium has collapsed by around 70 per cent.

This led to mining billionaire Andrew Forrest shutting down his nickel mine near Kambalda in Western Australia in January, after buying it six months earlier for $760 million.

BHP is planning to shut down its Nickel West division in WA, while Core Lithium has closed its Grants mine near Darwin.

Potential opportunities

Whether the share market continues to rise (and by how much) will depend largely on the Reserve Bank’s next move.

Market traders have fully priced in the first interest rate cut by September, with a 75 per cent likelihood of a follow-up rate cut by Christmas.

“If we do see cuts in interest rates, that’ll be very positive and could possibly see further highs in the market,” Mr Dive said.

These highs are certainly being seen on Wall Street’s tech sector, as stocks with anything to do with artificial intelligence (AI) have skyrocketed, including NVIDIA, Facebook’s parent company Meta, Amazon, Microsoft and Google’s parent Alphabet.

“Australia is a little bit limited” when it comes to stocks with AI-exposure, according to Ms Liu.

She says companies which build or own data centres will benefit from the technology stock rally, as it requires an extraordinary amount of computing power to train machines to think like humans.

In that regard, she believes NextDC and Goodman Group stocks will be driven higher by the AI trend.

As for where the best opportunities lie, Mr Dive suggests looking into “sectors that are beaten up and out of favour”.

“It’s obviously not our consumer discretionaries at the moment. But look at interest rate-sensitive sectors, so that’s listed property and infrastructure. They’ve had a bit of a tough time over the past year.”

Risks ahead

There is a risk markets could experience a correction or fall significantly if cost-of-living pressures do not subside quickly.

“If inflation does remain elevated, and companies aren’t able to pass on their costs like they have over the last few years … we’re likely to see perhaps some [share price] downgrades in the near term,” said Mr Tang.

Mr Dive, however, warned the “biggest risk out there is the iron ore price”, which is currently trading around $US115 ($177) per tonne.

The price of this steelmaking commodity will largely be influenced by China’s future economic performance.

In that regard, China is currently navigating a prolonged property slump, an aging population, deflation and economic malaise.

“If iron ore was to crack, and fall back towards its marginal cost of production, $US80 a tonne, it could be a bloodbath for the resource sector, and that will drag the [ASX 200] index down,” Mr Dive said.

He also noted “it wouldn’t be very good for government finances”, given Australia relies heavily on iron ore sales to bolster its budget position.

Storm clouds overseas could have a major impact on the Australian share market.

“The biggest risk will be geopolitical, whether there’s trade war, or other issues coming through the Middle East, and the US election,” Ms Liu said.

And there’s always the risk the economy could tip into recession — though that’s viewed as a long shot by most market analysts, for now.

Disclaimer: the contents of this article are not intended as investment advice.