State governments pump inflation – MacroBusiness

CBA senior economist Belinda Allen has undertaken a detailed investigation into public sector capital expenditures (capex).

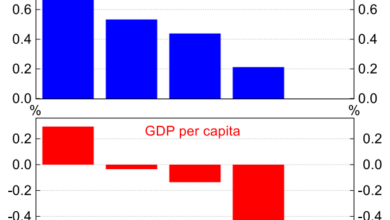

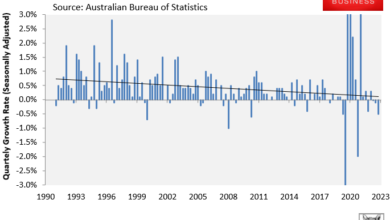

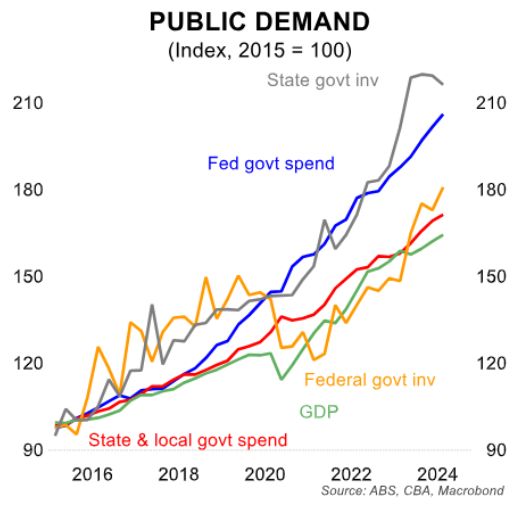

Allen notes that the government share of GDP is sitting at close to record highs (outside of the pandemic period):

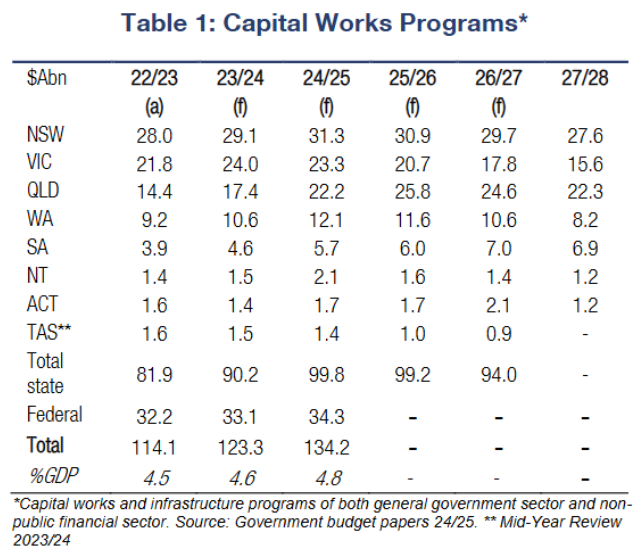

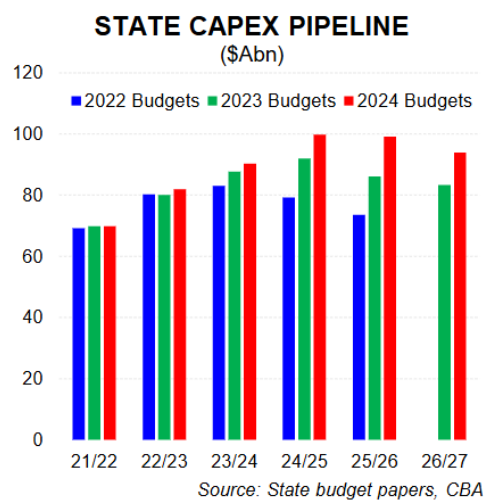

Public sector capex is projected to total $134 billion in 2024-25, a record high:

Advertisement

This equates to 4.8% of GDP, higher than the proportions in both 2022/23 and 2023/24.

“The lift in capex spending from 2021-22 till 2024-25 is a large 33% for both Federal and state governments combined”, notes Allen.

Advertisement

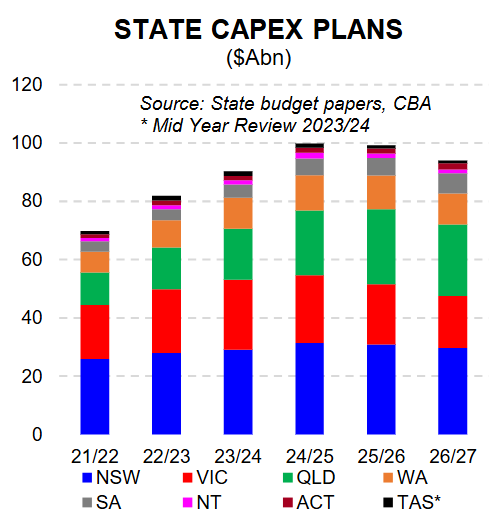

However, the states are leading the charge with a 34% lift compared to 10% for the federal government:

The expanded pipelines of work alongside higher costs have meant that “the peak in the capex pipeline now sits in 2024-25 and over $20 billion higher than estimated just two years”, notes Allen.

Advertisement

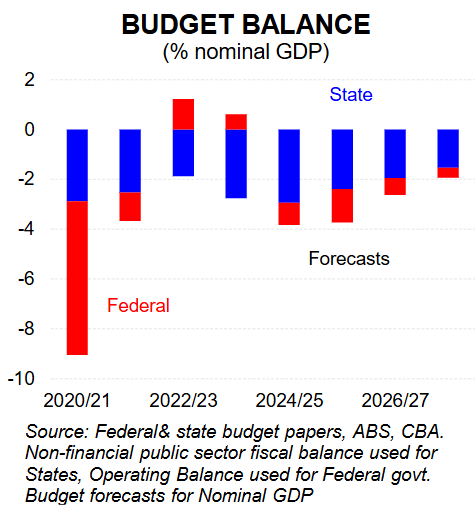

The increase in infrastructure spending is one of the reasons why the state governments have pushed the overall budget position into deficit:

Advertisement

Allen notes that the heavy infrastructure investment, primarily by the states, is a double-edged sword.

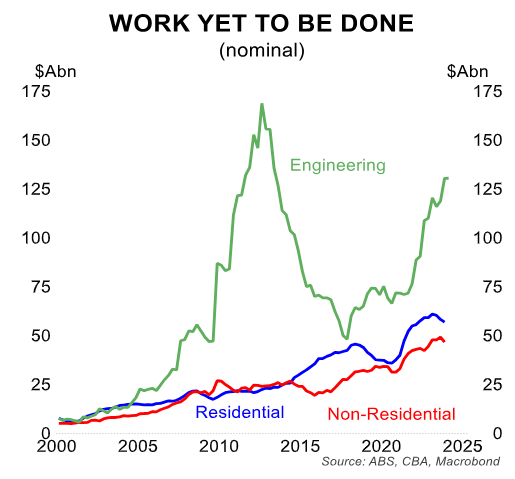

In the short-run, “the large pipeline of work has contributed to some crowding out of private business investment and dwelling investment as well as persistent cost pressures in the construction and engineering space”.

Advertisement

“Capacity is constrained in the construction sector and cost pressures remain acute. The residential construction industry continue to highlight that public infrastructure projects are drawing workers who would other work in the residential space”.

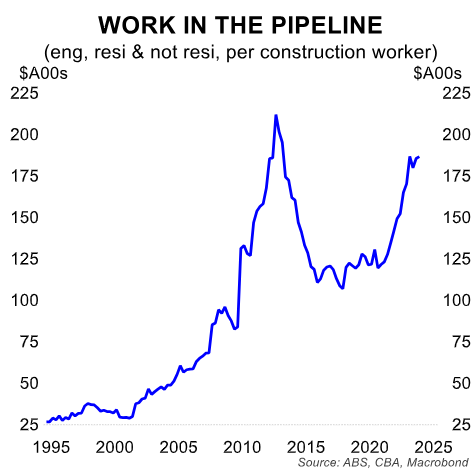

“Outside of the mining investment boom, work in pipeline per construction worker is at record highs”.

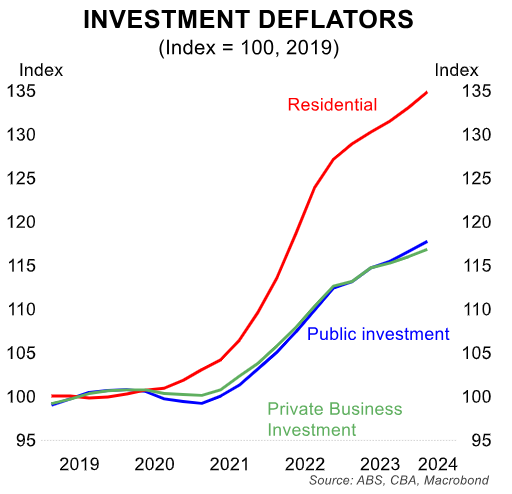

“Persistent labour and material costs are likely to continue and will continue after also rising significantly since 2020”, Allen warns.

Advertisement

In this regard, the states are adding to domestic demand and Australia’s inflationary pressures.

However, “over the medium term, we expect this work to add to productivity growth and lower inflation”.

Advertisement

I will add that the states are caught between a rock and a hard place.

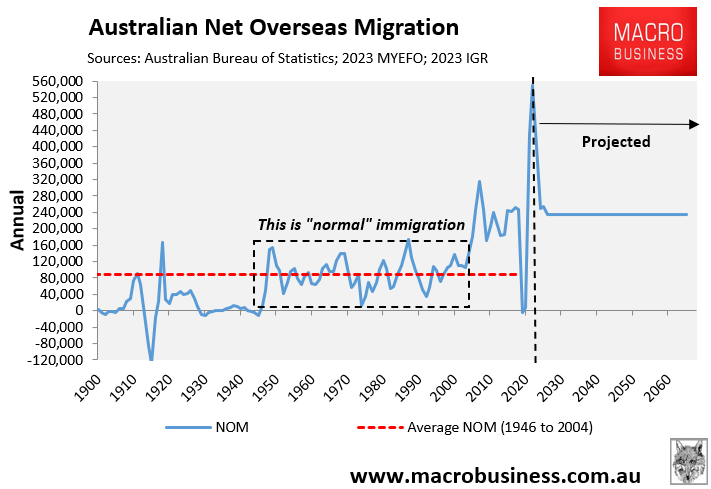

The federal government has chosen to run a high population growth policy. Therefore, the states need to build infrastructure to accommodate their ballooning populations.

Advertisement

Otherwise, infrastructure and services will become increasingly congested, resulting in deteriorating living standards for residents and lower long-run productivity growth via capital shallowing.

The solution is to lower net overseas migration to a level that is commensurate with the nation’s capacity to build homes and infrastructure and doesn’t place upward pressure on costs and inflation.

Australia needs a significantly smaller, better targeted, and more skilled migration system.

Advertisement