5 Best Forex Brokers in Brazil (☑️Updated 2024*)

The 5 best Forex brokers in Brazil revealed. We have explored and tested several prominent brokers to identify the 5 bests.

In this in-depth guide you’ll learn:

- What is a Forex broker in Brazil

- Who are the best brokers are

- Pros and cons of each broker

- Popular FAQs about the best Forex brokers in Brazil

And lots more…

So, if you’re ready to go “all in” with the 5 best Forex brokers in Brazil…

Let’s dive right in…

Best Forex Brokers in Brazil

| 👥 Best Forex Broker in the Brazil | 💰 Minimum Deposit | ⚖️ Regulators | ✔️ Accepts Brazil Traders |

| AvaTrade | BRL 495.72 or $100 | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA | ✔️ |

| IC Markets | BRL991.44 in $200 | ASIC, CySEC, FSA, SCB | ✔️ |

| Saxo Bank | None | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA | ✔️ |

| FP Markets | BRL 495.72 or $100 | ASIC, CySEC, FSCA, FSA, FSC | ✔️ |

| Exness | Based on chosen regional deposit method | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA | ✔️ |

🏆 10 Best Forex Brokers

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  |

Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  |

Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 🥉 |  |

Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  |

Read Review | SFSA, FSCA, CySec* | USD 5 | Visit Broker >> |

| 5 |  |

Read Review | IFSC, FCA, CySEC, ASIC, CMA | USD 5 | Visit Broker >> |

| 6 |  |

Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  |

Read Review | IFSC | USD 10 | Visit Broker >> |

| 8 |  |

Read Review | Not Regulated | 0.001 BTC | Visit Broker >> |

| 9 |  |

Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  |

Read Review | SVGFSA | USD 5 | Visit Broker >> |

What is a Forex broker in Brazil?

Forex traders in Brazil often opt for international brokers due to a wider range of currency pairs, advanced trading platforms, and competitive pricing.

Additionally, international brokers offer access to global financial markets, better liquidity, and regulatory oversight from established authorities, providing traders with enhanced opportunities and flexibility for their investments.

5 Best Forex Brokers in Brazil

- ☑️AvaTrade – Overall, Award-winning trading platforms

- ☑️IC Markets – The Best Forex Broker in Brazil

- ☑️Saxo Bank – Best Trading App

- FP Markets – Global, multi-regulated broker

- Exness – Best multi-asset financial services

The 5 Best Forex Brokers in Brazil

Below is our definitive list of the 5 best Forex brokers in Brazil that offer a feature-rich environment with sound regulation.

AvaTrade

Overview

AvaTrade stands out as an excellent choice for Forex traders in Brazil for several reasons. Firstly, it offers a diverse range of currency pairs, including those involving the Brazilian real, enabling traders to access key markets efficiently.

Secondly, AvaTrade provides user-friendly trading platforms equipped with advanced tools and analytics, catering to both novice and experienced traders.

Additionally, the broker offers competitive spreads, low fees, and various account types to suit different trading preferences and experience levels.

Furthermore, AvaTrade is regulated by reputable authorities such as ASIC and the Central Bank of Ireland, instilling trust and confidence among Brazilian traders. Its multilingual customer support ensures assistance in Portuguese, addressing any concerns promptly.

Overall, AvaTrade’s comprehensive features, regulatory compliance, and customer-centric approach make it a compelling option for Forex traders in Brazil seeking reliable and accessible trading services.

Unique Features

| Feature | Information |

| ⚖️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA |

| 💻 Account Types | Retail Account, Professional Account |

| 💵 Minimum Spread | From 0.0 pips |

| 💸 Minimum Deposit | BRL 495.72 or $100 |

| 📱 Platforms Supported | AvaTradeGO

AvaOptions AvaSocial MetaTrader 4 MetaTrader 5 DupliTrade ZuluTrade |

| 📈 Range of Markets | Forex

Stocks Commodities Cryptocurrencies Treasuries Bonds Indices Exchange-Traded Funds (ETFs) Options Contracts for Difference (CFDs) Precious Metals |

| 📊 Demo Account | Yes |

| ✴️ Social Trading Offered | Instagram

YouTube |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| AvaTrade supports the construction of diversified investment portfolios by offering a wide selection of trading instruments, including forex pairs, equities, commodities, indices, and cryptocurrencies. | Some users have noted that the spreads are more substantial in comparison to other brokers, potentially impacting trading expenses, especially for those who trade frequently. |

| The facilitation of social trading is achieved through the incorporation of AvaTrade and ZuluTrade, which enables users to observe and imitate the strategies utilized by successful traders. | When compared to alternative platforms, the research and analysis tools provided by AvaTrade may be deemed somewhat limited, which could hinder some traders from undertaking thorough market analysis. |

| AvaProtect offers advanced technical analysis and charting, AvaSocial enables social trading interactions, and AvaTradeGo simplifies mobile trading. | Inexperienced traders might perceive the advanced functionalities and resources of the platform as overpowering, thereby requiring a phase of dedication to completely master. |

| AvaTrade ensures a secure and dependable trading environment for its clients by adhering to the regulations set forth by various reputable regulatory bodies, such as the Central Bank of Ireland and the Financial Services Commission of the British Virgin Islands. | Despite the provision of customer support by AvaTrade, certain clients may encounter dissatisfaction because of discrepancies in service quality and responsiveness. |

| AvaTrade offers a diverse range of educational materials to traders, including webinars, tutorials, and market analysis, with the intention of augmenting their knowledge and comprehension. | Occasional reports have surfaced concerning complications or delays associated with the AvaTrade withdrawal process. Individuals who require prompt access to their funds might perceive this as an unfavourable situation. |

Trust Score

AvaTrade has a high trust score of 96%

IC Markets

Overview

IC Markets is an excellent choice for traders in Brazil seeking reliable Forex trading services. With ultra-low spreads starting from as low as 0.0 pips, it ensures competitive pricing.

Traders can access a wide range of currency pairs, including BRL crosses, facilitating seamless global market participation. IC Markets offers advanced trading platforms such as MetaTrader 4 and 5, equipped with powerful analytical tools and customizable features, catering to diverse trading strategies.

Additionally, the broker provides access to other assets like CFDs on indices, commodities, and cryptocurrencies. Leverage options are available up to 1:500, allowing traders to amplify their positions.

IC Markets prioritizes transparency and security, regulated by reputable authorities like ASIC and CySEC. Brazilian traders benefit from multilingual customer support and localized account conditions, making it convenient and accessible.

Overall, IC Markets’ combination of low spreads, advanced platforms, diverse assets, generous leverage, and regulatory compliance makes it a top choice for traders in Brazil.

Unique Features

| Feature | Information |

| ⚖️ Regulation | ASIC, CySEC, FSA, SCB |

| 💻 Account Types | cTrader Account, Raw Spread Account, Standard Account. |

| 💵 Minimum Spread | From 0.0 pips |

| 💸 Minimum Deposit | BRL991.44 in $200 |

| 📱 Platforms Supported | MetaTrader 4

MetaTrader 5 cTrader IC Social Signal Start ZuluTrade |

| 📈 Range of Markets | Forex

Commodities Indices Bonds Cryptocurrencies Stocks Futures |

| 📊 Demo Account | Yes |

| ✴️ Social Trading Offered | LinkedIn

YouTube |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| A competitive spread policy, specifically for its Raw Spread accounts, is offered by IC Markets, attracting traders in pursuit of economical trading opportunities. | An examination of the educational resources provided by IC Markets in comparison to other brokers may indicate a relative scarcity, potentially hindering the advancement of novice traders in their pursuit of knowledge. |

| IC Markets enables social trading through its partnership with ZuluTrade, which provides users with the ability to observe and replicate the strategies utilized by successful traders. | Inexperienced traders might perceive the advanced functionalities and resources offered by IC Markets as overwhelming, thereby requiring a phase of adaptation prior to fully capitalizing on them. |

| IC Markets provides a diverse range of trading instruments, including commodities, indices, forex pairs, and cryptocurrencies, to cater to a broad spectrum of trading preferences. | Despite the provision of customer support by IC Markets, certain clients may encounter dissatisfaction because of discrepancies in service quality and responsiveness. |

| The broker offers a variety of account types, including Standard and Raw Spread accounts, from which clients may choose the one that best suits their trading style and individual inclinations. | Occasional reports have surfaced concerning IC Markets withdrawal process complications or delays. This may be disconcerting for users who require immediate access to their funds. |

| IC Markets is supervised by reputable regulatory bodies, such as the Australian Securities and Investments Commission (ASIC) and the Seychelles Financial Services Authority (FSA), to ensure that clients conduct business in a secure and transparent environment. | Users have reported instances of intermittent platform instability or technical challenges that have occurred during transactions on IC Markets. These issues have the potential to disrupt trading activities. |

Trust Score

IC Markets has a trust score of 86%

Saxo Bank

Overview

Saxo Bank offers a sophisticated platform for traders in Brazil seeking comprehensive investment solutions.

Saxo Bank’s proprietary trading platforms, SaxoTraderGO and SaxoTraderPRO, are renowned for their advanced features, intuitive interface, and customizable tools, empowering traders to execute strategies effectively.

Saxo Bank provides access to a wide array of assets, including Forex, stocks, bonds, commodities, and options, enabling diversified investment portfolios. Saxo Bank’s investment choices range from traditional instruments to more complex derivatives, catering to various risk appetites and trading styles.

Account conditions are transparent, with competitive pricing and flexible leverage options tailored to Brazilian traders’ needs.

Additionally, Saxo Bank emphasizes education and research, offering insights and analysis to support informed decision-making.

With its commitment to innovation, diverse asset selection, transparent account conditions, and robust trading platforms, Saxo Bank is a premier choice for traders in Brazil seeking sophisticated investment opportunities.

Unique Features

| Feature | Information |

| ⚖️ Regulation | Central Bank of Ireland (CBI), BVI FSC, ASIC, FSCA, JFSA, FFAJ, ADGM, CySEC, ISA |

| 💻 Account Types | Saxo Account, Joint Account, Corporate Account, Professional |

| 💵 Minimum Spread | From 0.0 pips |

| 💸 Minimum Deposit | None |

| 📱 Platforms Supported | SaxoTraderGO

SaxoTraderPro |

| 📈 Range of Markets | Stocks

ETFs Bonds Mutual funds Crypto ETPs |

| 📊 Demo Account | Yes |

| ✴️ Social Trading Offered | Instagram

YouTube |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Saxo Bank grants traders’ access to a vast array of asset classes, currency pairings, commodities, and indices, thereby diversifying their trading opportunities. | Although Saxo Bank provides competitive spreads, its fee structure is intricate, encompassing a range of commissions and charges that may result in increased trading expenses for traders. |

| SaxoTraderGO, the principal platform of the broker, provides sophisticated charting functionalities, customizable layouts, and smooth execution, thereby enabling traders to efficiently implement their strategies. | The potential lack of comprehensive Islamic trading account options at Saxo Bank may pose a disadvantage for traders in search of Sharia-compliant trading solutions. |

| Saxo Bank is an internationally renowned and firmly established brokerage known for its dependability, openness, and compliance with regulatory requirements; it offers traders a sense of assurance. | Notwithstanding the provision of multilingual assistance, traders may encounter constraints in accessing customer support during non-standard trading hours due to time zone disparities. |

| Saxo Bank is an internationally renowned and firmly established brokerage known for its dependability, openness, and compliance with regulatory requirements; it offers traders a sense of assurance. |

Trust Score

Saxo Bank has a high trust score of 96%

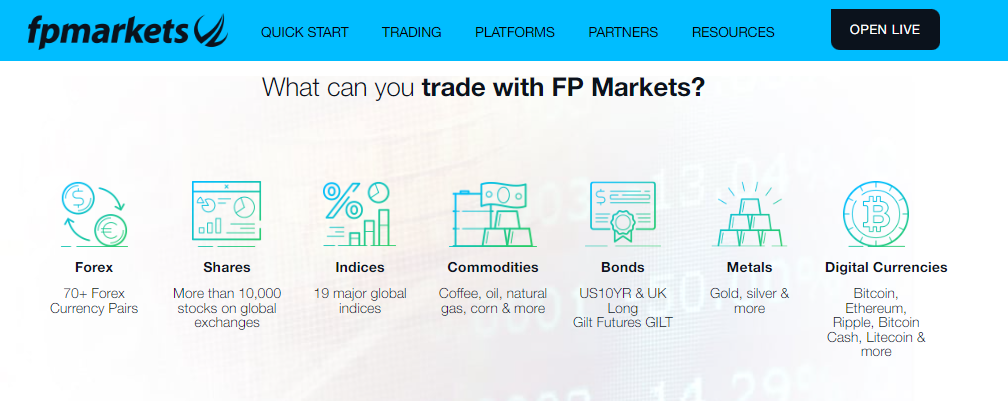

FP Markets

Overview

FP Markets stands out as an exceptional option for Forex traders in Brazil due to its unique features tailored to meet their needs. The broker offers tight spreads, starting from 0.0 pips, ensuring cost-effective trading.

Brazilian traders benefit from access to a wide range of currency pairs, including those involving the Brazilian real, facilitating seamless participation in global Forex markets. FP Markets provides advanced trading platforms like MetaTrader 4 and 5, renowned for their reliability and comprehensive tools, empowering traders to execute strategies effectively.

Additionally, the broker offers competitive leverage options up to 1:500, allowing traders to optimize their positions. With its transparent pricing, fast execution, regulatory compliance, and multilingual customer support, FP Markets ensures a seamless and secure trading experience for Brazilian Forex traders.

Overall, FP Markets’ combination of low spreads, extensive currency pairs, advanced platforms, competitive leverage, and dedicated customer service makes it a compelling choice for traders in Brazil.

Unique Features

| Feature | Information |

| ⚖️ Regulation | ASIC, CySEC, FSCA, FSA, FSC |

| 💻 Account Types | MT4/5 Standard Account, an MT4/5 Raw Account, an MT4/5 Islamic Standard Account, and an MT 4/5 Islamic Raw Account |

| 💵 Minimum Spread | From 0.0 pips |

| 💸 Minimum Deposit | BRL 495.72 or $100 |

| 📱 Platforms Supported | MetaTrader 4

MetaTrader 5 IRESS cTrader FP Markets App |

| 📈 Range of Markets | Forex

Shares Metals Commodities Indices Cryptocurrencies Bonds ETFs |

| 📊 Demo Account | Yes |

| ✴️ Social Trading Offered | LinkedIn

YouTube |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The technologically sophisticated architecture of FP Markets benefits traders. | As a result of FP Markets’ global orientation, not all regional payment alternatives may garner equivalent levels of interest. Despite offering a wide variety of products, certain traders may demonstrate a preference for niche or local markets. |

| Investors are provided with comprehensive customer support services administered by a group of committed and well-informed personnel. | Withdrawal fees are computed by FP Markets for a variety of payment methods. |

| FP Markets are regulated by several international organizations, including the FSCA, CySEC, ASIC, FSA, and FSC. | |

| FP Markets provides a comprehensive assortment of educational resources with the intention of aiding traders in enhancing their trading expertise. | |

| A variety of account categories are provided by FP Markets to accommodate the diverse trading preferences and requirements of its customers. | |

| cTrader, MetaTrader, IRESS, and MetaTrader 5 are examples of trading platforms that provide sophisticated charting and analytical capabilities. |

Trust Score

FP Markets has a high trust score of 87%

Exness

Overview

Exness presents a compelling option for traders in Brazil, offering tailored solutions to enhance their trading experience.

With BRL-based trading accounts and the ability to accept BRL deposits, the broker ensures seamless transactions and eliminates currency conversion hassles for Brazilian traders. This localized approach not only enhances convenience but also reduces costs associated with currency exchange.

Additionally, Exness boasts competitive spreads and low trading fees, optimizing profitability for traders. The broker provides access to a diverse range of currency pairs, including BRL crosses, enabling Brazilian traders to explore various opportunities in global Forex markets.

With its user-friendly trading platforms, reliable execution, and responsive customer support, Exness ensures a smooth and efficient trading environment for Brazilian traders.

Overall, Exness’ focus on localized services, competitive pricing, and comprehensive offerings makes it a top choice for traders in Brazil looking for a reliable Forex broker.

Unique Features

| Feature | Information |

| ⚖️ Regulation | FSA, CBCS, FSC, FSC BVI, FSCA, CySEC, FCA |

| 💻 Account Types | Standard Account

Standard Cent Account Raw Spread Account Zero Account Pro Account |

| 💵 Minimum Spread | From 0.0 pips |

| 💸 Minimum Deposit | Based on chosen regional deposit method |

| 📱 Platforms Supported | MetaTrader 4

MetaTrader 5 Exness Terminal Exness Trade app |

| 📈 Range of Markets | Forex

Metals Crypto Energies Indices Stocks |

| 📊 Demo Account | Yes |

| ✴️ Social Trading Offered | Instagram

YouTube |

Pros and Cons

| ✔️ Pros | ❌ Cons |

| Traders possess the ability to adjust leverage in accordance with their individual risk tolerance and trading approach. | Exness operates in numerous territories, each of which has its own set of regulations. |

| Before engaging in live investments, traders may choose to establish a demo account to acquire practical experience with virtual funds. | There are experts who contend that the platform’s trading capabilities and instruments, despite their high degree of customizability, fall short in comparison to other specialized platforms. However, this representation solely embodies a minority of traders. |

| The transparent disclosure of all trading conditions, fees, and spreads by Exness has garnered commendation. | Despite making every effort, customer support agents may encounter instances of unavailability. Variations in the magnitude and quality of their responses may ensue consequently. |

| Exness does not charge any fees for deposits or withdrawals. | Certain traders, in contrast to their competitors, may be deterred from employing the user interface due to its potential intricacy and refinement. |

| Local withdrawal and deposit options are accessible. | Potential clients in pursuit of a broader range of investment options may be deterred from joining Exness due to its singular emphasis on FX and CFDs. |

| MetaTrader users have access to trading automation options from Exness, which includes Expert Advisors (EAs) designed specifically for Taiwanese consumers. | Additionally, substantial leverage raises the likelihood of suffering significant losses. |

| A multitude of markets are readily available to traders due to the wide-ranging selection of platforms and account categories. | Despite the meticulousness of market analysis and insights, some traders might consider them insufficient. |

Trust Score

Exness has a trust score of 97%

Conclusion

Overall, selecting the right international Forex broker is crucial for traders in Brazil. Factors such as localized services, competitive pricing, diverse currency pairs, and regulatory compliance play pivotal roles in making an informed decision. Ultimately, finding the best-fit broker ensures a seamless and rewarding trading experience.

Frequently Asked Questions

Can I trade Forex in Brazil using an international broker?

Yes, Brazilian traders can participate in Forex trading using international brokers that accept clients from Brazil.

Are international Forex brokers regulated in Brazil?

No, international Forex brokers are typically regulated in their home countries by relevant financial authorities, or else in other regions where they operate, but they can legally serve Brazilian clients.

What are the advantages of using an international Forex broker in Brazil?

International brokers often offer a wider range of currency pairs, competitive pricing, advanced trading platforms, and access to global financial markets.

Are there any restrictions on leverage when trading Forex with international brokers in Brazil?

While international brokers may offer high-leverage options, Brazilian regulators have imposed restrictions on leverage for Forex trading. Traders should verify the maximum allowable leverage according to local regulations.

Is Forex trading legal in Brazil with international brokers?

Yes, Forex trading is legal in Brazil, and Brazilian traders can legally engage in Forex trading with international brokers if they comply with local tax regulations and reporting requirements.