Alps Advisors Inc. Sells 382 Shares of Interactive Brokers Group, Inc. (NASDAQ:IBKR)

Alps Advisors Inc. lessened its holdings in shares of Interactive Brokers Group, Inc. (NASDAQ:IBKR – Free Report) by 9.7% in the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 3,573 shares of the financial services provider’s stock after selling 382 shares during the quarter. Alps Advisors Inc.’s holdings in Interactive Brokers Group were worth $309,000 at the end of the most recent reporting period.

Alps Advisors Inc. lessened its holdings in shares of Interactive Brokers Group, Inc. (NASDAQ:IBKR – Free Report) by 9.7% in the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 3,573 shares of the financial services provider’s stock after selling 382 shares during the quarter. Alps Advisors Inc.’s holdings in Interactive Brokers Group were worth $309,000 at the end of the most recent reporting period.

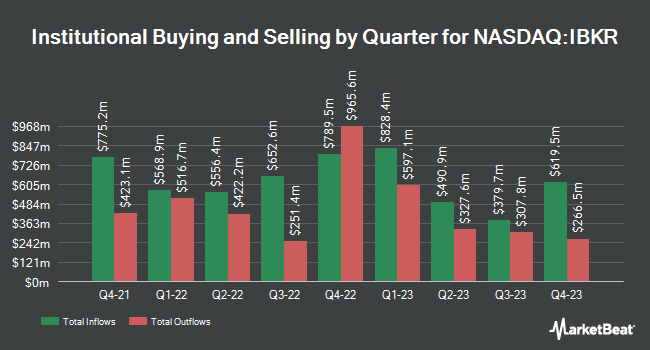

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Headlands Technologies LLC bought a new position in Interactive Brokers Group during the third quarter worth about $40,000. Atlas Capital Advisors LLC bought a new position in Interactive Brokers Group during the first quarter worth about $40,000. Eagle Bay Advisors LLC purchased a new stake in shares of Interactive Brokers Group in the second quarter worth about $31,000. Belpointe Asset Management LLC lifted its holdings in shares of Interactive Brokers Group by 64.5% in the first quarter. Belpointe Asset Management LLC now owns 579 shares of the financial services provider’s stock worth $48,000 after buying an additional 227 shares in the last quarter. Finally, Dark Forest Capital Management LP purchased a new stake in shares of Interactive Brokers Group in the first quarter worth about $49,000. Institutional investors own 21.56% of the company’s stock.

Interactive Brokers Group Price Performance

Shares of NASDAQ IBKR opened at $109.10 on Wednesday. Interactive Brokers Group, Inc. has a one year low of $70.83 and a one year high of $112.50. The firm’s 50 day simple moving average is $97.01 and its two-hundred day simple moving average is $88.87. The stock has a market capitalization of $45.93 billion, a P/E ratio of 19.28, a PEG ratio of 0.99 and a beta of 0.83.

Interactive Brokers Group (NASDAQ:IBKR – Get Free Report) last issued its quarterly earnings results on Tuesday, January 16th. The financial services provider reported $1.52 EPS for the quarter, missing analysts’ consensus estimates of $1.53 by ($0.01). Interactive Brokers Group had a net margin of 7.72% and a return on equity of 4.66%. The business had revenue of $1.14 billion for the quarter, compared to the consensus estimate of $1.14 billion. During the same quarter in the previous year, the business earned $1.30 earnings per share. The firm’s revenue was up 16.7% on a year-over-year basis. As a group, equities analysts expect that Interactive Brokers Group, Inc. will post 6.07 earnings per share for the current fiscal year.

Interactive Brokers Group Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Thursday, March 14th. Shareholders of record on Friday, March 1st will be given a dividend of $0.10 per share. This represents a $0.40 dividend on an annualized basis and a yield of 0.37%. The ex-dividend date of this dividend is Thursday, February 29th. Interactive Brokers Group’s payout ratio is currently 7.07%.

Insider Buying and Selling at Interactive Brokers Group

In other news, insider Thomas Aj Frank sold 13,189 shares of the firm’s stock in a transaction that occurred on Wednesday, January 3rd. The shares were sold at an average price of $86.13, for a total value of $1,135,968.57. Following the transaction, the insider now owns 630,023 shares in the company, valued at $54,263,880.99. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. In other news, insider Thomas Aj Frank sold 13,189 shares of the firm’s stock in a transaction that occurred on Wednesday, January 3rd. The shares were sold at an average price of $86.13, for a total value of $1,135,968.57. Following the transaction, the insider now owns 630,023 shares in the company, valued at $54,263,880.99. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Vice Chairman Earl H. Nemser sold 5,000 shares of the firm’s stock in a transaction that occurred on Wednesday, February 21st. The stock was sold at an average price of $104.86, for a total transaction of $524,300.00. Following the completion of the transaction, the insider now owns 113,770 shares in the company, valued at approximately $11,929,922.20. The disclosure for this sale can be found here. Insiders have sold 520,027 shares of company stock worth $48,369,714 over the last ninety days. Insiders own 3.21% of the company’s stock.

Wall Street Analysts Forecast Growth

A number of brokerages have recently issued reports on IBKR. Redburn Atlantic began coverage on shares of Interactive Brokers Group in a report on Friday, December 1st. They issued a “buy” rating and a $100.00 price target on the stock. The Goldman Sachs Group raised shares of Interactive Brokers Group from a “neutral” rating to a “buy” rating and increased their price target for the stock from $88.00 to $102.00 in a report on Tuesday, January 9th. Finally, UBS Group lowered their price target on shares of Interactive Brokers Group from $108.00 to $104.00 and set a “buy” rating on the stock in a report on Tuesday, January 9th. One research analyst has rated the stock with a hold rating and seven have given a buy rating to the company’s stock. Based on data from MarketBeat, the company presently has a consensus rating of “Moderate Buy” and an average price target of $110.38.

Get Our Latest Report on Interactive Brokers Group

About Interactive Brokers Group

Interactive Brokers Group, Inc operates as an automated electronic broker worldwide. The company engages in the execution, clearance, and settlement of trades in stocks, options, futures, foreign exchange instruments, bonds, mutual funds, exchange traded funds (ETFs), precious metals, and cryptocurrencies.

See Also

Want to see what other hedge funds are holding IBKR? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Interactive Brokers Group, Inc. (NASDAQ:IBKR – Free Report).

Receive News & Ratings for Interactive Brokers Group Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Interactive Brokers Group and related companies with MarketBeat.com’s FREE daily email newsletter.