Atb Cap Markets Brokers Boost Earnings Estimates for Shopify Inc. (NYSE:SHOP)

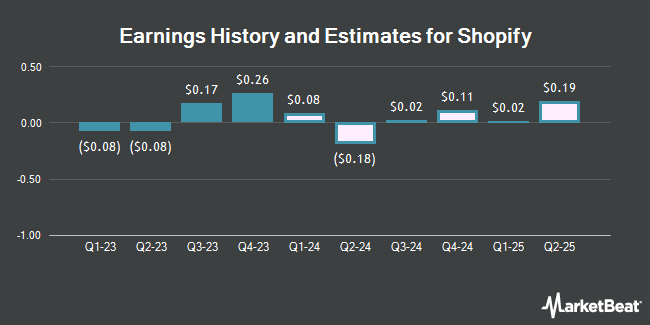

Shopify Inc. (NYSE:SHOP – Free Report) (TSE:SHOP) – Analysts at Atb Cap Markets upped their Q1 2024 EPS estimates for Shopify in a research note issued on Tuesday, April 30th. Atb Cap Markets analyst M. Toner now anticipates that the software maker will post earnings per share of $0.05 for the quarter, up from their prior forecast of $0.03. The consensus estimate for Shopify’s current full-year earnings is $0.58 per share. Atb Cap Markets also issued estimates for Shopify’s Q2 2024 earnings at $0.08 EPS and FY2025 earnings at $0.84 EPS.

Shopify (NYSE:SHOP – Get Free Report) (TSE:SHOP) last released its quarterly earnings results on Tuesday, February 13th. The software maker reported $0.26 earnings per share for the quarter, beating analysts’ consensus estimates of $0.22 by $0.04. The company had revenue of $2.14 billion for the quarter, compared to analysts’ expectations of $2.07 billion. Shopify had a return on equity of 4.48% and a net margin of 1.87%.

Several other equities research analysts have also recently commented on the company. DA Davidson boosted their target price on Shopify from $86.00 to $90.00 and gave the stock a “buy” rating in a report on Wednesday, February 14th. Jefferies Financial Group lifted their price objective on shares of Shopify from $65.00 to $80.00 and gave the company a “hold” rating in a research note on Friday, January 5th. Truist Financial lifted their price objective on shares of Shopify from $65.00 to $90.00 and gave the company a “hold” rating in a research note on Monday, February 12th. Needham & Company LLC reissued a “hold” rating on shares of Shopify in a research report on Tuesday, April 16th. Finally, CIBC boosted their target price on shares of Shopify from $82.00 to $100.00 and gave the stock an “outperform” rating in a research report on Wednesday, February 7th. Two investment analysts have rated the stock with a sell rating, eighteen have given a hold rating and seventeen have given a buy rating to the company. According to MarketBeat, the stock presently has a consensus rating of “Hold” and a consensus price target of $79.03.

Check Out Our Latest Analysis on SHOP

Shopify Price Performance

Shares of NYSE:SHOP opened at $72.02 on Thursday. Shopify has a 12 month low of $45.50 and a 12 month high of $91.57. The stock has a market cap of $92.66 billion, a price-to-earnings ratio of 800.31 and a beta of 2.20. The stock’s 50 day moving average price is $74.77 and its 200 day moving average price is $73.00. The company has a debt-to-equity ratio of 0.10, a current ratio of 6.99 and a quick ratio of 6.99.

Hedge Funds Weigh In On Shopify

A number of large investors have recently modified their holdings of the stock. Wealth Management Partners LLC lifted its position in shares of Shopify by 0.9% during the fourth quarter. Wealth Management Partners LLC now owns 13,922 shares of the software maker’s stock worth $1,085,000 after purchasing an additional 126 shares in the last quarter. SJS Investment Consulting Inc. lifted its position in shares of Shopify by 59.1% during the fourth quarter. SJS Investment Consulting Inc. now owns 350 shares of the software maker’s stock worth $27,000 after purchasing an additional 130 shares in the last quarter. Tradition Wealth Management LLC lifted its position in shares of Shopify by 7.5% during the fourth quarter. Tradition Wealth Management LLC now owns 2,007 shares of the software maker’s stock worth $156,000 after purchasing an additional 140 shares in the last quarter. Pachira Investments Inc. lifted its position in shares of Shopify by 2.1% during the fourth quarter. Pachira Investments Inc. now owns 7,084 shares of the software maker’s stock worth $552,000 after purchasing an additional 146 shares in the last quarter. Finally, Baldwin Brothers LLC MA lifted its position in shares of Shopify by 49.0% during the fourth quarter. Baldwin Brothers LLC MA now owns 447 shares of the software maker’s stock worth $35,000 after purchasing an additional 147 shares in the last quarter. 69.27% of the stock is currently owned by institutional investors and hedge funds.

Shopify Company Profile

Shopify Inc, a commerce company, provides a commerce platform and services in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, Australia, China, and Latin America. The company’s platform enables merchants to displays, manages, markets, and sells its products through various sales channels, including web and mobile storefronts, physical retail locations, pop-up shops, social media storefronts, native mobile apps, buy buttons, and marketplaces; and enables to manage products and inventory, process orders and payments, fulfill and ship orders, new buyers and build customer relationships, source products, leverage analytics and reporting, manage cash, payments and transactions, and access financing.

Featured Articles

Receive News & Ratings for Shopify Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Shopify and related companies with MarketBeat.com’s FREE daily email newsletter.