Atb Cap Markets Brokers Increase Earnings Estimates for Bird Construction Inc. (TSE:BDT)

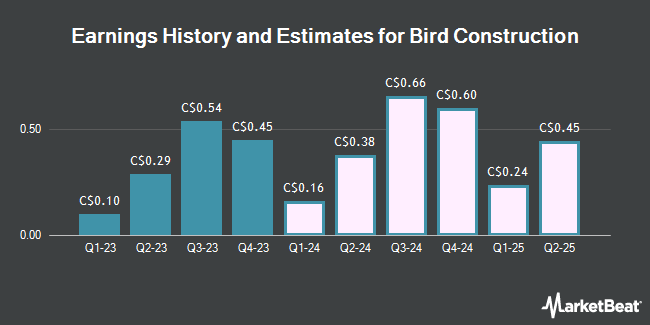

Bird Construction Inc. (TSE:BDT – Free Report) – Equities researchers at Atb Cap Markets upped their Q3 2024 earnings estimates for shares of Bird Construction in a research note issued on Tuesday, May 14th. Atb Cap Markets analyst C. Murray now expects that the company will post earnings of $0.61 per share for the quarter, up from their previous estimate of $0.58. The consensus estimate for Bird Construction’s current full-year earnings is $1.79 per share. Atb Cap Markets also issued estimates for Bird Construction’s Q3 2025 earnings at $0.74 EPS.

Bird Construction (TSE:BDT – Get Free Report) last posted its earnings results on Tuesday, March 5th. The company reported C$0.45 earnings per share (EPS) for the quarter, beating analysts’ consensus estimates of C$0.40 by C$0.05. The company had revenue of C$792.07 million during the quarter, compared to the consensus estimate of C$722.63 million. Bird Construction had a net margin of 2.56% and a return on equity of 24.03%.

BDT has been the subject of several other reports. Raymond James lifted their price target on Bird Construction from C$20.50 to C$25.00 and gave the company an “outperform” rating in a research report on Thursday. Canaccord Genuity Group raised their price target on shares of Bird Construction from C$21.00 to C$23.00 and gave the company a “buy” rating in a research report on Wednesday. Stifel Nicolaus upped their price objective on shares of Bird Construction from C$24.00 to C$25.00 and gave the stock a “buy” rating in a research report on Thursday. National Bankshares raised their target price on Bird Construction from C$18.00 to C$21.00 and gave the company a “sector perform” rating in a research report on Thursday. Finally, ATB Capital upped their price target on Bird Construction from C$23.00 to C$25.00 and gave the stock an “outperform” rating in a report on Wednesday. Two analysts have rated the stock with a hold rating and five have issued a buy rating to the stock. Based on data from MarketBeat.com, the stock presently has a consensus rating of “Moderate Buy” and a consensus target price of C$23.71.

Get Our Latest Research Report on Bird Construction

Bird Construction Stock Performance

Shares of BDT stock opened at C$21.11 on Friday. Bird Construction has a 52-week low of C$8.01 and a 52-week high of C$22.74. The company has a quick ratio of 1.20, a current ratio of 1.26 and a debt-to-equity ratio of 46.93. The stock has a market cap of C$1.14 billion, a PE ratio of 15.87, a price-to-earnings-growth ratio of 0.53 and a beta of 1.23. The business has a 50-day simple moving average of C$19.18 and a 200-day simple moving average of C$15.95.

Bird Construction Increases Dividend

The company also recently disclosed a monthly dividend, which will be paid on Thursday, June 20th. Shareholders of record on Friday, May 31st will be paid a dividend of $0.047 per share. This is a positive change from Bird Construction’s previous monthly dividend of $0.05. This represents a $0.56 annualized dividend and a yield of 2.67%. The ex-dividend date of this dividend is Friday, May 31st. Bird Construction’s payout ratio is 42.11%.

Bird Construction Company Profile

Bird Construction Inc provides construction services in Canada. The company primarily focuses on projects in the industrial, and institutional, and infrastructure markets. It constructs large, complex industrial buildings, including manufacturing, processing, distribution, and warehouse facilities; and provides electrical and instrumentation, high voltage testing and commissioning services, as well as power line construction, structural, mechanical, and piping, including off-site metal and modular fabrication.

Read More

Receive News & Ratings for Bird Construction Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Bird Construction and related companies with MarketBeat.com’s FREE daily email newsletter.