Barrington Research Brokers Reduce Earnings Estimates for Universal Technical Institute, Inc. (NYSE:UTI)

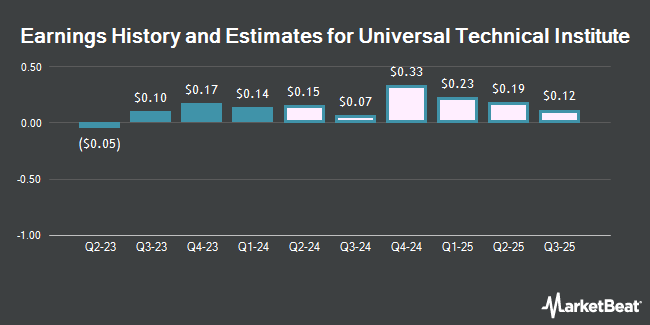

Universal Technical Institute, Inc. (NYSE:UTI – Free Report) – Stock analysts at Barrington Research decreased their Q3 2024 earnings estimates for shares of Universal Technical Institute in a research report issued to clients and investors on Tuesday, May 28th. Barrington Research analyst A. Paris now forecasts that the company will post earnings of $0.06 per share for the quarter, down from their prior estimate of $0.11. Barrington Research has a “Outperform” rating and a $20.00 price objective on the stock. The consensus estimate for Universal Technical Institute’s current full-year earnings is $0.71 per share. Barrington Research also issued estimates for Universal Technical Institute’s Q4 2024 earnings at $0.34 EPS.

Universal Technical Institute (NYSE:UTI – Get Free Report) last posted its earnings results on Wednesday, May 8th. The company reported $0.14 earnings per share for the quarter, missing analysts’ consensus estimates of $0.15 by ($0.01). The firm had revenue of $184.18 million during the quarter, compared to the consensus estimate of $177.01 million. Universal Technical Institute had a net margin of 2.97% and a return on equity of 10.55%.

UTI has been the subject of a number of other research reports. B. Riley reissued a “buy” rating and set a $22.00 price objective (up previously from $20.00) on shares of Universal Technical Institute in a research report on Thursday. Rosenblatt Securities restated a “buy” rating and set a $18.00 target price on shares of Universal Technical Institute in a research note on Monday, April 29th. Finally, StockNews.com lowered shares of Universal Technical Institute from a “buy” rating to a “hold” rating in a research report on Wednesday. Two research analysts have rated the stock with a hold rating and five have issued a buy rating to the company. According to MarketBeat, the stock presently has an average rating of “Moderate Buy” and a consensus target price of $17.40.

Read Our Latest Analysis on UTI

Universal Technical Institute Stock Performance

UTI opened at $15.82 on Friday. Universal Technical Institute has a 12-month low of $6.20 and a 12-month high of $17.09. The company has a market cap of $851.13 million, a price-to-earnings ratio of 43.94, a PEG ratio of 1.52 and a beta of 1.22. The company has a current ratio of 1.02, a quick ratio of 1.02 and a debt-to-equity ratio of 0.60. The company’s 50 day moving average is $15.18 and its 200 day moving average is $14.01.

Insider Buying and Selling

In related news, Director Loretta Lydia Sanchez sold 6,288 shares of Universal Technical Institute stock in a transaction dated Friday, May 24th. The shares were sold at an average price of $15.22, for a total transaction of $95,703.36. Following the completion of the transaction, the director now directly owns 13,712 shares of the company’s stock, valued at approximately $208,696.64. The transaction was disclosed in a filing with the SEC, which is available through the SEC website. 27.60% of the stock is currently owned by company insiders.

Institutional Investors Weigh In On Universal Technical Institute

A number of hedge funds have recently made changes to their positions in UTI. Brandywine Global Investment Management LLC lifted its position in shares of Universal Technical Institute by 8.3% during the third quarter. Brandywine Global Investment Management LLC now owns 15,540 shares of the company’s stock valued at $130,000 after buying an additional 1,190 shares during the last quarter. Kennedy Capital Management LLC increased its position in shares of Universal Technical Institute by 2.4% during the third quarter. Kennedy Capital Management LLC now owns 74,516 shares of the company’s stock worth $624,000 after purchasing an additional 1,751 shares in the last quarter. New York State Common Retirement Fund boosted its position in shares of Universal Technical Institute by 28.0% in the 4th quarter. New York State Common Retirement Fund now owns 10,493 shares of the company’s stock worth $131,000 after purchasing an additional 2,296 shares in the last quarter. International Assets Investment Management LLC grew its stake in Universal Technical Institute by 1,152.0% during the 4th quarter. International Assets Investment Management LLC now owns 3,130 shares of the company’s stock worth $39,000 after buying an additional 2,880 shares during the last quarter. Finally, American International Group Inc. increased its position in Universal Technical Institute by 19.6% during the 1st quarter. American International Group Inc. now owns 19,494 shares of the company’s stock valued at $311,000 after buying an additional 3,194 shares in the last quarter. 75.67% of the stock is currently owned by hedge funds and other institutional investors.

Universal Technical Institute Company Profile

Universal Technical Institute, Inc provides transportation, skilled trades, and healthcare education programs in the United States. The company operates in two segments, UTI and Concorde. It offers certificate, diploma, or degree programs under various brands, such as Universal Technical Institute, Motorcycle Mechanics Institute, Marine Mechanics Institute, NASCAR Technical Institute, and MIAT College of Technology.

Featured Articles

Receive News & Ratings for Universal Technical Institute Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Universal Technical Institute and related companies with MarketBeat.com’s FREE daily email newsletter.