Brokers Issue Forecasts for Discover Financial Services’ Q2 2024 Earnings (NYSE:DFS)

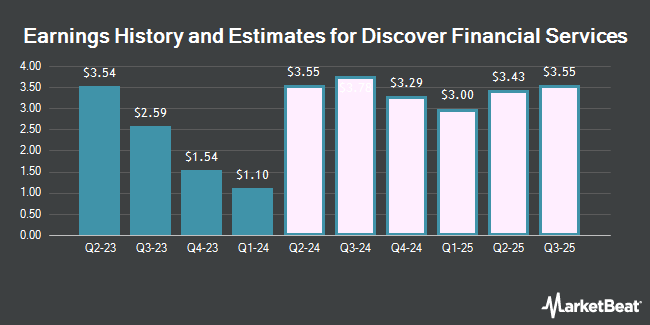

Discover Financial Services (NYSE:DFS – Free Report) – Equities research analysts at Zacks Research boosted their Q2 2024 EPS estimates for Discover Financial Services in a research report issued to clients and investors on Wednesday, June 26th. Zacks Research analyst D. Chatterjee now forecasts that the financial services provider will post earnings of $3.12 per share for the quarter, up from their prior estimate of $3.08. The consensus estimate for Discover Financial Services’ current full-year earnings is $11.46 per share. Zacks Research also issued estimates for Discover Financial Services’ Q3 2024 earnings at $3.73 EPS, Q2 2025 earnings at $3.03 EPS, Q4 2025 earnings at $3.30 EPS, FY2025 earnings at $12.38 EPS, Q1 2026 earnings at $3.19 EPS and FY2026 earnings at $13.84 EPS.

Several other research firms have also issued reports on DFS. Wells Fargo & Company increased their target price on Discover Financial Services from $105.00 to $135.00 and gave the stock an “equal weight” rating in a report on Wednesday, April 10th. HSBC raised their target price on shares of Discover Financial Services from $107.00 to $144.00 and gave the company a “hold” rating in a report on Thursday, March 21st. JPMorgan Chase & Co. upped their price target on shares of Discover Financial Services from $110.00 to $120.00 and gave the stock a “neutral” rating in a report on Wednesday, April 3rd. Seaport Res Ptn cut shares of Discover Financial Services from a “buy” rating to a “neutral” rating in a research note on Friday, March 15th. Finally, StockNews.com began coverage on shares of Discover Financial Services in a research report on Friday, June 21st. They set a “hold” rating for the company. Thirteen investment analysts have rated the stock with a hold rating and seven have assigned a buy rating to the company. According to data from MarketBeat.com, Discover Financial Services has a consensus rating of “Hold” and an average target price of $126.29.

Get Our Latest Analysis on Discover Financial Services

Discover Financial Services Price Performance

Discover Financial Services stock opened at $123.79 on Friday. The firm has a market cap of $31.04 billion, a PE ratio of 14.11, a price-to-earnings-growth ratio of 0.77 and a beta of 1.41. The company has a debt-to-equity ratio of 1.50, a current ratio of 1.12 and a quick ratio of 1.12. The stock’s fifty day moving average price is $124.71 and its two-hundred day moving average price is $118.43. Discover Financial Services has a one year low of $79.04 and a one year high of $131.65.

Discover Financial Services (NYSE:DFS – Get Free Report) last announced its earnings results on Thursday, April 18th. The financial services provider reported $1.10 earnings per share (EPS) for the quarter, missing analysts’ consensus estimates of $2.98 by ($1.88). Discover Financial Services had a return on equity of 17.07% and a net margin of 10.56%. The business had revenue of $4.21 billion for the quarter, compared to analyst estimates of $4.07 billion. During the same quarter in the previous year, the company earned $3.58 EPS.

Hedge Funds Weigh In On Discover Financial Services

Large investors have recently modified their holdings of the business. Norges Bank bought a new stake in shares of Discover Financial Services in the 4th quarter valued at about $322,199,000. Truist Financial Corp boosted its holdings in Discover Financial Services by 239.6% in the fourth quarter. Truist Financial Corp now owns 2,027,686 shares of the financial services provider’s stock valued at $227,912,000 after acquiring an additional 1,430,637 shares during the last quarter. Massachusetts Financial Services Co. MA acquired a new stake in Discover Financial Services during the 4th quarter valued at approximately $121,113,000. AQR Capital Management LLC raised its holdings in Discover Financial Services by 336.5% during the 3rd quarter. AQR Capital Management LLC now owns 1,133,784 shares of the financial services provider’s stock worth $98,220,000 after purchasing an additional 874,020 shares during the last quarter. Finally, Envestnet Asset Management Inc. lifted its position in shares of Discover Financial Services by 60.9% in the 4th quarter. Envestnet Asset Management Inc. now owns 2,122,824 shares of the financial services provider’s stock worth $238,605,000 after purchasing an additional 803,738 shares during the period. Institutional investors own 86.94% of the company’s stock.

Discover Financial Services Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Thursday, June 6th. Shareholders of record on Thursday, May 23rd were issued a dividend of $0.70 per share. This represents a $2.80 dividend on an annualized basis and a yield of 2.26%. The ex-dividend date of this dividend was Wednesday, May 22nd. Discover Financial Services’s payout ratio is 31.93%.

About Discover Financial Services

Discover Financial Services, through its subsidiaries, provides digital banking products and services, and payment services in the United States. It operates in two segments, Digital Banking and Payment Services. The Digital Banking segment offers Discover-branded credit cards to individuals; private student loans, personal loans, home loans, and other consumer lending; and direct-to-consumer deposit products comprising savings accounts, certificates of deposit, money market accounts, IRA certificates of deposit, IRA savings accounts and checking accounts, and sweep accounts.

Featured Articles

Receive News & Ratings for Discover Financial Services Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Discover Financial Services and related companies with MarketBeat.com’s FREE daily email newsletter.