Brokers Issue Forecasts for STERIS plc’s FY2024 Earnings (NYSE:STE)

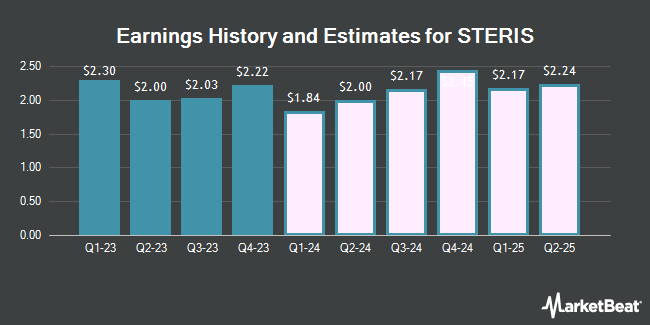

STERIS plc (NYSE:STE – Free Report) – Research analysts at Zacks Research cut their FY2024 earnings per share (EPS) estimates for shares of STERIS in a research note issued on Tuesday, March 5th. Zacks Research analyst R. Department now forecasts that the medical equipment provider will earn $8.67 per share for the year, down from their prior forecast of $8.68. The consensus estimate for STERIS’s current full-year earnings is $8.67 per share. Zacks Research also issued estimates for STERIS’s FY2025 earnings at $9.44 EPS and FY2026 earnings at $9.98 EPS.

A number of other equities research analysts have also recently issued reports on STE. JMP Securities reissued a “market outperform” rating and set a $265.00 target price on shares of STERIS in a report on Thursday, February 8th. Morgan Stanley decreased their price objective on STERIS from $225.00 to $215.00 and set an “equal weight” rating on the stock in a research note on Monday, December 4th. KeyCorp initiated coverage on STERIS in a research note on Tuesday, February 6th. They issued an “overweight” rating and a $253.00 target price for the company. Stephens reaffirmed an “overweight” rating and set a $250.00 target price on shares of STERIS in a report on Friday, February 9th. Finally, TheStreet upgraded shares of STERIS from a “c+” rating to a “b” rating in a research report on Wednesday, February 7th. Two analysts have rated the stock with a hold rating and four have assigned a buy rating to the stock. According to data from MarketBeat, the company presently has an average rating of “Moderate Buy” and an average price target of $239.60.

Check Out Our Latest Stock Report on STERIS

STERIS Stock Performance

Shares of STE stock opened at $233.70 on Friday. The firm’s 50 day moving average is $224.57 and its 200 day moving average is $218.96. The stock has a market capitalization of $23.09 billion, a P/E ratio of 40.93 and a beta of 0.80. STERIS has a 12 month low of $173.21 and a 12 month high of $254.00. The company has a current ratio of 2.43, a quick ratio of 1.49 and a debt-to-equity ratio of 0.50.

STERIS (NYSE:STE – Get Free Report) last issued its earnings results on Wednesday, February 7th. The medical equipment provider reported $2.22 earnings per share for the quarter, topping analysts’ consensus estimates of $2.17 by $0.05. The firm had revenue of $1.40 billion during the quarter, compared to analyst estimates of $1.35 billion. STERIS had a net margin of 10.48% and a return on equity of 13.67%. The company’s quarterly revenue was up 14.8% on a year-over-year basis. During the same quarter last year, the business earned $2.02 earnings per share.

STERIS Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, March 22nd. Stockholders of record on Friday, February 23rd will be given a dividend of $0.52 per share. The ex-dividend date of this dividend is Thursday, February 22nd. This represents a $2.08 dividend on an annualized basis and a dividend yield of 0.89%. STERIS’s dividend payout ratio (DPR) is presently 36.43%.

Hedge Funds Weigh In On STERIS

A number of hedge funds and other institutional investors have recently bought and sold shares of STE. Millburn Ridgefield Corp bought a new position in shares of STERIS during the 3rd quarter valued at about $25,000. Catalyst Capital Advisors LLC bought a new stake in shares of STERIS in the 3rd quarter worth approximately $25,000. 1832 Asset Management L.P. purchased a new stake in shares of STERIS in the 1st quarter valued at $25,000. West Tower Group LLC bought a new position in shares of STERIS during the 2nd quarter valued at $32,000. Finally, VisionPoint Advisory Group LLC purchased a new position in STERIS in the 4th quarter worth $34,000. Hedge funds and other institutional investors own 92.91% of the company’s stock.

About STERIS

STERIS plc provides infection prevention products and services worldwide. It operates through four segments: Healthcare, Applied Sterilization Technologies, Life Sciences, and Dental. The Healthcare segment offers cleaning chemistries and sterility assurance products; automated endoscope reprocessing system and tracking products; endoscopy accessories, washers, sterilizers, and other pieces of capital equipment for the operation of a sterile processing department; and equipment used directly in the operating room, including surgical tables, lights, and connectivity solutions, as well as equipment management services.

See Also

Receive News & Ratings for STERIS Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for STERIS and related companies with MarketBeat.com’s FREE daily email newsletter.