Brokers Issue Forecasts for Webster Financial Co.’s Q1 2024 Earnings (NYSE:WBS)

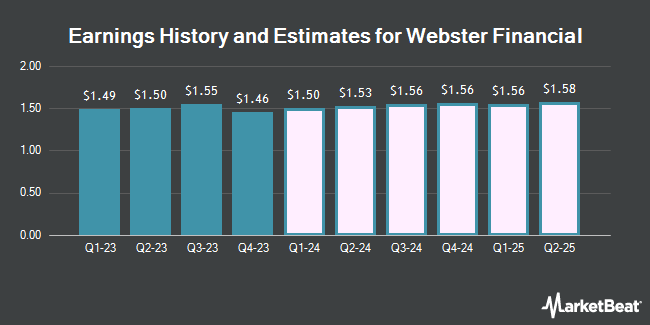

Webster Financial Co. (NYSE:WBS – Free Report) – Equities research analysts at Wedbush cut their Q1 2024 EPS estimates for Webster Financial in a note issued to investors on Wednesday, March 27th. Wedbush analyst D. Chiaverini now expects that the financial services provider will post earnings of $1.33 per share for the quarter, down from their prior estimate of $1.37. The consensus estimate for Webster Financial’s current full-year earnings is $5.90 per share. Wedbush also issued estimates for Webster Financial’s FY2024 earnings at $5.90 EPS, Q1 2025 earnings at $1.54 EPS, Q2 2025 earnings at $1.60 EPS, Q3 2025 earnings at $1.70 EPS and Q4 2025 earnings at $1.76 EPS.

A number of other research analysts have also recently weighed in on the stock. StockNews.com raised shares of Webster Financial from a “sell” rating to a “hold” rating in a research report on Thursday. Royal Bank of Canada reaffirmed an “outperform” rating and set a $59.00 price target on shares of Webster Financial in a research report on Wednesday, January 24th. Raymond James reaffirmed an “outperform” rating and set a $60.00 price target on shares of Webster Financial in a research report on Tuesday. Morgan Stanley boosted their target price on shares of Webster Financial from $51.00 to $61.00 and gave the stock an “overweight” rating in a research report on Wednesday, February 7th. Finally, Barclays assumed coverage on shares of Webster Financial in a report on Friday, March 8th. They issued an “overweight” rating and a $70.00 price target on the stock. Three research analysts have rated the stock with a hold rating and eleven have given a buy rating to the stock. Based on data from MarketBeat, the stock currently has an average rating of “Moderate Buy” and an average price target of $57.31.

Check Out Our Latest Stock Report on WBS

Webster Financial Trading Down 0.1 %

Shares of WBS stock opened at $50.74 on Thursday. The stock has a market cap of $8.71 billion, a price-to-earnings ratio of 10.38, a price-to-earnings-growth ratio of 0.34 and a beta of 1.32. The company has a quick ratio of 0.85, a current ratio of 0.85 and a debt-to-equity ratio of 0.41. Webster Financial has a fifty-two week low of $31.03 and a fifty-two week high of $53.39. The firm’s 50 day moving average price is $48.54 and its two-hundred day moving average price is $45.55.

Webster Financial (NYSE:WBS – Get Free Report) last released its earnings results on Tuesday, January 23rd. The financial services provider reported $1.46 earnings per share (EPS) for the quarter, missing analysts’ consensus estimates of $1.48 by ($0.02). Webster Financial had a net margin of 22.01% and a return on equity of 13.05%. The company had revenue of $996.96 million during the quarter, compared to analysts’ expectations of $674.82 million. During the same quarter in the previous year, the firm posted $1.60 earnings per share.

Hedge Funds Weigh In On Webster Financial

A number of large investors have recently made changes to their positions in WBS. Vanguard Group Inc. increased its holdings in Webster Financial by 88.3% in the first quarter. Vanguard Group Inc. now owns 17,401,872 shares of the financial services provider’s stock worth $976,594,000 after buying an additional 8,161,424 shares during the last quarter. Invesco Ltd. increased its holdings in Webster Financial by 219.4% in the first quarter. Invesco Ltd. now owns 4,782,300 shares of the financial services provider’s stock worth $268,381,000 after buying an additional 3,285,002 shares during the last quarter. State Street Corp grew its holdings in Webster Financial by 68.8% during the first quarter. State Street Corp now owns 7,511,290 shares of the financial services provider’s stock valued at $421,534,000 after purchasing an additional 3,061,831 shares during the last quarter. Norges Bank bought a new position in shares of Webster Financial in the fourth quarter valued at approximately $97,217,000. Finally, Point72 Asset Management L.P. raised its position in shares of Webster Financial by 2,063.7% in the second quarter. Point72 Asset Management L.P. now owns 1,888,900 shares of the financial services provider’s stock valued at $71,306,000 after purchasing an additional 1,801,600 shares during the period. Institutional investors and hedge funds own 85.58% of the company’s stock.

Insider Buying and Selling

In other Webster Financial news, COO Luis Massiani sold 13,500 shares of the company’s stock in a transaction dated Tuesday, January 30th. The shares were sold at an average price of $51.63, for a total value of $697,005.00. Following the completion of the sale, the chief operating officer now directly owns 89,621 shares of the company’s stock, valued at approximately $4,627,132.23. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. In other Webster Financial news, COO Luis Massiani sold 13,500 shares of the company’s stock in a transaction dated Tuesday, January 30th. The shares were sold at an average price of $51.63, for a total transaction of $697,005.00. Following the completion of the sale, the chief operating officer now directly owns 89,621 shares of the company’s stock, valued at $4,627,132.23. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this link. Also, insider Charles L. Wilkins sold 3,966 shares of the company’s stock in a transaction dated Thursday, January 25th. The shares were sold at an average price of $51.56, for a total transaction of $204,486.96. Following the sale, the insider now directly owns 49,528 shares of the company’s stock, valued at $2,553,663.68. The disclosure for this sale can be found here. Insiders sold 34,941 shares of company stock valued at $1,796,482 over the last 90 days. 0.88% of the stock is currently owned by company insiders.

Webster Financial Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Friday, February 16th. Stockholders of record on Monday, February 5th were given a dividend of $0.40 per share. The ex-dividend date of this dividend was Friday, February 2nd. This represents a $1.60 annualized dividend and a dividend yield of 3.15%. Webster Financial’s dividend payout ratio is currently 32.72%.

About Webster Financial

Webster Financial Corporation operates as the bank holding company for Webster Bank, National Association that provides a range of financial products and services to individuals, families, and businesses in the United States. It operates through three segments: Commercial Banking, HSA Bank, and Consumer Banking.

See Also

Receive News & Ratings for Webster Financial Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Webster Financial and related companies with MarketBeat.com’s FREE daily email newsletter.