Brokers Offer Predictions for Imperial Oil Limited’s FY2024 Earnings (NYSEAMERICAN:IMO)

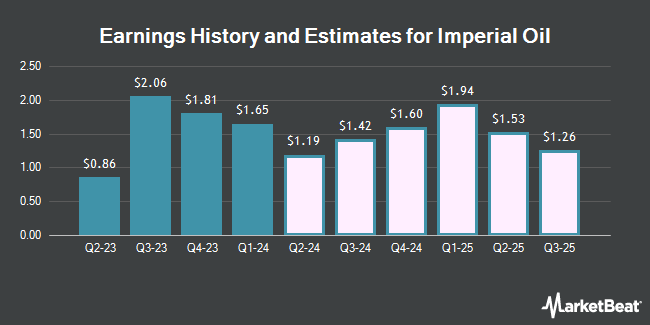

Imperial Oil Limited (NYSEAMERICAN:IMO – Free Report) (TSE:IMO) – Zacks Research upped their FY2024 earnings per share (EPS) estimates for shares of Imperial Oil in a research note issued on Wednesday, May 8th. Zacks Research analyst R. Department now anticipates that the energy company will earn $6.10 per share for the year, up from their prior estimate of $5.64. The consensus estimate for Imperial Oil’s current full-year earnings is $6.07 per share. Zacks Research also issued estimates for Imperial Oil’s Q4 2024 earnings at $1.60 EPS, Q2 2025 earnings at $1.53 EPS and FY2025 earnings at $5.89 EPS.

Separately, StockNews.com upgraded Imperial Oil from a “hold” rating to a “buy” rating in a research note on Sunday, May 5th. Four investment analysts have rated the stock with a hold rating and two have given a buy rating to the company’s stock. According to MarketBeat, Imperial Oil currently has an average rating of “Hold” and a consensus price target of $85.33.

Get Our Latest Stock Report on Imperial Oil

Imperial Oil Stock Performance

Shares of NYSEAMERICAN:IMO opened at $69.85 on Friday. The firm has a market capitalization of $37.43 billion, a price-to-earnings ratio of 10.84 and a beta of 1.46. The company has a quick ratio of 1.04, a current ratio of 1.34 and a debt-to-equity ratio of 0.17. Imperial Oil has a 1 year low of $44.89 and a 1 year high of $74.58.

Imperial Oil (NYSEAMERICAN:IMO – Get Free Report) (TSE:IMO) last released its quarterly earnings results on Friday, April 26th. The energy company reported $1.65 EPS for the quarter, beating analysts’ consensus estimates of $1.55 by $0.10. The business had revenue of $9.11 billion during the quarter, compared to analyst estimates of $11.61 billion. Imperial Oil had a return on equity of 20.76% and a net margin of 9.46%.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently made changes to their positions in IMO. Commonwealth Equity Services LLC grew its stake in shares of Imperial Oil by 8.2% during the 3rd quarter. Commonwealth Equity Services LLC now owns 33,774 shares of the energy company’s stock worth $2,080,000 after acquiring an additional 2,572 shares during the period. Raymond James & Associates lifted its holdings in Imperial Oil by 106.5% during the 3rd quarter. Raymond James & Associates now owns 20,396 shares of the energy company’s stock worth $1,256,000 after purchasing an additional 10,518 shares in the last quarter. Raymond James Financial Services Advisors Inc. lifted its holdings in Imperial Oil by 2.9% during the 3rd quarter. Raymond James Financial Services Advisors Inc. now owns 89,946 shares of the energy company’s stock worth $5,540,000 after purchasing an additional 2,563 shares in the last quarter. Bank of New York Mellon Corp lifted its holdings in Imperial Oil by 13.0% during the 3rd quarter. Bank of New York Mellon Corp now owns 277,892 shares of the energy company’s stock worth $17,115,000 after purchasing an additional 32,075 shares in the last quarter. Finally, Park Avenue Securities LLC purchased a new stake in Imperial Oil during the 3rd quarter worth about $370,000. Institutional investors own 20.74% of the company’s stock.

Imperial Oil Cuts Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Monday, July 1st. Shareholders of record on Monday, June 3rd will be paid a $0.4377 dividend. The ex-dividend date is Monday, June 3rd. This represents a $1.75 dividend on an annualized basis and a yield of 2.51%. Imperial Oil’s dividend payout ratio (DPR) is presently 27.74%.

About Imperial Oil

Imperial Oil Limited engages in exploration, production, and sale of crude oil and natural gas in Canada. The company operates through three segments: Upstream, Downstream and Chemical segments. The Upstream segment explores and produces crude oil, natural gas, synthetic crude oil, and bitumen. The Downstream segment transports and refines crude oil, blends refined products, and distributes and markets of refined products.

See Also

Receive News & Ratings for Imperial Oil Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Imperial Oil and related companies with MarketBeat.com’s FREE daily email newsletter.