Brokers Offer Predictions for Lockheed Martin Co.’s Q4 2025 Earnings (NYSE:LMT)

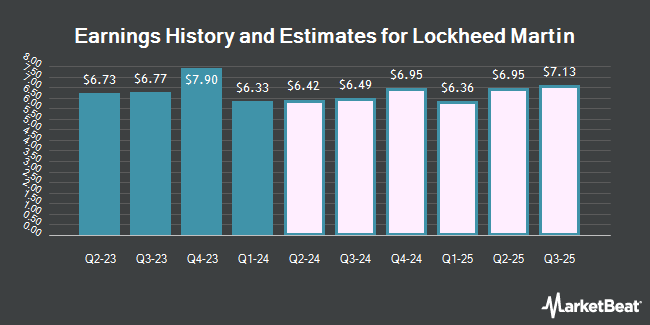

Lockheed Martin Co. (NYSE:LMT – Free Report) – Zacks Research lifted their Q4 2025 EPS estimates for Lockheed Martin in a research report issued to clients and investors on Tuesday, June 11th. Zacks Research analyst R. Department now anticipates that the aerospace company will earn $7.41 per share for the quarter, up from their previous estimate of $7.38. The consensus estimate for Lockheed Martin’s current full-year earnings is $26.17 per share. Zacks Research also issued estimates for Lockheed Martin’s FY2026 earnings at $30.21 EPS.

Lockheed Martin (NYSE:LMT – Get Free Report) last issued its earnings results on Tuesday, April 23rd. The aerospace company reported $6.33 earnings per share for the quarter, topping the consensus estimate of $5.80 by $0.53. Lockheed Martin had a net margin of 9.73% and a return on equity of 85.96%. The company had revenue of $17.20 billion for the quarter, compared to analyst estimates of $16.04 billion. During the same period in the prior year, the business posted $6.43 earnings per share. The firm’s revenue for the quarter was up 13.7% compared to the same quarter last year.

Several other analysts also recently issued reports on the stock. Citigroup upped their price target on shares of Lockheed Martin from $508.00 to $525.00 and gave the company a “buy” rating in a report on Wednesday, April 24th. UBS Group upped their price objective on shares of Lockheed Martin from $482.00 to $499.00 and gave the company a “neutral” rating in a research note on Wednesday, April 24th. The Goldman Sachs Group reduced their price objective on shares of Lockheed Martin from $380.00 to $377.00 and set a “sell” rating on the stock in a research note on Tuesday, April 23rd. JPMorgan Chase & Co. raised shares of Lockheed Martin from a “neutral” rating to an “overweight” rating and upped their price objective for the company from $475.00 to $518.00 in a research note on Monday, April 15th. Finally, Wells Fargo & Company upped their price objective on shares of Lockheed Martin from $460.00 to $480.00 and gave the company an “equal weight” rating in a research note on Thursday, April 25th. One research analyst has rated the stock with a sell rating, six have issued a hold rating, three have given a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat.com, the company presently has a consensus rating of “Hold” and a consensus price target of $485.40.

Check Out Our Latest Analysis on Lockheed Martin

Lockheed Martin Stock Down 0.8 %

Shares of NYSE LMT opened at $459.11 on Thursday. Lockheed Martin has a 12-month low of $393.77 and a 12-month high of $479.50. The company has a market capitalization of $110.16 billion, a PE ratio of 16.80, a price-to-earnings-growth ratio of 4.40 and a beta of 0.47. The company has a debt-to-equity ratio of 2.89, a current ratio of 1.30 and a quick ratio of 1.11. The firm’s 50-day moving average is $462.40 and its two-hundred day moving average is $449.01.

Lockheed Martin Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, June 28th. Shareholders of record on Monday, June 3rd will be paid a dividend of $3.15 per share. This represents a $12.60 dividend on an annualized basis and a yield of 2.74%. The ex-dividend date of this dividend is Monday, June 3rd. Lockheed Martin’s dividend payout ratio is currently 46.10%.

Hedge Funds Weigh In On Lockheed Martin

A number of large investors have recently bought and sold shares of the stock. American Trust raised its stake in Lockheed Martin by 1.8% during the first quarter. American Trust now owns 1,394 shares of the aerospace company’s stock worth $634,000 after purchasing an additional 24 shares during the period. OMC Financial Services LTD purchased a new position in Lockheed Martin during the first quarter worth approximately $2,757,000. EverSource Wealth Advisors LLC increased its position in shares of Lockheed Martin by 25.0% in the first quarter. EverSource Wealth Advisors LLC now owns 1,125 shares of the aerospace company’s stock worth $523,000 after acquiring an additional 225 shares in the last quarter. Motiv8 Investments LLC increased its position in shares of Lockheed Martin by 29.6% in the first quarter. Motiv8 Investments LLC now owns 1,248 shares of the aerospace company’s stock worth $568,000 after acquiring an additional 285 shares in the last quarter. Finally, Pathway Financial Advisers LLC acquired a new stake in shares of Lockheed Martin in the first quarter worth $4,060,000. Hedge funds and other institutional investors own 74.19% of the company’s stock.

Lockheed Martin Company Profile

Lockheed Martin Corporation, a security and aerospace company, engages in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services worldwide. The company operates through Aeronautics, Missiles and Fire Control, Rotary and Mission Systems, and Space segments.

See Also

Receive News & Ratings for Lockheed Martin Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Lockheed Martin and related companies with MarketBeat.com’s FREE daily email newsletter.