Brokers Offer Predictions for Orla Mining Ltd.’s FY2024 Earnings (TSE:OLA)

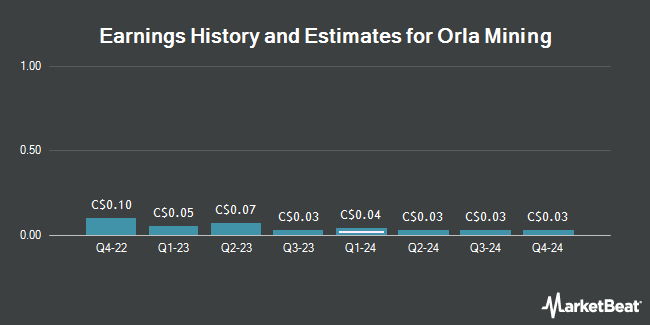

Orla Mining Ltd. (TSE:OLA – Free Report) – Equities research analysts at Desjardins decreased their FY2024 earnings estimates for shares of Orla Mining in a research note issued on Tuesday, January 16th. Desjardins analyst J. Sclodnick now expects that the company will earn $0.21 per share for the year, down from their prior estimate of $0.32. Desjardins has a “Buy” rating and a $6.50 price target on the stock. The consensus estimate for Orla Mining’s current full-year earnings is $0.23 per share.

A number of other research analysts have also issued reports on OLA. Royal Bank of Canada set a C$6.00 target price on shares of Orla Mining and gave the company an “outperform” rating in a report on Friday, December 15th. Cormark reduced their target price on shares of Orla Mining from C$6.50 to C$5.00 in a report on Wednesday, November 15th. TD Securities lowered shares of Orla Mining from a “buy” rating to a “hold” rating and reduced their target price for the company from C$5.50 to C$4.50 in a report on Monday, December 11th. BMO Capital Markets reduced their target price on shares of Orla Mining from C$8.00 to C$7.50 and set an “outperform” rating on the stock in a report on Tuesday, December 19th. Finally, Stifel Nicolaus reduced their target price on shares of Orla Mining from C$6.50 to C$5.25 and set a “buy” rating on the stock in a report on Thursday, December 21st. One analyst has rated the stock with a hold rating and four have given a buy rating to the company’s stock. According to data from MarketBeat, Orla Mining currently has an average rating of “Moderate Buy” and a consensus target price of C$6.09.

Get Our Latest Analysis on OLA

Orla Mining Price Performance

Shares of TSE OLA opened at C$4.47 on Friday. The stock has a market cap of C$1.41 billion, a price-to-earnings ratio of 21.29 and a beta of 1.55. The company has a current ratio of 2.91, a quick ratio of 1.22 and a debt-to-equity ratio of 30.49. The company’s 50-day moving average price is C$4.15 and its 200 day moving average price is C$5.04. Orla Mining has a 52 week low of C$3.53 and a 52 week high of C$6.90.

Orla Mining (TSE:OLA – Get Free Report) last issued its quarterly earnings data on Monday, November 13th. The company reported C$0.03 EPS for the quarter, missing analysts’ consensus estimates of C$0.06 by C($0.03). The business had revenue of C$80.89 million during the quarter. Orla Mining had a net margin of 22.04% and a return on equity of 12.06%.

Insider Transactions at Orla Mining

In related news, Director Jason Douglas Simpson acquired 37,964 shares of the business’s stock in a transaction dated Monday, December 4th. The shares were acquired at an average cost of C$4.09 per share, for a total transaction of C$155,409.43. In other Orla Mining news, Senior Officer John Andrew Cormier purchased 7,000 shares of the business’s stock in a transaction that occurred on Wednesday, December 13th. The shares were purchased at an average price of C$3.83 per share, for a total transaction of C$26,792.50. Also, Director Jason Douglas Simpson purchased 37,964 shares of the business’s stock in a transaction that occurred on Monday, December 4th. The stock was acquired at an average price of C$4.09 per share, for a total transaction of C$155,409.43. Insiders own 35.18% of the company’s stock.

Orla Mining Company Profile

Orla Mining Ltd. acquires, explores, operates, and develops mineral properties. The company explores for gold, silver, zinc, lead, and copper deposits. It owns 100% interests in the Camino Rojo project that consists of seven concessions covering an area of 138,636 hectares located in Zacatecas, Mexico; and Cerro Quema project totaling an area of 14,893 hectares located in the Azuero Peninsula, Panama.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Orla Mining, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Orla Mining wasn’t on the list.

While Orla Mining currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.