Brokers Offer Predictions for The AES Co.’s Q4 2025 Earnings (NYSE:AES)

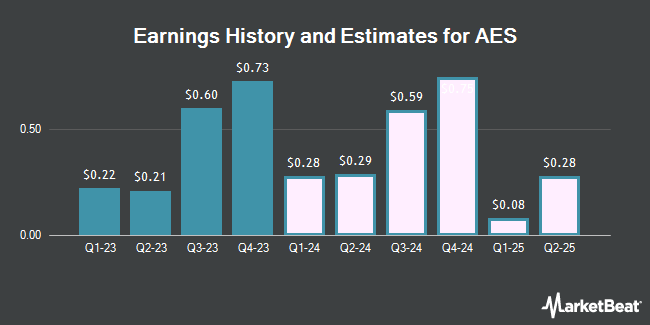

The AES Co. (NYSE:AES – Free Report) – Research analysts at Zacks Research cut their Q4 2025 earnings estimates for AES in a note issued to investors on Wednesday, March 27th. Zacks Research analyst R. Department now expects that the utilities provider will post earnings per share of $1.52 for the quarter, down from their previous estimate of $1.53. The consensus estimate for AES’s current full-year earnings is $1.90 per share.

AES has been the subject of a number of other reports. Barclays dropped their price objective on shares of AES from $21.00 to $20.00 and set an “overweight” rating for the company in a research note on Thursday, March 14th. Morgan Stanley reissued an “overweight” rating and issued a $25.00 price objective on shares of AES in a research note on Monday, March 25th. Finally, Argus reaffirmed a “buy” rating and set a $25.00 price target on shares of AES in a research note on Tuesday. One research analyst has rated the stock with a sell rating, three have assigned a hold rating and four have assigned a buy rating to the stock. According to MarketBeat.com, the company has an average rating of “Hold” and a consensus price target of $21.57.

AES Stock Performance

Shares of NYSE:AES opened at $17.93 on Friday. AES has a 52 week low of $11.43 and a 52 week high of $25.74. The stock has a market capitalization of $12.74 billion, a P/E ratio of 54.33, a PEG ratio of 1.03 and a beta of 1.07. The firm has a fifty day simple moving average of $16.30 and a two-hundred day simple moving average of $16.54. The company has a quick ratio of 0.61, a current ratio of 0.68 and a debt-to-equity ratio of 4.42.

AES (NYSE:AES – Get Free Report) last posted its earnings results on Tuesday, February 27th. The utilities provider reported $0.73 earnings per share for the quarter, beating the consensus estimate of $0.67 by $0.06. AES had a net margin of 2.12% and a return on equity of 38.76%. The company had revenue of $2.97 billion during the quarter, compared to analysts’ expectations of $3.36 billion. During the same period last year, the company posted $0.49 earnings per share. AES’s quarterly revenue was down 3.0% on a year-over-year basis.

AES Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, May 15th. Investors of record on Wednesday, May 1st will be issued a dividend of $0.1725 per share. The ex-dividend date of this dividend is Tuesday, April 30th. This represents a $0.69 dividend on an annualized basis and a yield of 3.85%. AES’s payout ratio is 209.10%.

Institutional Investors Weigh In On AES

A number of institutional investors and hedge funds have recently added to or reduced their stakes in the stock. Vanguard Group Inc. raised its holdings in shares of AES by 1.6% in the 1st quarter. Vanguard Group Inc. now owns 83,790,219 shares of the utilities provider’s stock valued at $2,155,923,000 after purchasing an additional 1,285,423 shares in the last quarter. Capital World Investors raised its holdings in shares of AES by 76.9% in the 4th quarter. Capital World Investors now owns 71,348,566 shares of the utilities provider’s stock valued at $1,373,460,000 after purchasing an additional 31,009,718 shares in the last quarter. Capital International Investors raised its holdings in shares of AES by 3.8% in the 4th quarter. Capital International Investors now owns 69,671,801 shares of the utilities provider’s stock valued at $1,341,277,000 after purchasing an additional 2,537,128 shares in the last quarter. BlackRock Inc. raised its holdings in shares of AES by 1.9% in the 2nd quarter. BlackRock Inc. now owns 46,239,885 shares of the utilities provider’s stock valued at $958,553,000 after purchasing an additional 844,270 shares in the last quarter. Finally, FMR LLC raised its holdings in shares of AES by 38.6% in the 3rd quarter. FMR LLC now owns 36,821,650 shares of the utilities provider’s stock valued at $559,689,000 after purchasing an additional 10,256,781 shares in the last quarter. Institutional investors own 93.13% of the company’s stock.

AES Company Profile

The AES Corporation, together with its subsidiaries, operates as a diversified power generation and utility company in the United States and internationally. The company owns and/or operates power plants to generate and sell power to customers, such as utilities, industrial users, and other intermediaries; owns and/or operates utilities to generate or purchase, distribute, transmit, and sell electricity to end-user customers in the residential, commercial, industrial, and governmental sectors; and generates and sells electricity on the wholesale market.

Featured Articles

Receive News & Ratings for AES Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for AES and related companies with MarketBeat.com’s FREE daily email newsletter.