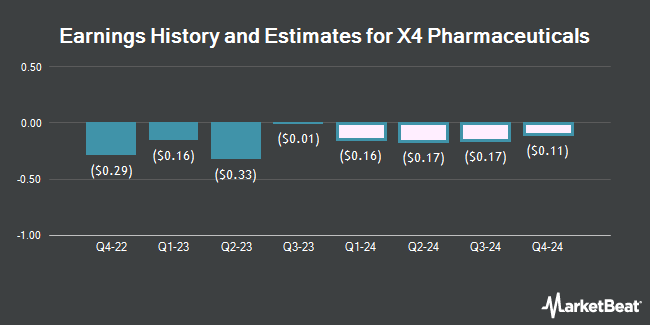

Brokers Offer Predictions for X4 Pharmaceuticals, Inc.’s Q2 2024 Earnings (NASDAQ:XFOR)

X4 Pharmaceuticals, Inc. (NASDAQ:XFOR – Free Report) – Analysts at Zacks Small Cap issued their Q2 2024 earnings estimates for X4 Pharmaceuticals in a report released on Tuesday, April 2nd. Zacks Small Cap analyst D. Bautz anticipates that the company will post earnings of ($0.20) per share for the quarter. The consensus estimate for X4 Pharmaceuticals’ current full-year earnings is ($0.52) per share. Zacks Small Cap also issued estimates for X4 Pharmaceuticals’ Q3 2024 earnings at ($0.18) EPS, Q4 2024 earnings at ($0.17) EPS and FY2026 earnings at ($0.15) EPS.

A number of other brokerages have also recently weighed in on XFOR. B. Riley cut shares of X4 Pharmaceuticals from a “buy” rating to a “neutral” rating and cut their price objective for the stock from $3.00 to $1.00 in a report on Tuesday, December 12th. HC Wainwright restated a “buy” rating and issued a $3.00 price objective on shares of X4 Pharmaceuticals in a report on Friday, March 22nd.

Get Our Latest Research Report on XFOR

X4 Pharmaceuticals Price Performance

Shares of XFOR opened at $1.47 on Thursday. The stock has a market cap of $246.87 million, a PE ratio of -2.45 and a beta of 0.49. The company has a debt-to-equity ratio of 1.07, a quick ratio of 5.34 and a current ratio of 5.34. X4 Pharmaceuticals has a fifty-two week low of $0.57 and a fifty-two week high of $2.58. The firm’s 50-day simple moving average is $1.02 and its two-hundred day simple moving average is $0.90.

Insider Transactions at X4 Pharmaceuticals

In related news, CEO Paula Ragan sold 49,678 shares of the stock in a transaction that occurred on Monday, March 11th. The shares were sold at an average price of $0.88, for a total transaction of $43,716.64. Following the transaction, the chief executive officer now owns 765,068 shares in the company, valued at $673,259.84. The sale was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. In other X4 Pharmaceuticals news, CEO Paula Ragan sold 49,678 shares of the company’s stock in a transaction that occurred on Monday, March 11th. The shares were sold at an average price of $0.88, for a total transaction of $43,716.64. Following the completion of the sale, the chief executive officer now directly owns 765,068 shares of the company’s stock, valued at $673,259.84. The sale was disclosed in a filing with the SEC, which can be accessed through this link. Also, CFO Adam S. Mostafa sold 27,721 shares of the company’s stock in a transaction that occurred on Monday, February 12th. The shares were sold at an average price of $1.01, for a total transaction of $27,998.21. Following the sale, the chief financial officer now directly owns 52,500 shares of the company’s stock, valued at $53,025. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 185,708 shares of company stock worth $170,428. Corporate insiders own 1.08% of the company’s stock.

Institutional Trading of X4 Pharmaceuticals

A number of hedge funds and other institutional investors have recently modified their holdings of XFOR. Bank of New York Mellon Corp bought a new position in X4 Pharmaceuticals during the first quarter valued at $246,000. Renaissance Technologies LLC lifted its holdings in X4 Pharmaceuticals by 26.1% during the 1st quarter. Renaissance Technologies LLC now owns 173,094 shares of the company’s stock valued at $303,000 after buying an additional 35,800 shares in the last quarter. Jane Street Group LLC purchased a new position in X4 Pharmaceuticals during the 1st quarter valued at about $64,000. Virtu Financial LLC purchased a new position in X4 Pharmaceuticals during the 1st quarter valued at about $45,000. Finally, BlackRock Inc. increased its position in X4 Pharmaceuticals by 4.3% during the 3rd quarter. BlackRock Inc. now owns 289,383 shares of the company’s stock valued at $494,000 after purchasing an additional 11,930 shares during the period. 72.03% of the stock is owned by hedge funds and other institutional investors.

X4 Pharmaceuticals Company Profile

X4 Pharmaceuticals, Inc, a late-stage clinical biopharmaceutical company, focuses on the research, development, and commercialization of novel therapeutics for the treatment of rare diseases. Its lead product candidate is mavorixafor, a small molecule inhibitor of the chemokine receptor C-X-C chemokine receptor type 4 (CXCR4), which is in Phase III clinical trial for the treatment of patients with warts, hypogammaglobulinemia, infections, and myelokathexis syndrome; and Phase II clinical trial to treat congenital, idiopathic, or cyclic neutropenia.

Read More

Receive News & Ratings for X4 Pharmaceuticals Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for X4 Pharmaceuticals and related companies with MarketBeat.com’s FREE daily email newsletter.