Brokers Set Expectations for Splash Beverage Group, Inc.’s Q2 2024 Earnings (NYSEAMERICAN:SBEV)

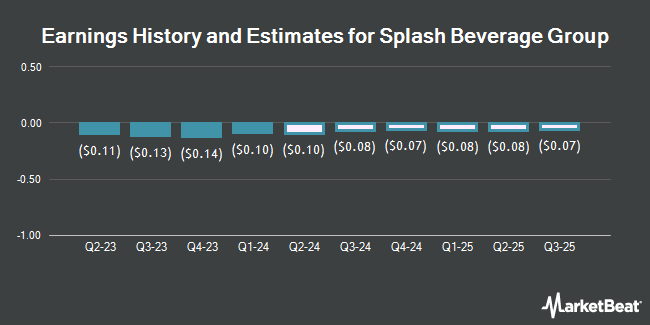

Splash Beverage Group, Inc. (NYSEAMERICAN:SBEV – Free Report) – Investment analysts at Roth Capital raised their Q2 2024 earnings estimates for Splash Beverage Group in a research report issued to clients and investors on Tuesday, June 25th. Roth Capital analyst S. Mcgowan now expects that the company will earn ($0.08) per share for the quarter, up from their prior estimate of ($0.10). The consensus estimate for Splash Beverage Group’s current full-year earnings is ($0.34) per share. Roth Capital also issued estimates for Splash Beverage Group’s Q3 2024 earnings at ($0.06) EPS, Q4 2024 earnings at ($0.08) EPS, FY2024 earnings at ($0.32) EPS and FY2025 earnings at ($0.31) EPS.

A number of other equities analysts have also issued reports on the stock. HC Wainwright reiterated a “buy” rating and issued a $1.00 target price on shares of Splash Beverage Group in a research report on Wednesday, May 22nd. Roth Mkm decreased their target price on shares of Splash Beverage Group from $2.85 to $1.00 and set a “buy” rating for the company in a research report on Tuesday.

Read Our Latest Stock Report on SBEV

Splash Beverage Group Stock Up 3.2 %

Shares of SBEV opened at $0.25 on Thursday. Splash Beverage Group has a 52-week low of $0.20 and a 52-week high of $1.18.

Splash Beverage Group (NYSEAMERICAN:SBEV – Get Free Report) last issued its earnings results on Wednesday, May 15th. The company reported ($0.10) earnings per share for the quarter, hitting analysts’ consensus estimates of ($0.10). The company had revenue of $1.54 million for the quarter, compared to analysts’ expectations of $5.21 million. Splash Beverage Group had a negative net margin of 150.64% and a negative return on equity of 1,659.09%.

Institutional Trading of Splash Beverage Group

A hedge fund recently bought a new stake in Splash Beverage Group stock. Sanibel Captiva Trust Company Inc. acquired a new stake in shares of Splash Beverage Group, Inc. (NYSEAMERICAN:SBEV – Free Report) during the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm acquired 60,000 shares of the company’s stock, valued at approximately $28,000. Sanibel Captiva Trust Company Inc. owned approximately 0.13% of Splash Beverage Group as of its most recent filing with the Securities & Exchange Commission. Institutional investors and hedge funds own 5.77% of the company’s stock.

Splash Beverage Group Company Profile

Splash Beverage Group, Inc engages in the manufacturing, distribution, marketing, and sale of various beverages in the United States. It is involved in the manufacture and distribution of non-alcoholic and alcoholic beverages; and retail sale of beverages and groceries online through qplash.com. The company’s products include flavored tequilas under the SALT Naturally Flavored Tequila name; hydration and energy products under the TapouT Performance name; wine under the Copa DI Vino name; and Pulpoloco Sangria.

See Also

Receive News & Ratings for Splash Beverage Group Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Splash Beverage Group and related companies with MarketBeat.com’s FREE daily email newsletter.