Interactive Brokers Group, Inc. (NASDAQ:IBKR) Shares Sold by BNP Paribas Financial Markets

BNP Paribas Financial Markets cut its stake in shares of Interactive Brokers Group, Inc. (NASDAQ:IBKR – Free Report) by 56.1% in the fourth quarter, according to its most recent disclosure with the SEC. The firm owned 44,433 shares of the financial services provider’s stock after selling 56,859 shares during the period. BNP Paribas Financial Markets’ holdings in Interactive Brokers Group were worth $3,683,000 at the end of the most recent quarter.

BNP Paribas Financial Markets cut its stake in shares of Interactive Brokers Group, Inc. (NASDAQ:IBKR – Free Report) by 56.1% in the fourth quarter, according to its most recent disclosure with the SEC. The firm owned 44,433 shares of the financial services provider’s stock after selling 56,859 shares during the period. BNP Paribas Financial Markets’ holdings in Interactive Brokers Group were worth $3,683,000 at the end of the most recent quarter.

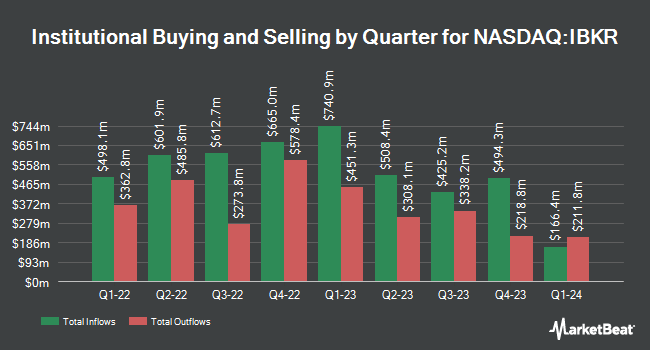

Several other hedge funds and other institutional investors have also added to or reduced their stakes in IBKR. Vanguard Group Inc. lifted its stake in Interactive Brokers Group by 3.3% in the 3rd quarter. Vanguard Group Inc. now owns 9,566,830 shares of the financial services provider’s stock valued at $828,105,000 after buying an additional 308,236 shares in the last quarter. Greenwich Wealth Management LLC boosted its stake in shares of Interactive Brokers Group by 6.5% in the third quarter. Greenwich Wealth Management LLC now owns 3,117,859 shares of the financial services provider’s stock worth $269,882,000 after acquiring an additional 189,555 shares during the last quarter. FMR LLC increased its position in shares of Interactive Brokers Group by 211.7% during the third quarter. FMR LLC now owns 1,773,533 shares of the financial services provider’s stock worth $153,517,000 after purchasing an additional 1,204,573 shares in the last quarter. Bronte Capital Management Pty Ltd. raised its stake in Interactive Brokers Group by 0.6% in the 3rd quarter. Bronte Capital Management Pty Ltd. now owns 841,228 shares of the financial services provider’s stock valued at $72,817,000 after purchasing an additional 4,777 shares during the last quarter. Finally, Charles Schwab Investment Management Inc. lifted its holdings in Interactive Brokers Group by 16.1% in the 4th quarter. Charles Schwab Investment Management Inc. now owns 840,852 shares of the financial services provider’s stock valued at $69,707,000 after purchasing an additional 116,890 shares in the last quarter. 23.80% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

IBKR has been the subject of a number of recent research reports. Barclays increased their target price on shares of Interactive Brokers Group from $132.00 to $136.00 and gave the company an “overweight” rating in a research report on Wednesday, April 17th. Citigroup raised their target price on shares of Interactive Brokers Group from $105.00 to $135.00 and gave the stock a “buy” rating in a research note on Thursday, April 11th. Jefferies Financial Group increased their price target on Interactive Brokers Group from $133.00 to $138.00 and gave the company a “buy” rating in a report on Wednesday, April 17th. Piper Sandler boosted their price objective on Interactive Brokers Group from $105.00 to $125.00 and gave the stock an “overweight” rating in a research note on Friday, April 12th. Finally, Bank of America raised their target price on Interactive Brokers Group from $147.00 to $152.00 and gave the stock a “buy” rating in a research note on Wednesday, April 17th. One equities research analyst has rated the stock with a hold rating and eight have assigned a buy rating to the company’s stock. According to data from MarketBeat, the stock has an average rating of “Moderate Buy” and an average price target of $124.00.

Check Out Our Latest Stock Analysis on IBKR

Interactive Brokers Group Trading Up 0.8 %

NASDAQ IBKR opened at $126.60 on Wednesday. The stock has a fifty day simple moving average of $114.48 and a 200-day simple moving average of $98.59. The stock has a market cap of $53.31 billion, a PE ratio of 21.64, a P/E/G ratio of 1.25 and a beta of 0.81. Interactive Brokers Group, Inc. has a twelve month low of $72.60 and a twelve month high of $126.83.

Interactive Brokers Group (NASDAQ:IBKR – Get Free Report) last announced its earnings results on Tuesday, April 16th. The financial services provider reported $1.64 earnings per share for the quarter, topping the consensus estimate of $1.63 by $0.01. The company had revenue of $1.20 billion during the quarter, compared to analyst estimates of $1.19 billion. Interactive Brokers Group had a net margin of 7.62% and a return on equity of 4.72%. Research analysts predict that Interactive Brokers Group, Inc. will post 6.49 EPS for the current year.

Interactive Brokers Group Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, June 14th. Shareholders of record on Friday, May 31st will be given a $0.25 dividend. This is a positive change from Interactive Brokers Group’s previous quarterly dividend of $0.10. The ex-dividend date of this dividend is Friday, May 31st. This represents a $1.00 dividend on an annualized basis and a yield of 0.79%. Interactive Brokers Group’s payout ratio is presently 6.84%.

Interactive Brokers Group Profile

Interactive Brokers Group, Inc operates as an automated electronic broker worldwide. The company engages in the execution, clearance, and settlement of trades in stocks, options, futures, foreign exchange instruments, bonds, mutual funds, exchange traded funds (ETFs), precious metals, and cryptocurrencies.

Recommended Stories

Receive News & Ratings for Interactive Brokers Group Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Interactive Brokers Group and related companies with MarketBeat.com’s FREE daily email newsletter.