Interactive Brokers Stock (NASDAQ:IBKR) Down After Q4 Miss

Interactive Brokers Group (NASDAQ:IBKR) stock fell about 3% in after-hours trading yesterday following the release of its fourth-quarter results. While revenue and earnings missed analysts’ expectations, they improved on a year-over-year basis, driven by an expanding customer base and higher interest rates.

IBKR provides online trading services for stocks, options, futures, currencies, crypto, and gold.

O4 Earnings Snapshot

The company’s adjusted Q4 earnings increased 16.9% year-over-year to $1.52 per share but missed the consensus estimate of $1.53. Meanwhile, Q4 adjusted net revenue increased to $1.14 billion from $958 million in the year-ago quarter but came in lower than the Street’s estimate of $1.17 billion.

Net interest income increased 29% to $348 million, due to improved benchmark rates, customer margin loans, and customer credit balances. Furthermore, Commission revenue rose 5% to $348 million. However, non-interest expenses also saw an uptick, increasing to $323 million from $287 million in the same period last year.

In terms of key metrics, total customer daily average revenue trades (DARTs) increased 2% year-over-year to 1.93 million. Also, customer trading volume remained mixed across product types, with options and futures contracts up by 21% and 4%, respectively, while stock share volumes dipped by 22% year-over-year.

Is IBKR a Good Stock to Buy?

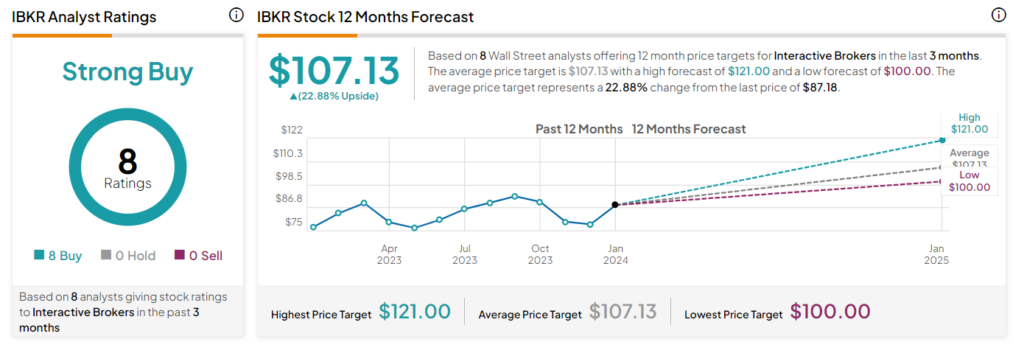

Wall Street analysts have a Strong Buy consensus rating on IBKR stock based on eight unanimous Buys assigned in the past three months. The average price target of $107.13 per share implies 22.9% upside potential. Shares have gained 13.5% in the past year.