The challenges and implications of non-approved customs brokers – Trade Finance Global

Estimated reading time: 6 minutes

Customs brokers facilitate smooth border crossings by conducting. Their diligence and attention to detail contribute to the accuracy of customs declarations, ensuring importers pay and account for correct import VAT (value-added tax) and duty.

In 2022 alone, 38.6 million import declarations were made for goods from the EU to the UK, a 13% increase from 2021. A vast 78.3% of all rest of world (ROW) declarations were made by ‘third parties’ in 2022.

While most customs agents maintain high levels of compliance, some, known as ‘non-approved brokers’, pose risks. There are specific measures that UK importers can take to mitigate the consequences of poor customs agent practices. The first is identifying the non-approved brokers and understanding why effective communication with various supply chain actors is important.

Identification

The easiest way to identify non-approved brokers is by using the MSS / CDS report.

Use the filter option and go to ‘Deferment1’ (equivalent of the ‘Fir DAN’ in MSS) column, untick blanks and own/familiar deferent account numbers, leaving any ‘odd’ accounts you do not recognise. Investigate these deferment accounts, find out declarant details and make contact.

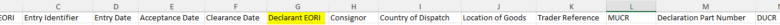

Note that with CDS, as opposed to CHIEF/MSS, the declarant’s details (name and address) are no longer visible. Additionally, searching for the declarant’s EORI in the EORI Checker tool may be challenging, as companies may opt out for its details to be shown publicly. However, if the last 3 digits of the EORI number are removed, the VAT Checker can come in handy to find the company name and address – that way, declarant details can be known.

Once non-approved brokers are identified, they can be contacted directly. Ask for:

- Shipping documentation/information, including import declarations used for clearance

- Import clearance instructions received from the importer or other (contracting) party

If possible, try to establish and contact the regional manager for large forwarders or courier companies such as FedEx, UPS, or DHL. Any customs broker should provide all shipping information for audit and record-keeping purposes and be questioned regarding clearance without the importer’s knowledge.

Some reasons for non-approved brokers acting without consent

There are reasons, some of which are genuine, why non-approved brokers might clear goods without the importer’s consent or instruction:

- Exporter’s instructions: Sometimes, the supplier instructs its own forwarder to clear goods (‘deliver all in’) to expedite delivery, sometimes without the importer’s knowledge. In such cases, forwarders (and their customs agents) act on instructions received from the contracting party. To mitigate such instances, importers should regularly communicate their preferred customs brokers’ information and processes to suppliers, including out-of-office contact details, where possible.

- Lack of importer’s contact information – Brokers may struggle to obtain import clearance instructions if they lack correct contact details. While this is not the best excuse, importers should ensure their contact details are registered with all supply chain actors and encourage persistence in seeking clearance instructions.

- Importer’s lack of knowledge: Sometimes, the importer’s staff may not know about incoming shipments or have any knowledge of customs compliance. With time-critical shipments, such situations are difficult for customs agents, who are under pressure to clear the goods and allow the driver to deliver without delays. Continuous education and the right contact person details can avoid such issues.

While genuine instances occur, forwarders and agents have no excuses for taking advantage of the importer, the ‘time critical situation’, and its position.

Bad practices

Many trade specialists have experienced various poor practices in their careers, and combining all of these stories could make up a TV drama. Although most UK customs brokers are very compliant, some notable bad practices include:

- Clearing goods without the importer’s knowledge: clearing goods without seeking import clearance instructions, claiming the brokerage or forwarder operates more efficiently this way, e.g. delivering DDP to the UK forwarder’s warehouse.

- ‘Conditional favours’: waiving declaration (or its amendments) fees for wrongly raised declarations, providing the importer ensures proper communication next time.

- Refusing entry amendments: agents refusing to raise entry amendments (C18, C21, and C2001) even if they are in the wrong.

- Refusing shipping documentation: some exhibit poor customer service and refuse to provide necessary shipping documents upon request.

- Poor customs compliance knowledge: Some agents do not fully understand trade compliance basics, such as rules of origin and needed legal evidence, e.g., declaring the importer’s knowledge (document code U112) without due diligence or assuming the origin is the same as the country of dispatch.

- Renomination issues: resisting renominations to the importer’s chosen customs broker, charging (unreasonable) fees or claiming it would be quicker for them to clear the goods

- Returned Goods: For some goods returning to the shipper, agents claim the importer didn’t pay duties or VAT despite having the necessary setup for automatic clearance

Minimising the impact

There are several practices to minimise the impact of poor compliance by non-approved brokers.

First, ensure the relevant people within the business have adequate information or an import clearance template or instructions ready to send to suppliers. Something as simple as an e-mail template, excel spreadsheet, or contact person’s details (importer’s customs brokers) would suffice.

Whilst advising all suppliers of the importer’s EORI or deferment account may not be the best practice for security reasons and risks of data misuse, a lot depends on supply chain actors’ trust and reliability.

Another good practice is advising suppliers of preferred delivery methods in emergencies. Communicating a contingency plan will better ensure adherence to the importer’s instructions. Adding the importer’s customs broker contacts outside of office hours can also be a good solution.

Leaving your customs broker details with various third parties (their systems may flag specific clearance instructions, such as contacting a specific company for clearance) will leave non-approved brokers with no excuses.

Some UK importers may benefit from maintaining various accounts with multiple customs intermediaries tailored for specific routes, products, or suppliers. This method reduces overreliance on a single broker.

Generally, if the customs intermediary is reluctant to cooperate, contacting the supplier or its forwarder might help, as the forwarder is the broker’s customer. If the forwarder is hesitant, requesting the supplier urge their forwarder can also be effective.

Arranging a call with all parties and providing clear instructions can resolve many issues related to importer clearances. Keeping records of all agreements, no matter how minor, is crucial to quickly refer back to the agreed terms when needed (e.g., contacting a non-approved broker).

Lastly, the UK government plans to introduce the Customs Intermediaries Voluntary Standards, which will provide training and set compliance quality levels for customs brokers.

This will help UK Importers to better identify brokers adhering to such standards. From customs intermediaries’ perspective, it’s an opportunity to upskill the staff and earn a ‘badge of high-quality customs compliance’.

While not all brokers are optimistic regarding the standards, with many questioning the worthiness of the AEO status, these standards are very much needed to reduce bad practices that unfortunately are still present.