Wedbush Brokers Reduce Earnings Estimates for GameStop Corp. (NYSE:GME)

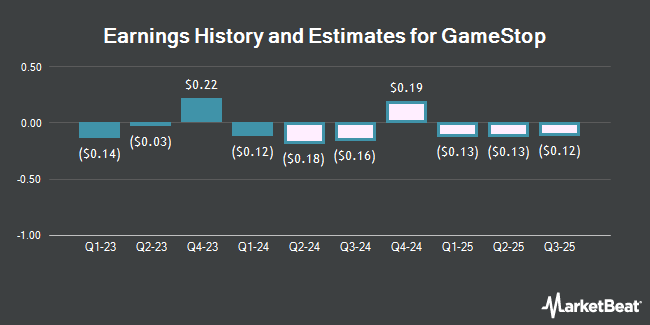

GameStop Corp. (NYSE:GME – Free Report) – Equities researchers at Wedbush lowered their Q4 2026 EPS estimates for GameStop in a report issued on Tuesday, June 11th. Wedbush analyst M. Pachter now expects that the company will post earnings of $0.09 per share for the quarter, down from their prior estimate of $0.11. Wedbush currently has a “Underperform” rating and a $11.00 price objective on the stock. The consensus estimate for GameStop’s current full-year earnings is $0.01 per share.

GameStop (NYSE:GME – Get Free Report) last released its quarterly earnings data on Friday, June 7th. The company reported ($0.12) earnings per share (EPS) for the quarter, missing analysts’ consensus estimates of ($0.09) by ($0.03). GameStop had a net margin of 0.51% and a return on equity of 1.78%. The firm had revenue of $881.80 million during the quarter, compared to analysts’ expectations of $995.30 million. During the same quarter in the previous year, the firm posted ($0.14) EPS. GameStop’s revenue was down 28.7% compared to the same quarter last year.

Separately, StockNews.com upgraded shares of GameStop from a “sell” rating to a “hold” rating in a research report on Wednesday, March 27th.

Check Out Our Latest Research Report on GME

GameStop Price Performance

Shares of NYSE GME opened at $25.46 on Thursday. GameStop has a 1 year low of $9.95 and a 1 year high of $64.83. The company has a debt-to-equity ratio of 0.01, a current ratio of 2.11 and a quick ratio of 1.44. The company’s 50-day moving average is $19.08 and its 200 day moving average is $16.35. The stock has a market capitalization of $7.79 billion, a P/E ratio of 318.23 and a beta of -0.27.

Institutional Investors Weigh In On GameStop

A number of hedge funds and other institutional investors have recently bought and sold shares of GME. Headlands Technologies LLC bought a new position in shares of GameStop in the fourth quarter worth approximately $55,000. First United Bank & Trust bought a new position in shares of GameStop in the fourth quarter worth approximately $70,000. Fifth Third Bancorp lifted its stake in shares of GameStop by 50.6% in the fourth quarter. Fifth Third Bancorp now owns 4,300 shares of the company’s stock worth $75,000 after buying an additional 1,445 shares in the last quarter. Russell Investments Group Ltd. lifted its stake in shares of GameStop by 147.2% in the first quarter. Russell Investments Group Ltd. now owns 5,080 shares of the company’s stock worth $65,000 after buying an additional 3,025 shares in the last quarter. Finally, Merit Financial Group LLC bought a new position in shares of GameStop in the fourth quarter worth approximately $176,000. Hedge funds and other institutional investors own 29.21% of the company’s stock.

Insider Activity at GameStop

In other GameStop news, General Counsel Mark Haymond Robinson sold 4,379 shares of the company’s stock in a transaction dated Tuesday, April 2nd. The shares were sold at an average price of $11.61, for a total value of $50,840.19. Following the sale, the general counsel now owns 64,308 shares in the company, valued at $746,615.88. The sale was disclosed in a filing with the SEC, which is available through the SEC website. In other GameStop news, General Counsel Mark Haymond Robinson sold 4,379 shares of the company’s stock in a transaction dated Tuesday, April 2nd. The shares were sold at an average price of $11.61, for a total value of $50,840.19. Following the sale, the general counsel now owns 64,308 shares in the company, valued at $746,615.88. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Also, insider Daniel William Moore sold 7,779 shares of the company’s stock in a transaction dated Wednesday, April 24th. The stock was sold at an average price of $10.20, for a total transaction of $79,345.80. Following the completion of the sale, the insider now owns 13,606 shares in the company, valued at approximately $138,781.20. The disclosure for this sale can be found here. Insiders have sold 27,421 shares of company stock worth $288,153 over the last 90 days. 12.28% of the stock is owned by company insiders.

GameStop Company Profile

GameStop Corp., a specialty retailer, provides games and entertainment products through its stores and ecommerce platforms in the United States, Canada, Australia, and Europe. The company sells new and pre-owned gaming platforms; accessories, such as controllers, gaming headsets, and virtual reality products; new and pre-owned gaming software; and in-game digital currency, digital downloadable content, and full-game downloads.

Featured Articles

Receive News & Ratings for GameStop Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for GameStop and related companies with MarketBeat.com’s FREE daily email newsletter.