William Blair Brokers Lower Earnings Estimates for Fortrea Holdings Inc. (NASDAQ:FTRE)

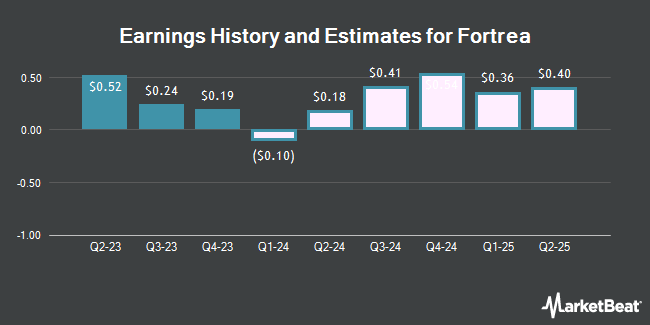

Fortrea Holdings Inc. (NASDAQ:FTRE – Free Report) – Research analysts at William Blair cut their Q1 2024 EPS estimates for Fortrea in a research note issued on Monday, March 11th. William Blair analyst M. Smock now anticipates that the company will post earnings of ($0.10) per share for the quarter, down from their previous forecast of $0.25. William Blair has a “Market Perform” rating on the stock. The consensus estimate for Fortrea’s current full-year earnings is $1.07 per share. William Blair also issued estimates for Fortrea’s Q4 2024 earnings at $0.54 EPS.

Other analysts have also recently issued reports about the company. Citigroup upgraded Fortrea from a “neutral” rating to a “buy” rating and upped their target price for the company from $34.00 to $40.00 in a report on Monday, December 11th. Jefferies Financial Group initiated coverage on Fortrea in a report on Thursday, January 4th. They issued a “buy” rating and a $44.00 target price on the stock. Evercore ISI upgraded Fortrea from an “in-line” rating to an “outperform” rating and upped their target price for the company from $32.00 to $36.00 in a report on Friday, December 1st. Barclays reduced their target price on Fortrea from $38.00 to $35.00 and set an “overweight” rating on the stock in a report on Thursday, January 25th. Finally, Deutsche Bank Aktiengesellschaft started coverage on Fortrea in a report on Wednesday, March 6th. They set a “hold” rating and a $36.00 price target on the stock. One analyst has rated the stock with a sell rating, two have assigned a hold rating and four have assigned a buy rating to the stock. Based on data from MarketBeat, the company presently has an average rating of “Hold” and a consensus target price of $36.33.

Check Out Our Latest Analysis on FTRE

Fortrea Trading Up 0.6 %

Fortrea stock opened at $39.15 on Thursday. The business has a 50 day moving average of $33.71 and a 200-day moving average of $31.32. Fortrea has a 1 year low of $24.92 and a 1 year high of $40.16. The company has a quick ratio of 1.62, a current ratio of 1.62 and a debt-to-equity ratio of 0.90.

Fortrea (NASDAQ:FTRE – Get Free Report) last issued its earnings results on Monday, March 11th. The company reported $0.19 EPS for the quarter, missing the consensus estimate of $0.23 by ($0.04). The business had revenue of $775.40 million during the quarter, compared to analysts’ expectations of $779.09 million. Fortrea’s quarterly revenue was up 1.8% on a year-over-year basis.

Hedge Funds Weigh In On Fortrea

A number of large investors have recently modified their holdings of FTRE. Whittier Trust Co. of Nevada Inc. purchased a new stake in Fortrea in the 4th quarter valued at $25,000. Whittier Trust Co. purchased a new stake in Fortrea in the 4th quarter valued at $25,000. ZRC Wealth Management LLC purchased a new stake in Fortrea in the 4th quarter valued at $27,000. Allworth Financial LP purchased a new stake in Fortrea in the 4th quarter valued at $28,000. Finally, Glassman Wealth Services purchased a new stake in Fortrea in the 4th quarter valued at $28,000.

Fortrea Company Profile

Fortrea Holdings Inc, a contract research organization, primarily engages in the provision of biopharmaceutical product and medical device development services worldwide. It operates through two segments: Clinical Services and Enabling Services. The Clinical Services segment provides across the clinical pharmacology and clinical development spectrum.

Featured Articles

Receive News & Ratings for Fortrea Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Fortrea and related companies with MarketBeat.com’s FREE daily email newsletter.