Zacks Research Brokers Lift Earnings Estimates for CMS Energy Co. (NYSE:CMS)

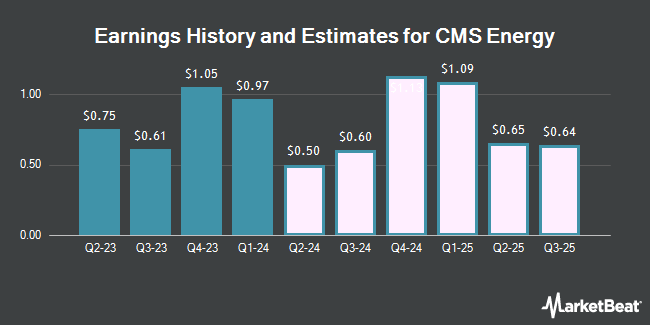

CMS Energy Co. (NYSE:CMS – Free Report) – Stock analysts at Zacks Research lifted their Q2 2024 earnings estimates for shares of CMS Energy in a research note issued to investors on Thursday, May 16th. Zacks Research analyst R. Department now anticipates that the utilities provider will post earnings of $0.60 per share for the quarter, up from their previous estimate of $0.50. The consensus estimate for CMS Energy’s current full-year earnings is $3.33 per share. Zacks Research also issued estimates for CMS Energy’s Q3 2024 earnings at $0.72 EPS, Q4 2024 earnings at $1.03 EPS, Q3 2025 earnings at $0.71 EPS, Q4 2025 earnings at $1.12 EPS and FY2025 earnings at $3.60 EPS.

CMS Energy (NYSE:CMS – Get Free Report) last announced its quarterly earnings data on Thursday, April 25th. The utilities provider reported $0.97 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.92 by $0.05. CMS Energy had a net margin of 13.19% and a return on equity of 12.83%. The company had revenue of $2.18 billion for the quarter, compared to analysts’ expectations of $2.32 billion. During the same period in the previous year, the company posted $0.70 EPS. CMS Energy’s revenue was down 4.7% compared to the same quarter last year.

CMS has been the topic of a number of other reports. JPMorgan Chase & Co. upped their price target on shares of CMS Energy from $65.00 to $66.00 and gave the stock an “overweight” rating in a research note on Wednesday, March 13th. BMO Capital Markets upped their price target on shares of CMS Energy from $68.00 to $71.00 and gave the stock an “outperform” rating in a research note on Tuesday. Royal Bank of Canada lowered their price target on shares of CMS Energy from $65.00 to $63.00 and set an “outperform” rating on the stock in a research note on Monday, March 4th. UBS Group cut shares of CMS Energy from a “buy” rating to a “neutral” rating and set a $65.00 price objective on the stock. in a research note on Thursday, April 4th. Finally, Barclays increased their price objective on shares of CMS Energy from $57.00 to $59.00 and gave the company an “equal weight” rating in a research note on Tuesday, April 30th. One investment analyst has rated the stock with a sell rating, four have given a hold rating and seven have issued a buy rating to the company’s stock. According to MarketBeat, the stock has an average rating of “Moderate Buy” and a consensus target price of $63.75.

Get Our Latest Report on CMS Energy

CMS Energy Stock Performance

NYSE:CMS opened at $63.24 on Friday. The company has a quick ratio of 1.05, a current ratio of 1.35 and a debt-to-equity ratio of 1.82. CMS Energy has a fifty-two week low of $49.87 and a fifty-two week high of $63.76. The stock has a market cap of $18.85 billion, a PE ratio of 19.28, a price-to-earnings-growth ratio of 2.57 and a beta of 0.37. The firm’s fifty day simple moving average is $59.95 and its 200-day simple moving average is $58.28.

CMS Energy Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, May 31st. Shareholders of record on Wednesday, May 15th will be issued a $0.515 dividend. The ex-dividend date of this dividend is Tuesday, May 14th. This represents a $2.06 dividend on an annualized basis and a yield of 3.26%. CMS Energy’s dividend payout ratio (DPR) is 62.80%.

Insider Buying and Selling at CMS Energy

In other news, SVP Brian F. Rich sold 2,000 shares of the stock in a transaction dated Thursday, May 2nd. The shares were sold at an average price of $61.10, for a total transaction of $122,200.00. Following the transaction, the senior vice president now directly owns 97,682 shares in the company, valued at approximately $5,968,370.20. The sale was disclosed in a legal filing with the SEC, which is available at this hyperlink. In other news, SVP Brian F. Rich sold 2,000 shares of the stock in a transaction dated Thursday, May 2nd. The shares were sold at an average price of $61.10, for a total transaction of $122,200.00. Following the transaction, the senior vice president now directly owns 97,682 shares in the company, valued at approximately $5,968,370.20. The sale was disclosed in a legal filing with the SEC, which is available at this hyperlink. Also, SVP Brandon J. Hofmeister sold 3,500 shares of the stock in a transaction dated Friday, February 23rd. The stock was sold at an average price of $57.78, for a total transaction of $202,230.00. Following the transaction, the senior vice president now owns 68,971 shares in the company, valued at $3,985,144.38. The disclosure for this sale can be found here. 0.40% of the stock is owned by insiders.

Institutional Inflows and Outflows

Hedge funds have recently bought and sold shares of the business. Headinvest LLC purchased a new position in CMS Energy in the third quarter valued at approximately $26,000. Scarborough Advisors LLC acquired a new stake in CMS Energy in the fourth quarter valued at approximately $29,000. Voisard Asset Management Group Inc. acquired a new stake in CMS Energy in the fourth quarter valued at approximately $36,000. Headlands Technologies LLC acquired a new stake in CMS Energy in the first quarter valued at approximately $43,000. Finally, Tobam grew its position in CMS Energy by 2,432.3% in the fourth quarter. Tobam now owns 785 shares of the utilities provider’s stock valued at $46,000 after acquiring an additional 754 shares in the last quarter. Hedge funds and other institutional investors own 93.57% of the company’s stock.

CMS Energy Company Profile

CMS Energy Corporation operates as an energy company primarily in Michigan. The company operates through three segments: Electric Utility; Gas Utility; and Enterprises. The Electric Utility segment is involved in the generation, purchase, transmission, distribution, and sale of electricity. This segment generates electricity through coal, wind, gas, renewable energy, oil, and nuclear sources.

Further Reading

Receive News & Ratings for CMS Energy Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for CMS Energy and related companies with MarketBeat.com’s FREE daily email newsletter.