Forex technical analysis and forecast: Majors, equities and commodities

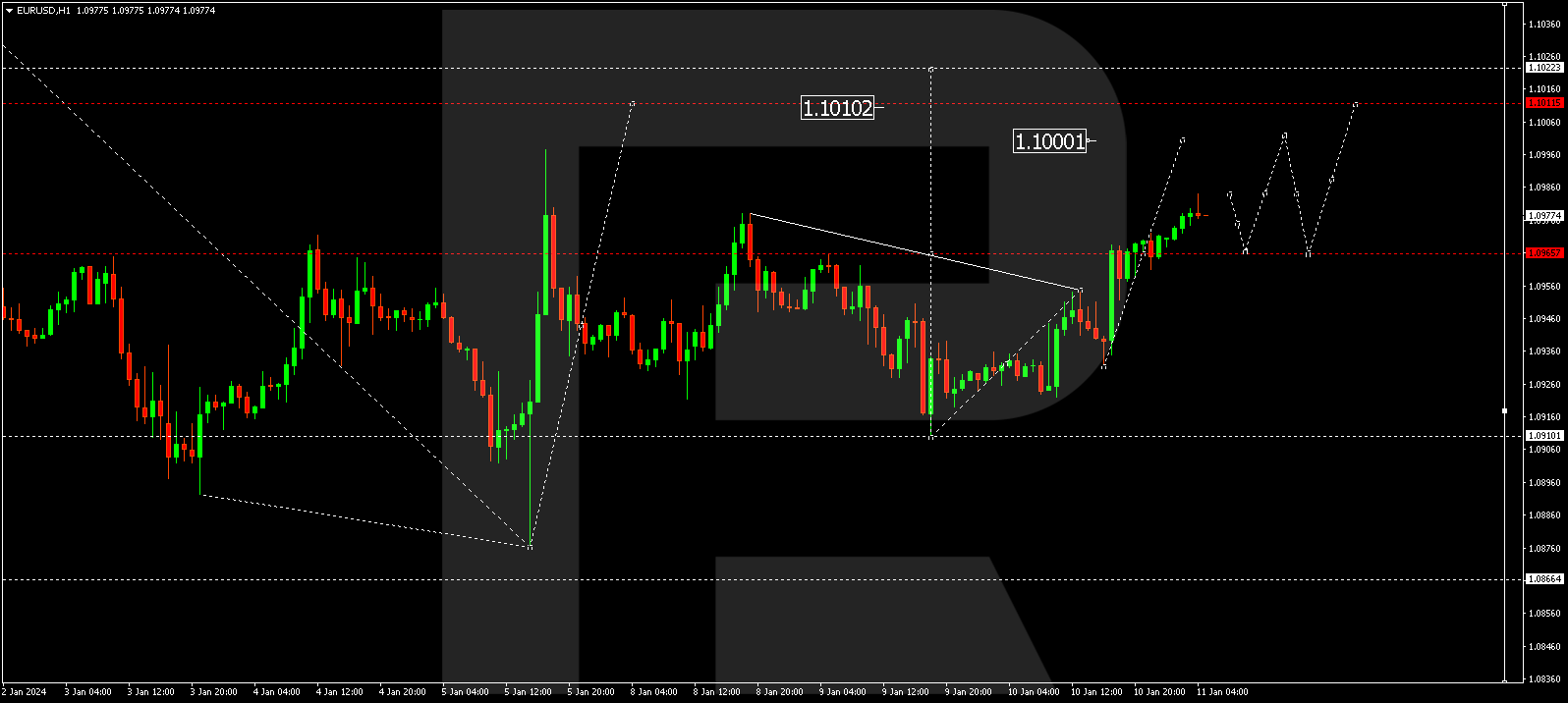

EUR/USD, “Euro vs US Dollar”

The EUR/USD pair has broken the 1.0966 level upwards and continues forming a growth structure to 1.1000. Once this level is reached, a decline link to 1.0966 is not excluded (a test from above). Right after that, another growth structure to 1.1010 could form. Next, a new decline wave to 1.0866 is expected.

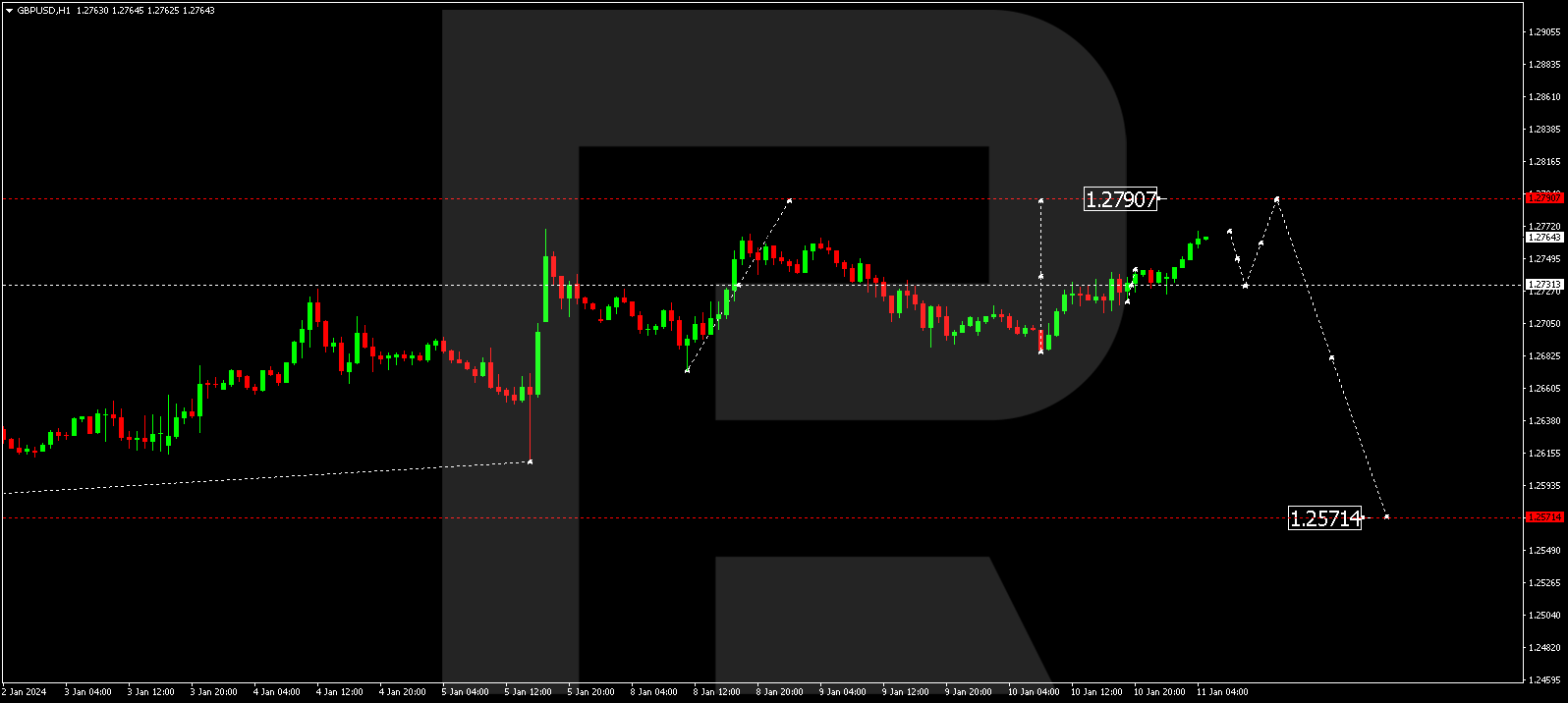

GBP/USD, “Great Britain Pound vs US Dollar”

GBP/USD has broken the 1.2733 level upwards and continues developing a corrective structure to 1.2790. Once the correction is over, a new decline wave to 1.2751 might begin. This is a local target.

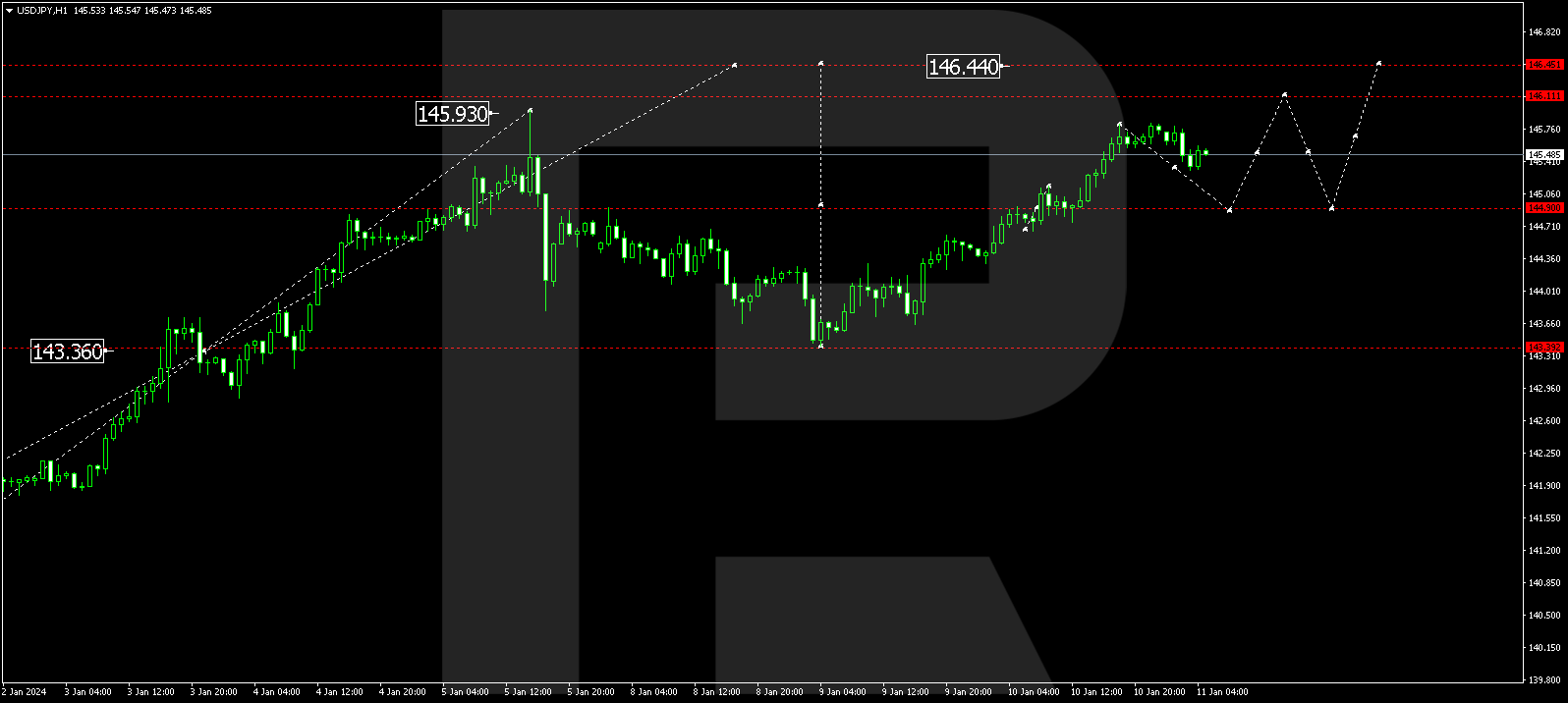

USD/JPY, “US Dollar vs Japanese Yen”

The USD/JPY pair has completed a growth wave to 145.81, and a correction to 144.90 is expected today. Once the correction is over, a new growth wave to 146.44 could start. This is the first target.

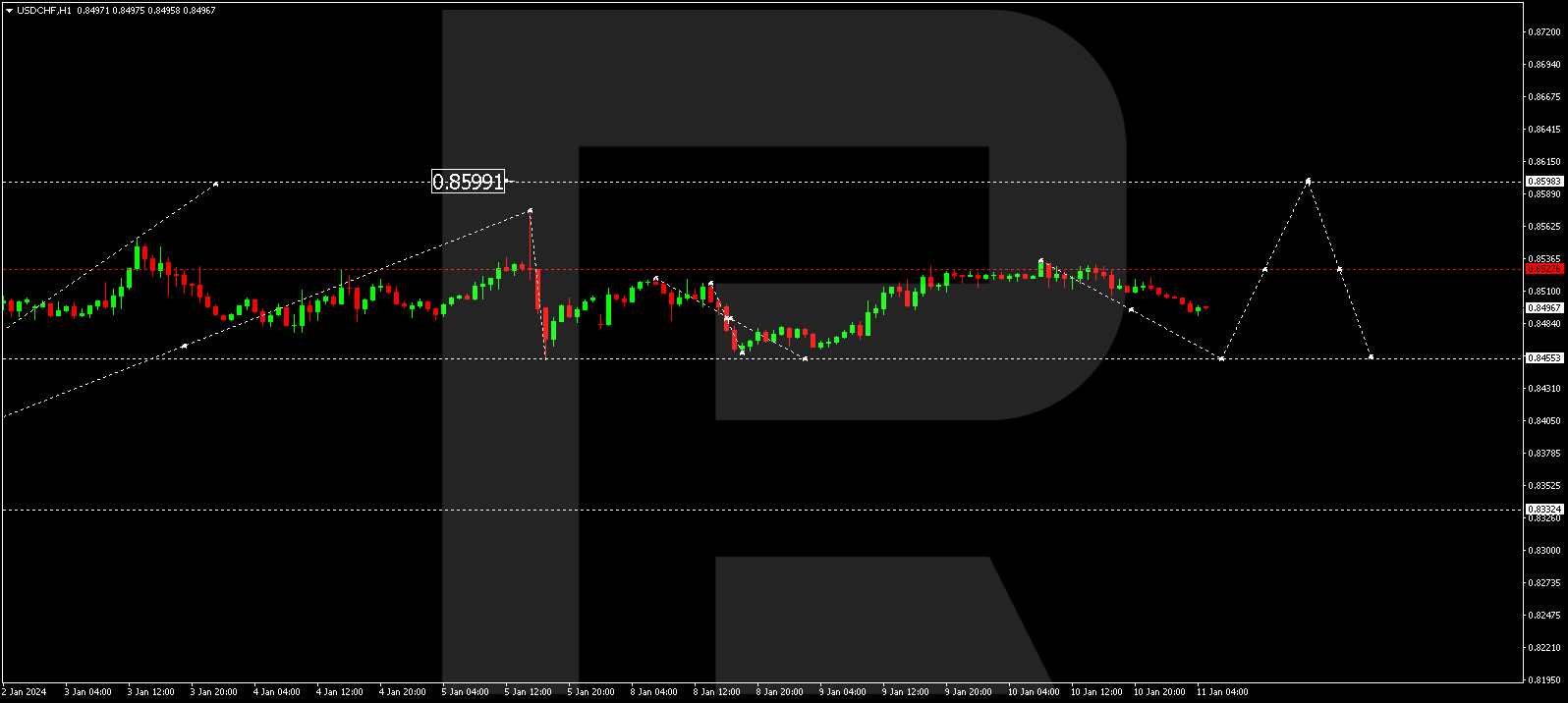

USD/CHF, “US Dollar vs Swiss Franc”

USD/CHF continues developing a consolidation range under 0.8527, and today the range is expected to extend downwards to 0.8455. Next, a growth wave to 0.8598 could begin. This is the first target.

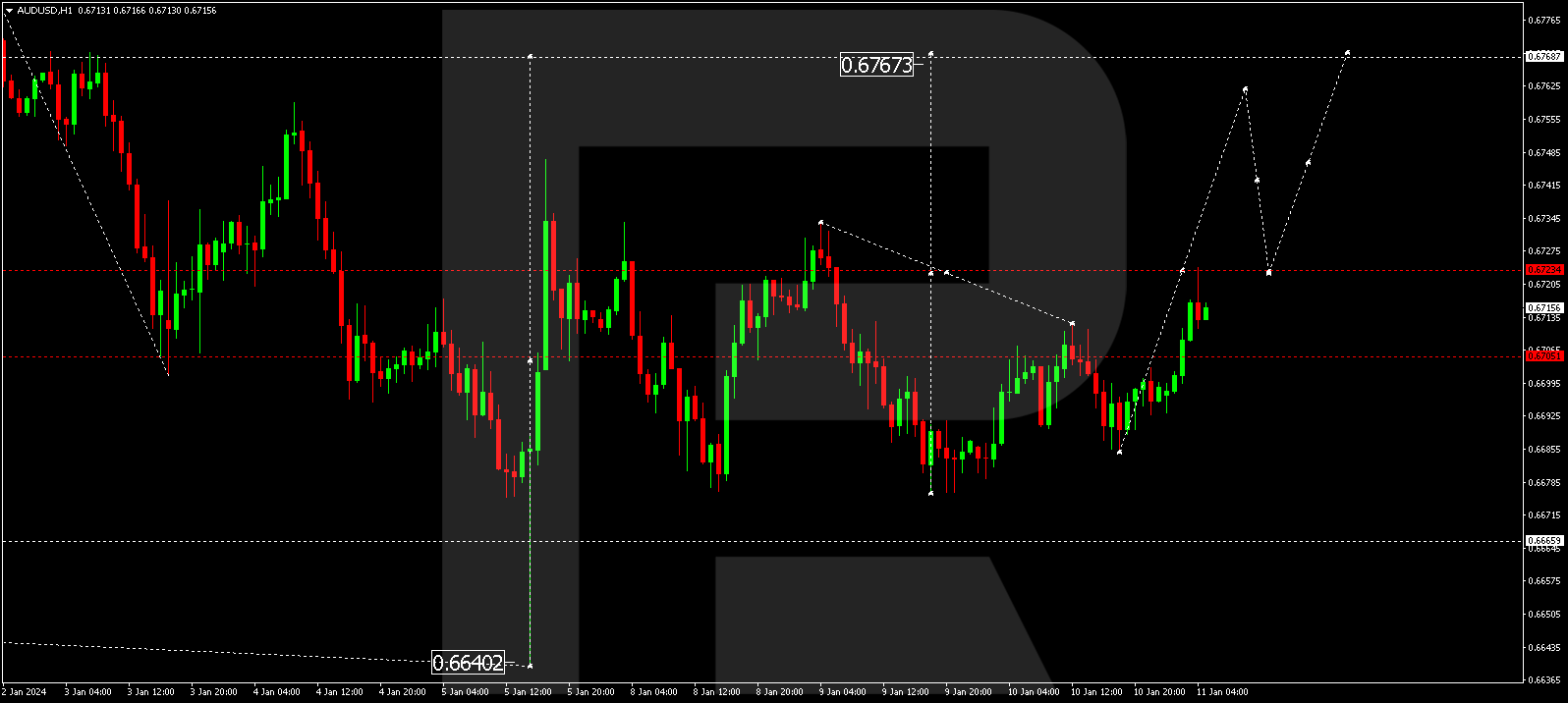

AUD/USD, “Australian Dollar vs US Dollar”

AUD/USD has completed a growth structure to 0.6723. A narrow consolidation range might form around this level today. With an escape upwards, the corrective wave to 0.6767 might continue. Once the correction is over, a new decline wave to 0.6600 by the trend could begin.

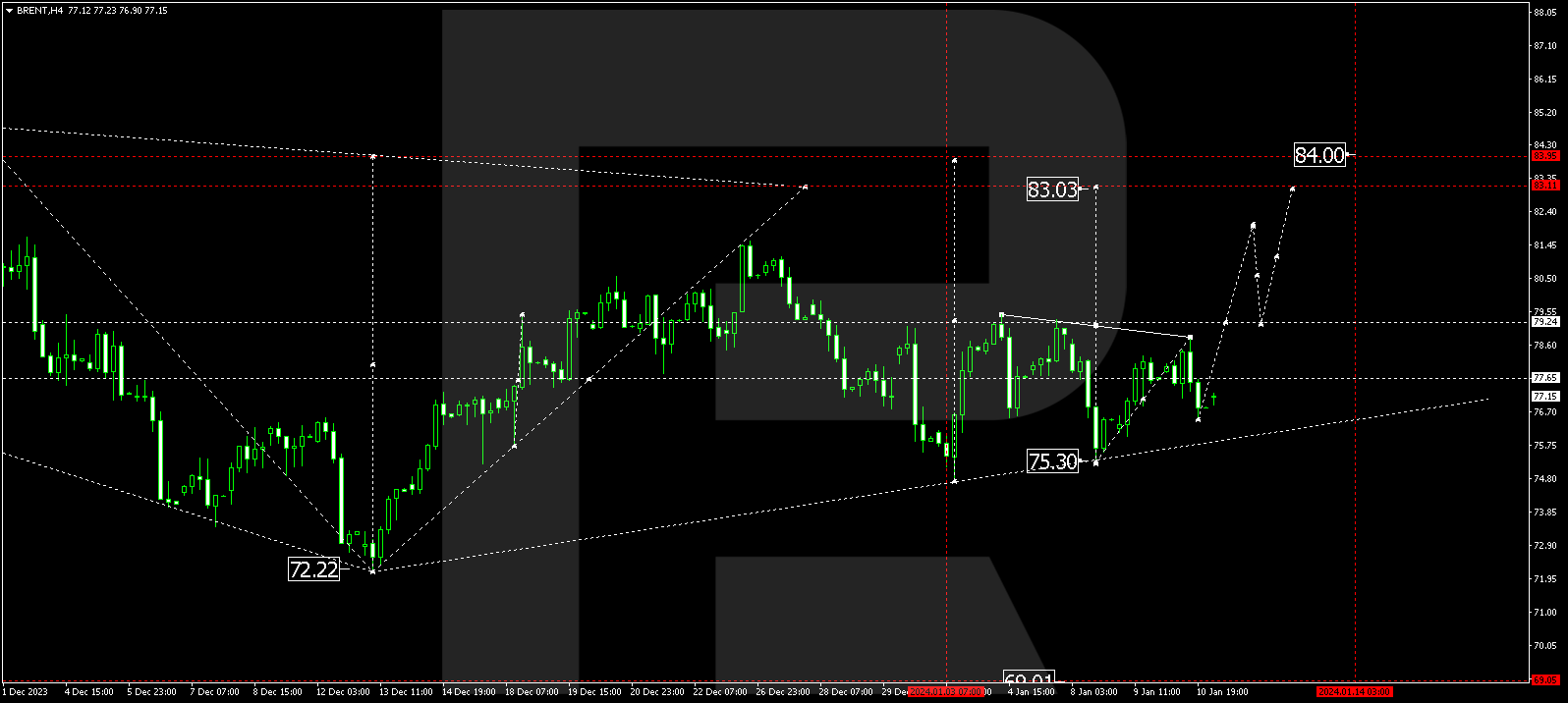

Brent

Brent continues developing a consolidation range around 77.65 without any bright trend. A growth link to 79.24 might form today, and once this level breaks upwards, the potential for a wave to 83.00 might open, from where the trend could continue to 84.00.

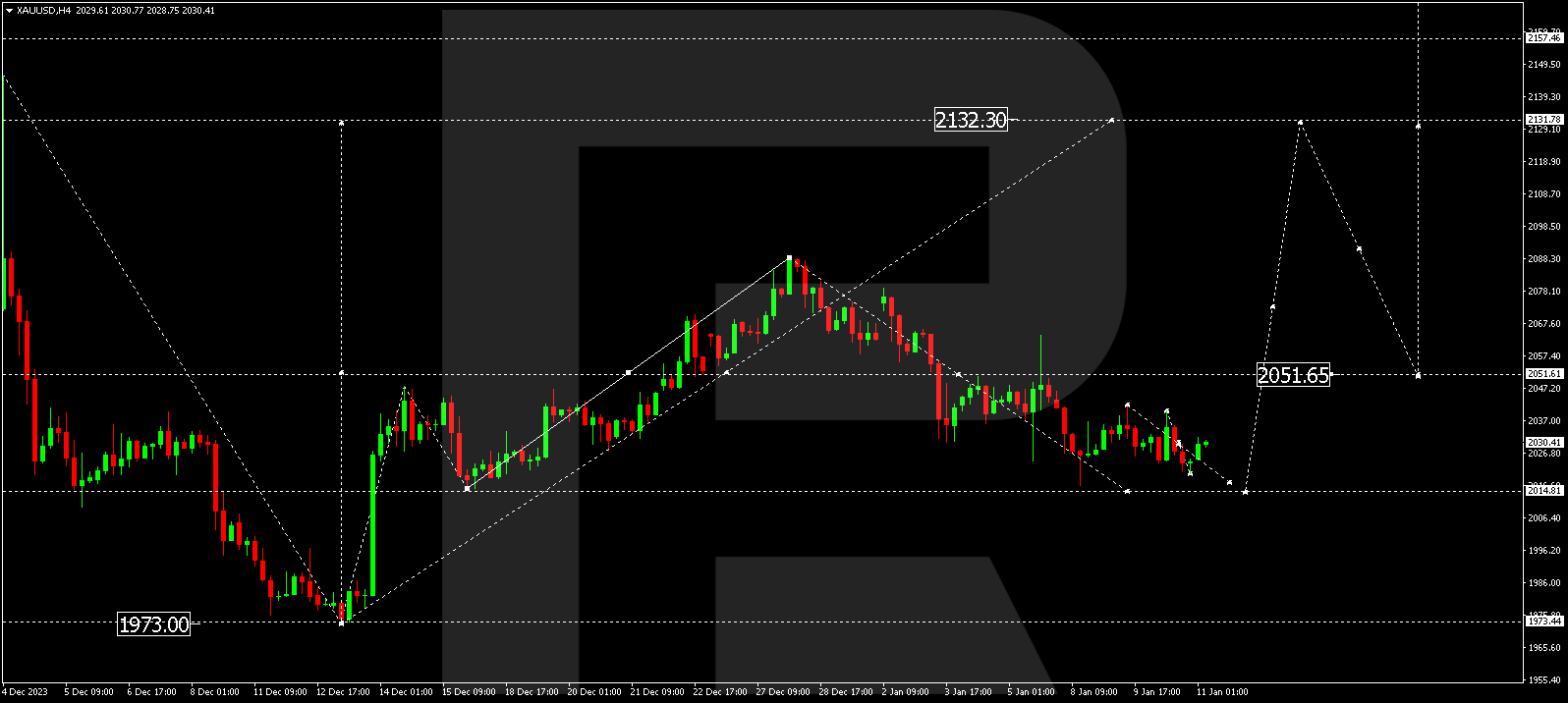

XAU/USD, “Gold vs US Dollar”

Gold continues developing a decline wave to 2014.80. Once it reaches this level, a new growth wave to 2051.65 could start. Upon breaking this level upwards as well, the trend could continue to 2131.78.

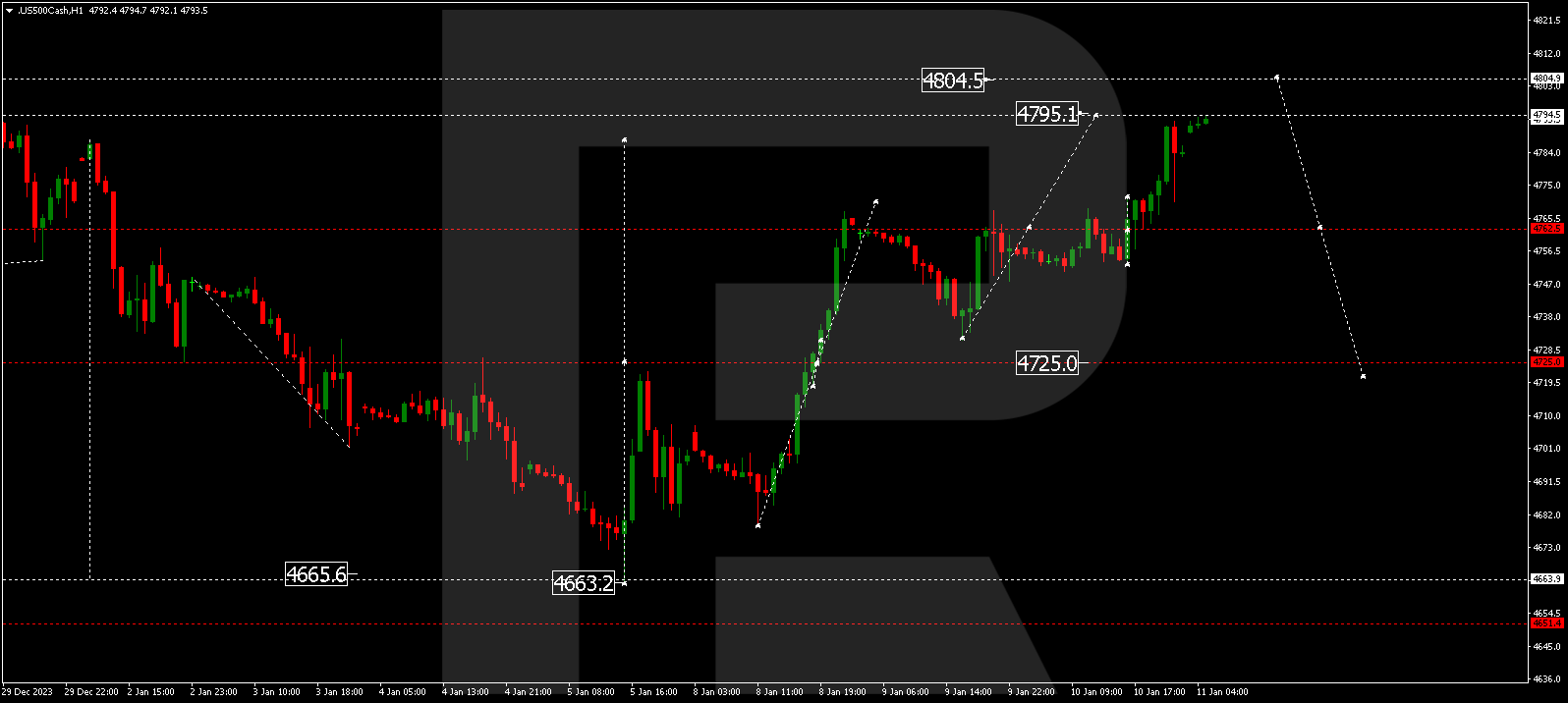

S&P 500

The stock index continues developing a growth structure to 4795.0. Once this level is reached, a new consolidation range might develop under this level. With an escape from the range downwards, a correction to 4725.0 might start. An upward escape might entail a price rise to 4805.0, from where the trend could continue to 4900.0.