INR Holds Steady Amid Global Currency Fluctuations

What’s going on here?

The Indian rupee (INR) held its ground on June 14, 2024, trading at 83.53 against the US dollar (USD) as of 10:00 a.m. IST, thanks to anticipated RBI interventions.

What does this mean?

The Reserve Bank of India’s routine interventions have been key in keeping the rupee from dipping to its record low of 83.5750, seen in April 2024. Despite global economic pressures and ongoing local dollar demand, RBI’s proactive measures have kept the INR stable. Most Asian currencies weakened on June 14, with the Indonesian rupiah (IDR) leading the decline by falling 0.6%. Meanwhile, the Japanese yen (JPY) dropped 0.5% to 157.86 after the Bank of Japan (BoJ) announced plans to reduce bond buying, despite maintaining steady interest rates.

Why should I care?

For markets: Global forces at play.

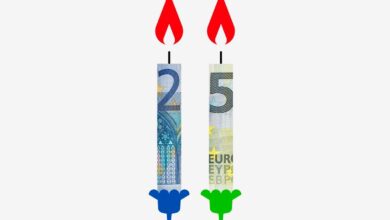

The strong US dollar is impacting currencies worldwide, driven by weak sentiment around the euro. US economic indicators, including a rise in initial jobless claims to a 10-month high and a surprising drop in May’s producer prices, show a cooling labor market and easing price pressures. Consequently, the 10-year US Treasury yield saw a slight uptick during Asian trading hours after hitting a two-month low of 4.22%.

The bigger picture: Central banks and market moves.

The RBI’s interventions highlight the delicate balancing act central banks face in today’s volatile economy. With Japan allowing more flexibility in long-term interest rates and the US experiencing a cooling labor market, the interconnectedness of global financial systems is evident. MUFG Bank’s observations about the limited negative spillovers affecting Asian currencies underscore the nuanced interplay of local and global factors.