Putin urges transition to national currencies in Russia-Uzbekistan settlements — Daryo News

Russian leader Vladimir Putin considers it critically important for Uzbekistan to switch to national currencies in settlements, highlighting the ruble’s 58% share in bilateral commercial transactions in 2023, Kremlin.ru reports. President Putin’s call for using national currencies—such as the Russian ruble (RUB) and the Uzbek soum (UZS)— could aim to reduce reliance on the US dollar (USD) in bilateral trade. By doing so, both countries can assert greater economic independence and mitigate the impact of external sanctions or fluctuations in the dollar exchange rate.

“It is important that our countries are consistently switching to national currencies in settlements, which we consider extremely important. In financial settlements, cooperation between credit and banking institutions is strengthening. The share of the ruble in bilateral commercial transactions reached 58% at the end of last year and continues to grow”, Putin said.

When bilateral transactions occur in national currencies, it enhances financial stability. The ruble and soum become more predictable and less susceptible to sudden market shifts. This stability fosters confidence among businesses, investors, and consumers, promoting sustainable economic growth.

“I have already spoken broadly and mentioned narrowly: more than 3,000 enterprises with Russian participation are operating in the Uzbek market, and this is a good start. And on the whole, Russian capital investments in Uzbekistan’s economy exceeded $9 bn”, he added.

Benefits of ruble usage:

Reduced transaction costs: Using the ruble directly reduces the need for currency conversion, minimizing transaction costs for businesses.

Enhanced trade relations: As more transactions occur in rubles, trade relations between the two nations strengthen. This fosters deeper economic ties and facilitates smoother cross-border commerce.

Learning from China and Russia

Amidst unprecedented Western sanctions, Russia found itself unable to transact in dollars and euros—the world’s dominant currencies. In response, Moscow sought alternatives to manage its trade and reserves. Two key players emerged: the Chinese yuan and gold.

“Russian-Chinese trade and economic cooperation are actively developing, despite the persistent attempts of the states of the collective West to put a spoke in the wheels,” Russian Foreign Minister Sergey Lavrov said.

-

Yuanization: Russia rapidly increased its use of the yuan in two main ways. First, it boosted the yuan’s share in its reserves, allowing the Chinese currency to play a more significant role. Second, Russia shifted to direct ruble-yuan trade, bypassing the dollar as an intermediary. However, this move also introduced new vulnerabilities, making Russia somewhat dependent on Beijing’s goodwill.

-

Gold: Russia turned to gold as a store of value. While gold is not entirely sanctions-proof, it provided an alternative to the dollar and euro. However, scaling up the illicit gold trade has proven challenging for Russia.

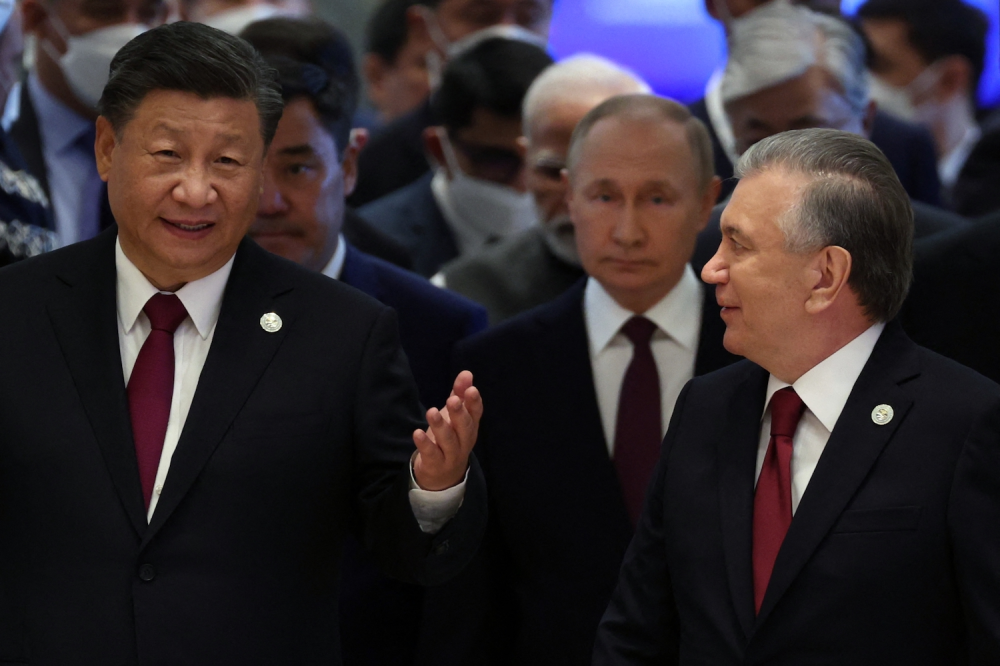

China and Russia have made substantial progress in reducing their reliance on the dollar. More than 90% of their mutual payments are now conducted in their national currencies—the yuan and the ruble. This achievement demonstrates almost full de-dollarization of economic ties between the two nations.

Risks and benefits

China is Russia’s top trade partner, and the tightly controlled yuan-ruble exchange rate creates risks. While a tightly managed yuan may seem stable, Chinese authorities have previously adjusted the rate to their advantage. For instance, during Russia’s invasion of Ukraine, China allowed the ruble to depreciate further, making Chinese goods more expensive for Russians. China could manipulate this exchange rate for political or economic reasons.

The Russian Central Bank holds Chinese bonds, but if Beijing restricts yuan outflows, selling these bonds and converting the proceeds to rubles could become challenging.