USD gains traction

Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

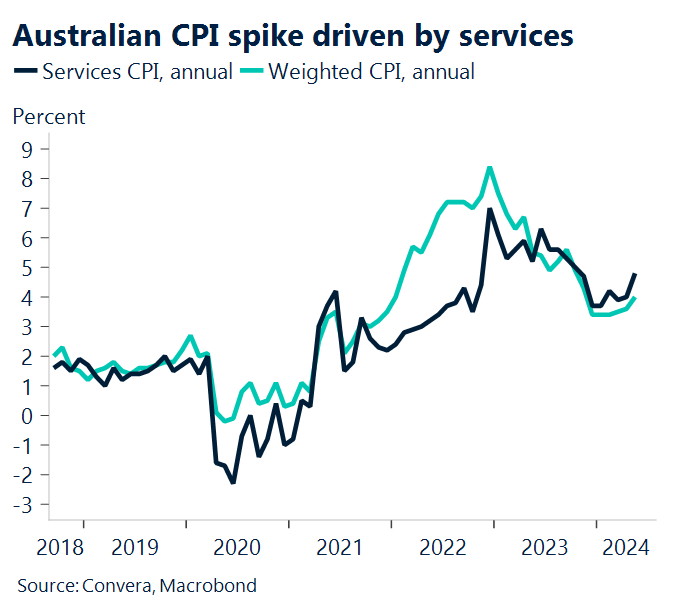

Aussie surges after CPI shock

The Australian dollar was strongly higher on Wednesday after a hotter-than-expected inflation reading caused markets to look to a potential Reserve Bank of Australia rate hike in August.

The RBA might be forced to take action at its next meeting, due 6 August, after the monthly annual inflation for May came in at 4.0% — a sharp rise on the 3.6% in April and well above forecasts for 3.8%.

The probability of a rate hike at the RBA’s 6 August meeting climbed from 10% to 33% after the CPI announcement (source: Refinitiv).

At last week’s meeting, the RBA governor Michele Bullock said the central bank had considered a rate hike. This week’s inflation reading makes a hike more likely.

The Aussie was higher across markets with the best gains versus the euro and British pound.

Elsewhere, MoF/BoJ headlines should be closely monitored, as JPY acknowledged but disregarded Kanda’s warning about watching FX with high urgency.

The USD strengthened and may see further upside against EUR, JPY, CHF, and CNH during or after the US Presidential debate on Thursday.

Key events:

US Presidential debate on Thursday

RBA’s Hauser speaks at 19:30 AEST on Thursday

PHP rate decision

Ongoing monitoring of MoF/BoJ statements

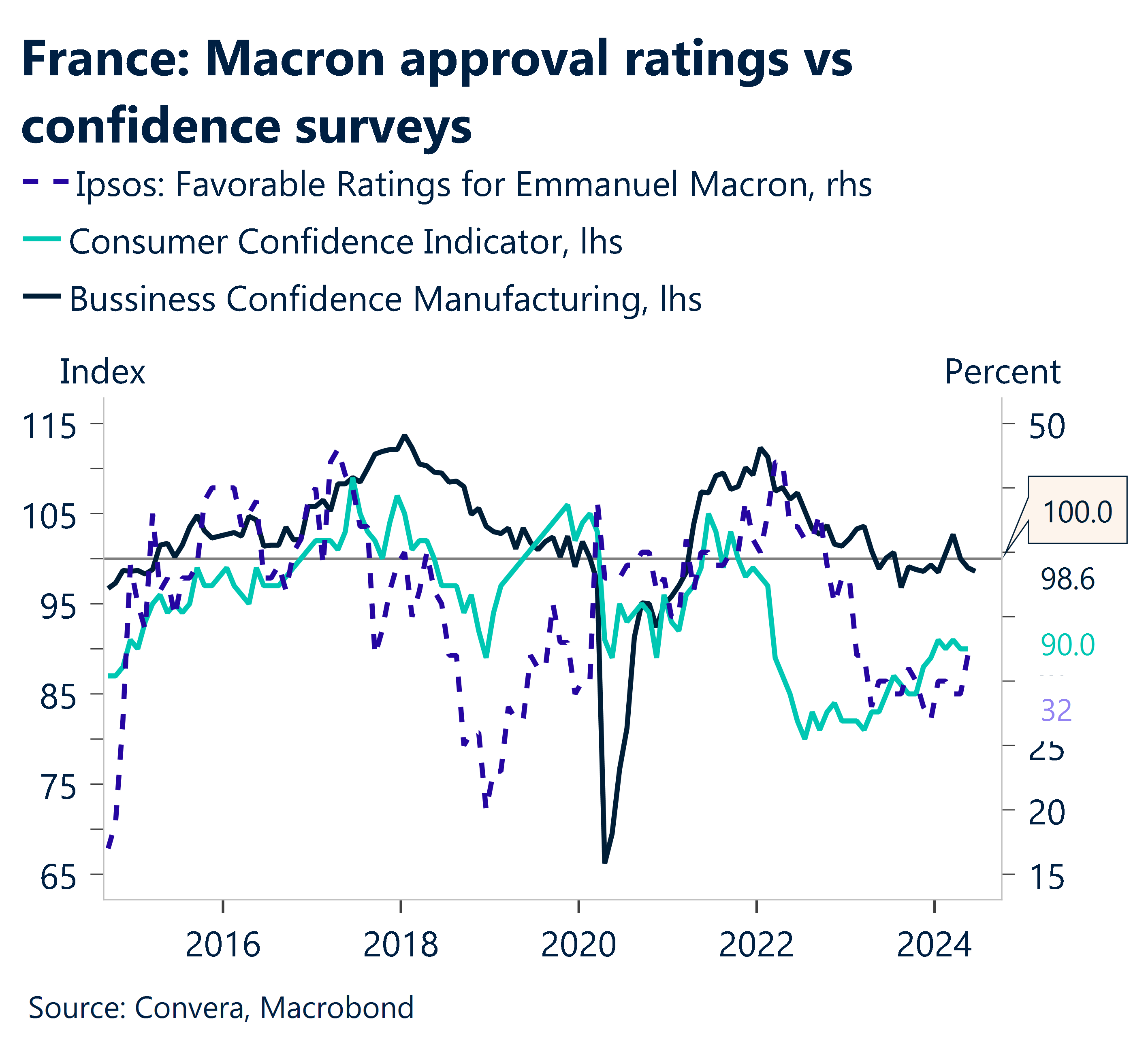

Euro pressured by French political uncertainty

The economic confidence index of the European Commission increased from 95.6 to 96 in May. May saw gains in consumer confidence, the manufacturing and services sectors, while retail and construction showed some deterioration. We think that the primary focus will be on manufacturing and services, both of which have room for improvement. Regarding components to be aware of, manufacturing selling price expectations have been gradually rising lately, which may indicate that pressure on core goods prices will continue to rise. Meanwhile, we’ll be observing if expectations for services selling prices continue to rise or fall.

The surprise announcement for a sudden lower house election by President Macron is the cause of the EUR’s decline. This move has caused the bond spread between France and Germany to expand, which has had an impact on the whole region.

Peso weakens on trade imbalance as BSP holds rates

We anticipate that the BSP will maintain its policy rate at 6.50%, noting the fact that the monetary board continues to feel that tight monetary policy is necessary to contain inflation until it more firmly settles within the 2-4% target range. Having said that, the BSP will probably admit that the most recent government statement about the lowering of rice import tariffs poses risks to the inflation forecast, which may allow the BSP to begin its reducing cycle later in the year. Despite this, we believe the BSP will continue to take a “less hawkish” attitude and won’t be indicating any impending rate reduction beginning in Q3. Instead, it will likely emphasize a data-dependent strategy due to the ongoing high level of uncertainty, which includes the timing of the Fed cutting cycle.

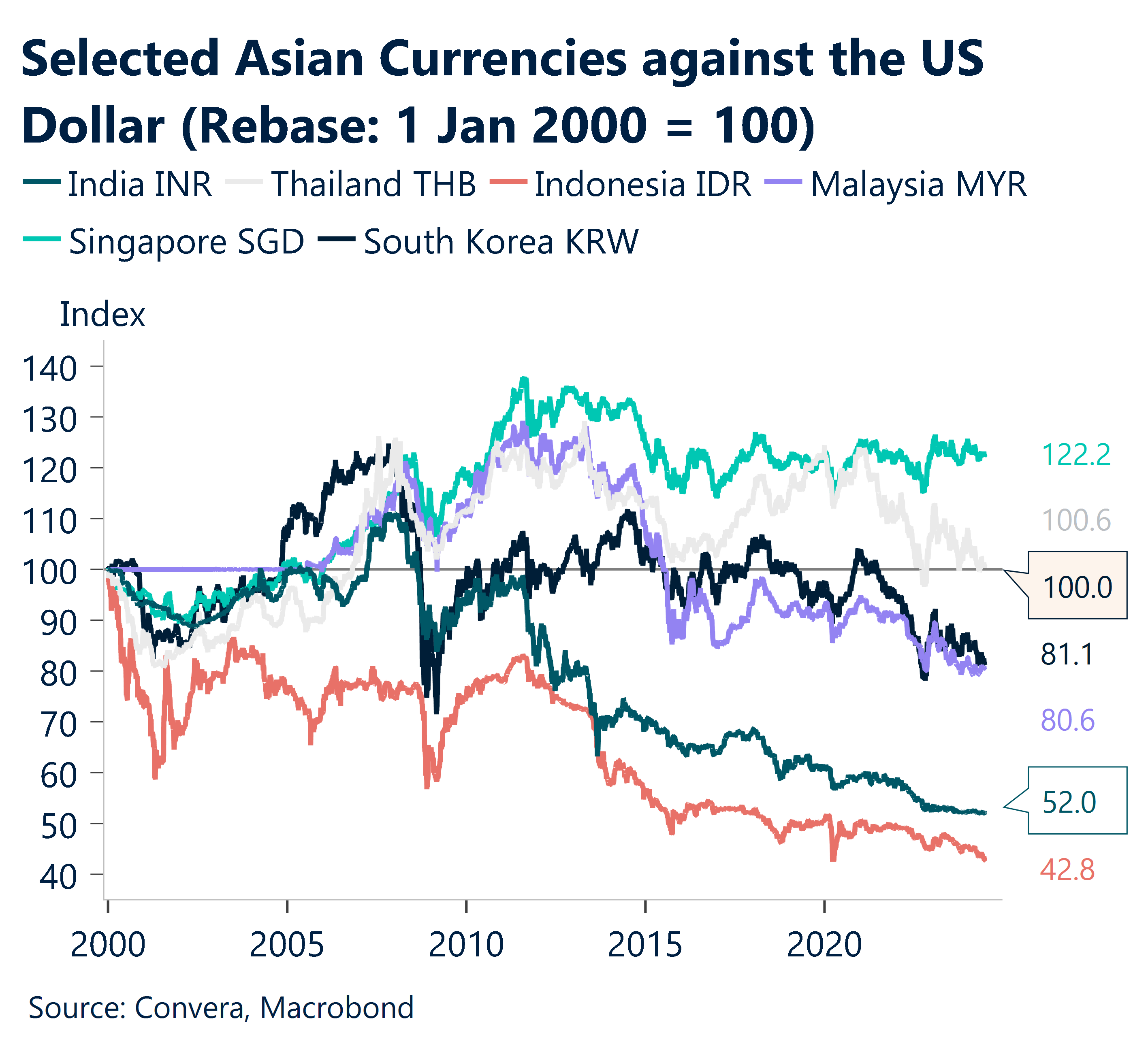

Due to the continuing widening trade imbalance and the growing demand for foreign exchange reserves, the peso has been among the weakest currencies.

USD Asia hits top of the range

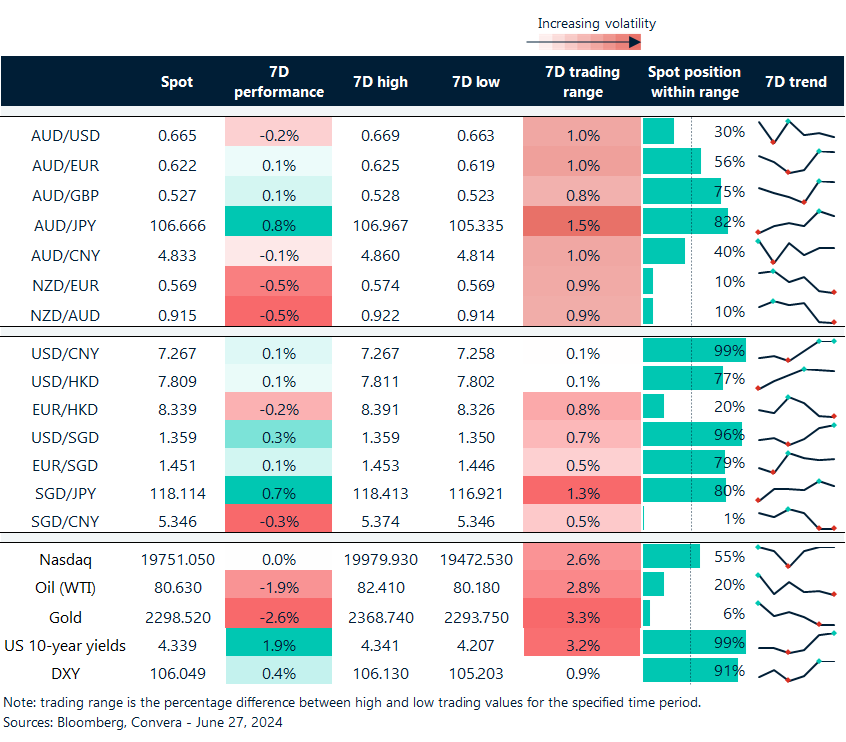

Table: seven-day rolling currency trends and trading ranges

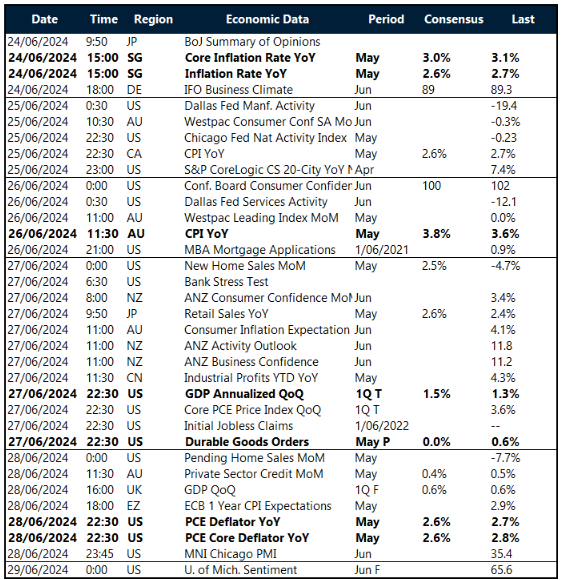

Key global risk events

Calendar: 24 – 29 June

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]