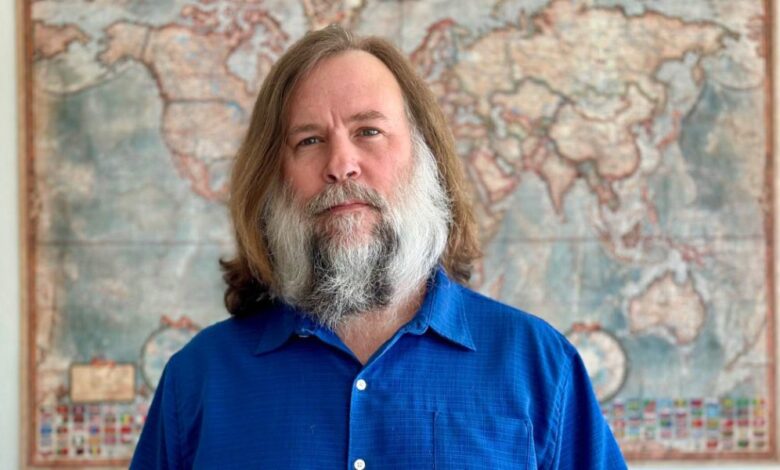

Benjamin Ogden, Founder & CEO of DataGenn AI – Interview Series

Benjamin Ogden is the founder and CEO of DataGenn AI, building autonomous investor and trader agents that have been finely tuned to generate profitable trading predictions and execute market trades. Utilizing Reinforcement Learning from Human Feedback (RLHF), the agents’ trade prediction accuracy continually improves. Currently, DataGenn AI is in the process of raising funds to support its continued growth and innovation in the financial services industry.

Benjamin holds a Bachelor’s degree in Finance from the University of Central Florida. He has personally traded billions in stocks and crypto, mastering market dynamics with thousands of hours in real-time price action tracking. A seasoned internet technology developer since 2001, Benjamin is also an SEO expert who has earned over $20 million in profits reverse engineering Google search algorithm updates.

You are a serial entrepreneur, could you share with us some highlights from your career?

There are many highlights as I’ve been running businesses as an entrepreneur since I was a kid age 6 or 7. I absolutely love learning. The path and process of learning drives my thirst for additional knowledge & wisdom. Developing a social blogging community and running a company as the CEO of thoughts.com from 2007-2012 was a great learning experience and career transformer for me. Likewise, trading the stock market heavily after that was another important learning experience that eventually influenced me down the path to working on GenAI trading agents at DataGenn AI. Lastly, the recent transition from working on iGaming SEO to fine-tuning LLMs and learning the fundamentals of machine learning has been invigorating because it gives me the opportunity to develop generative AI-powered trading agents for financial markets, realizing a vision of accelerating compound interest effects, a breakthrough financial markets belief I’ve held for over a decade.

When did you initially become interested in AI and machine learning?

I started gaining interest in AI mid-2022. Once I saw what Jasper.ai was doing at that time, I immediately shifted my daily focus from iGaming SEO Marketing to reviewing state of the art artificial intelligence software & platforms of the time such as Jasper AI & ChatGPT. As my learnings grew throughout 2023, and LLMs progressed rapidly, so did my passion for building valuable financial market trading technologies which harness the power of LLMs and artificial intelligence.

Can you share the genesis story behind DataGenn AI?

I studied Finance in college at UCF. While in college I had a particular interest in the financial markets. In 2012, I had a specific & detailed vision of a new technology I planned on inventing circa 2012, which I call “Digital Capital Mining”. The idea with DCM is simple: Speed up the effects of compound interest by compounding daily, hence digitally mining capital over 252 stock market trading days per year.

Can you explain how DataGenn INVEST leverages Google’s Gemini model and MoE models to predict intraday trading movements?

I can provide a high-level overview of tools we’re using at DataGenn AI, but don’t comment on key specifics at this time. In short: with DataGenn INVEST we’re using multiple frontier language models and entity specific agents built on MoE architecture.

What are the specific advantages of using RLHF (Reinforcement Learning with Human Feedback) in training your trading agents?

RLHF is essential in training the model to learn the correct answer and/or provide specific types of responses based on the user prompt. By using RLHF with our agents’ predictions and executed market trades, we can improve each agent’s accuracy of both trade predictions and market trades over time and frequent iterations. RLHF also helps with efficiency and training the agents to understand nuance and execute complex tasks.

How does DataGenn integrate real-time data from multiple sources into its trading strategy?

At our current phase of testing multiple models and backtesting trading agent performance, we have an agent at Alpha level trading agent in testing that is using real-time data from AlphaAdvantage. We also have a Beta level agent in testing that uses Pinescript on TradingView for backtesting. We are conducting critical research and testing our agents predictions and trade executions. In production, we’ll be using a Bloomberg terminal for trading, market data, and critical news, etc.

How does DataGenn INVEST ensure the accuracy and reliability of its trading predictions in volatile financial markets?

We are building, testing, and backtesting the DataGenn INVEST agents’ trading strategy algorithms and safety guardrails by using Financial Market industry standards such as Stop Loss orders to reduce drawdown risk and Trailing Stop Loss orders to effectively capture increased profits while simultaneously locking in trade gains. We take Responsible AI seriously and we’re committed to building AI systems safely, whether they be for financial markets or biopharmaceutical research.

How do you see autonomous trading agents like DataGenn INVEST changing the landscape of financial markets?

DataGenn INVEST Agents are a game changer. The sizes of portfolio returns DataGenn INVEST trading agents will realize is unfathomable to today’s investing world, typical, and professional investor. This is because, for example, $100,000 compounded at 1% daily becomes $14,377,277 in just two years time.

Are there new features or capabilities that you are particularly excited about introducing?

I’m looking forward to presenting our team’’s research findings which demonstrate when we’ve built the DataGenn INVEST trading agent systems correctly and they’re earning frequent profits trading financial markets with a focus of accelerating compound interest through daily compounding. This is a major accomplishment we’ve earned through tireless & passionate work to become the leader of GenAI Financial Markets Trading.

Thank you for the great interview, readers who wish to learn more should visit DataGenn AI.