BNP Paribas Financial Markets Has $611,000 Stock Holdings in Federal Agricultural Mortgage Co. (NYSE:AGM)

BNP Paribas Financial Markets cut its stake in Federal Agricultural Mortgage Co. (NYSE:AGM – Free Report) by 68.9% during the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 3,195 shares of the credit services provider’s stock after selling 7,074 shares during the quarter. BNP Paribas Financial Markets’ holdings in Federal Agricultural Mortgage were worth $611,000 as of its most recent SEC filing.

BNP Paribas Financial Markets cut its stake in Federal Agricultural Mortgage Co. (NYSE:AGM – Free Report) by 68.9% during the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 3,195 shares of the credit services provider’s stock after selling 7,074 shares during the quarter. BNP Paribas Financial Markets’ holdings in Federal Agricultural Mortgage were worth $611,000 as of its most recent SEC filing.

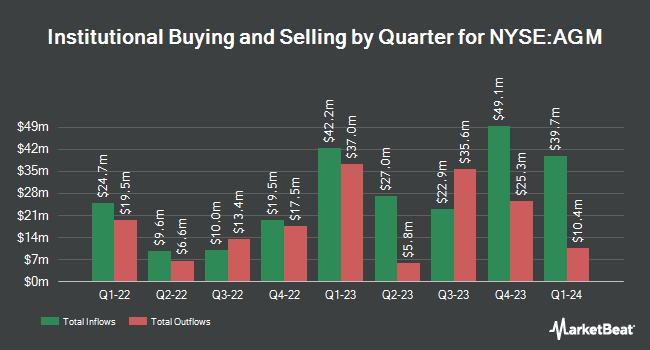

Several other large investors also recently modified their holdings of AGM. International Assets Investment Management LLC acquired a new stake in Federal Agricultural Mortgage during the fourth quarter worth about $18,283,000. Victory Capital Management Inc. boosted its stake in shares of Federal Agricultural Mortgage by 111.3% in the 4th quarter. Victory Capital Management Inc. now owns 8,752 shares of the credit services provider’s stock valued at $1,674,000 after purchasing an additional 4,611 shares during the last quarter. Allspring Global Investments Holdings LLC boosted its stake in Federal Agricultural Mortgage by 943.6% during the fourth quarter. Allspring Global Investments Holdings LLC now owns 28,355 shares of the credit services provider’s stock worth $5,422,000 after acquiring an additional 25,638 shares in the last quarter. SRS Capital Advisors Inc. boosted its stake in Federal Agricultural Mortgage by 304.6% during the fourth quarter. SRS Capital Advisors Inc. now owns 263 shares of the credit services provider’s stock worth $50,000 after acquiring an additional 198 shares in the last quarter. Finally, Quadrature Capital Ltd bought a new position in Federal Agricultural Mortgage during the third quarter worth $1,437,000. 68.03% of the stock is owned by institutional investors.

Analysts Set New Price Targets

Separately, Keefe, Bruyette & Woods reissued an “outperform” rating and set a $212.00 target price (down from $225.00) on shares of Federal Agricultural Mortgage in a research note on Wednesday, May 8th.

Check Out Our Latest Report on Federal Agricultural Mortgage

Federal Agricultural Mortgage Stock Performance

NYSE:AGM traded down $0.94 on Friday, reaching $174.67. 61,001 shares of the company’s stock were exchanged, compared to its average volume of 43,928. The company has a debt-to-equity ratio of 1.38, a current ratio of 0.46 and a quick ratio of 0.46. The firm has a market cap of $1.90 billion, a price-to-earnings ratio of 10.65, a P/E/G ratio of 1.50 and a beta of 1.08. Federal Agricultural Mortgage Co. has a 52 week low of $132.47 and a 52 week high of $199.40. The stock has a fifty day simple moving average of $183.94 and a 200-day simple moving average of $182.45.

Federal Agricultural Mortgage (NYSE:AGM – Get Free Report) last released its quarterly earnings data on Monday, May 6th. The credit services provider reported $3.96 EPS for the quarter, beating analysts’ consensus estimates of $3.94 by $0.02. The company had revenue of $403.63 million during the quarter, compared to analyst estimates of $92.22 million. Federal Agricultural Mortgage had a net margin of 13.79% and a return on equity of 22.01%. During the same period last year, the business earned $3.56 earnings per share. As a group, sell-side analysts predict that Federal Agricultural Mortgage Co. will post 16.67 earnings per share for the current year.

Federal Agricultural Mortgage Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Friday, June 28th. Investors of record on Friday, June 14th will be paid a $1.40 dividend. This represents a $5.60 annualized dividend and a dividend yield of 3.21%. The ex-dividend date is Friday, June 14th. Federal Agricultural Mortgage’s payout ratio is 34.15%.

Federal Agricultural Mortgage Profile

Federal Agricultural Mortgage Corporation provides a secondary market for various loans made to borrowers in the United States. It operates through four segments: Corporate AgFinance, Farm & Ranch, Rural Utilities, and Renewable Energy. The company’s Agricultural Finance line of business engages in purchasing and retaining eligible loans and securities; guaranteeing the payment of principal and interest on securities that represent interests in or obligations secured by pools of eligible loans; servicing eligible loans; and issuing LTSPCs for eligible loans.

Featured Articles

Before you consider Federal Agricultural Mortgage, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Federal Agricultural Mortgage wasn’t on the list.

While Federal Agricultural Mortgage currently has a “Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

Click the link below and we’ll send you MarketBeat’s list of the 10 best stocks to own in 2024 and why they should be in your portfolio.