BNP Paribas Financial Markets Reduces Stock Holdings in MakeMyTrip Limited (NASDAQ:MMYT)

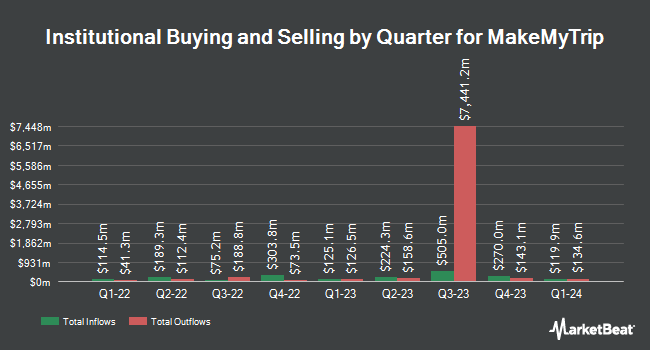

BNP Paribas Financial Markets lessened its stake in shares of MakeMyTrip Limited (NASDAQ:MMYT – Free Report) by 89.4% in the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 7,689 shares of the technology company’s stock after selling 65,122 shares during the quarter. BNP Paribas Financial Markets’ holdings in MakeMyTrip were worth $361,000 at the end of the most recent reporting period.

Several other large investors have also modified their holdings of the stock. Harbour Capital Advisors LLC lifted its stake in MakeMyTrip by 2.6% in the fourth quarter. Harbour Capital Advisors LLC now owns 17,845 shares of the technology company’s stock valued at $824,000 after buying an additional 447 shares during the last quarter. Liontrust Investment Partners LLP grew its position in MakeMyTrip by 2.3% during the 3rd quarter. Liontrust Investment Partners LLP now owns 30,509 shares of the technology company’s stock worth $1,236,000 after purchasing an additional 695 shares during the last quarter. Blue Trust Inc. increased its stake in MakeMyTrip by 12.3% in the fourth quarter. Blue Trust Inc. now owns 7,055 shares of the technology company’s stock valued at $331,000 after purchasing an additional 774 shares during the period. Exchange Traded Concepts LLC raised its holdings in shares of MakeMyTrip by 4.1% in the fourth quarter. Exchange Traded Concepts LLC now owns 20,490 shares of the technology company’s stock valued at $963,000 after buying an additional 799 shares during the last quarter. Finally, Summit Trail Advisors LLC boosted its stake in shares of MakeMyTrip by 10.0% during the fourth quarter. Summit Trail Advisors LLC now owns 22,000 shares of the technology company’s stock worth $1,034,000 after buying an additional 2,000 shares during the period. Institutional investors and hedge funds own 51.89% of the company’s stock.

MakeMyTrip Price Performance

Shares of NASDAQ:MMYT opened at $73.63 on Wednesday. MakeMyTrip Limited has a 52 week low of $25.75 and a 52 week high of $89.83. The company has a 50-day moving average price of $72.48 and a 200 day moving average price of $59.49. The company has a market cap of $7.81 billion, a P/E ratio of 44.09, a PEG ratio of 4.98 and a beta of 1.28. The company has a quick ratio of 2.88, a current ratio of 2.88 and a debt-to-equity ratio of 0.19.

Analyst Ratings Changes

Several analysts have commented on MMYT shares. StockNews.com raised MakeMyTrip from a “sell” rating to a “hold” rating in a research note on Friday, May 24th. Macquarie cut MakeMyTrip from an “outperform” rating to a “neutral” rating and upped their price target for the stock from $50.00 to $60.00 in a research note on Wednesday, February 21st.

Get Our Latest Analysis on MakeMyTrip

MakeMyTrip Profile

MakeMyTrip Limited, an online travel company, sells travel products and solutions in India, the United States, Singapore, Malaysia, Thailand, the United Arab Emirates, Peru, Colombia, Vietnam, and Indonesia. The company operates through three segments: Air Ticketing, Hotels and Packages, and Bus Ticketing.

Further Reading

Want to see what other hedge funds are holding MMYT? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for MakeMyTrip Limited (NASDAQ:MMYT – Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider MakeMyTrip, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and MakeMyTrip wasn’t on the list.

While MakeMyTrip currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.