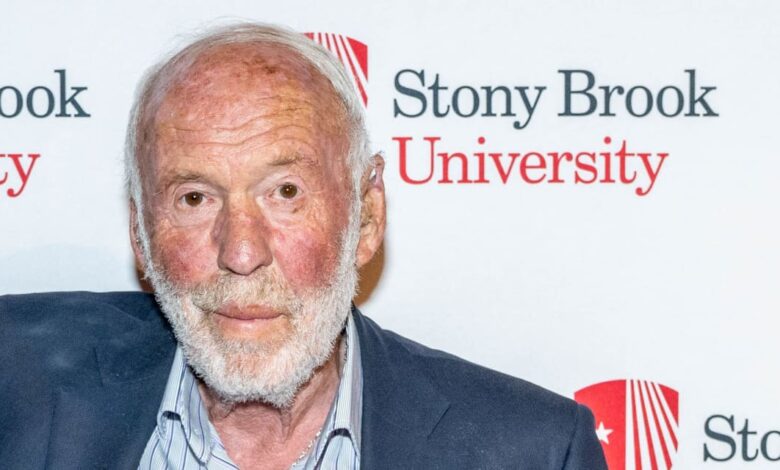

Former Renaissance Technologies CEO Jim Simons, Pioneer of Quant Investing, Dies Aged 86

Jim Simons, the founder and former CEO of Renaissance Technologies, died Friday, the Simons Foundation said. He was 86.

The mathematician-turned-hedge-fund-manager revolutionized investing five decades ago, introducing Wall Street to the power of quantitative, or quant, analysis in financial markets. Today, quant strategies are more sophisticated than ever, and employed by nearly all renowned investing firms, including Bridgewater and Two Sigma.

In the world of finance, Simons stands out as a visionary. While others were chatting with corporate managers and scrutinizing balance sheets to make investment decisions, he realized that there is structure and pattern in financial data, and that by applying mathematical models and exploiting the statistical anomalies, the market is—to some extent—predictable.

Simons founded Renaissance Technologies in Long Island, N.Y., in the late 1970s. Armed with a team of mathematicians, physicists, and computer scientists, Renaissance relied on empirical evidence and quantitative analysis to guide its investment decisions, and its success was nothing short of extraordinary.

The firm’s flagship fund,

delivered staggering returns for years, consistently outperforming the market by wide margins. Simons’ success has inspired a new generation of quantitative investors, who are drawn to the promise of generating alpha, or excess returns, by tapping into the vast data sets of financial markets.

Today, quantitative investing has become a dominant force on Wall Street. Fueled by technological advancements and expanding data availability, the strategies have evolved dramatically over the past decades since Simons started shop in a Long Island strip mall—and Renaissance was at the forefront of many of those changes.

Advertisement – Scroll to Continue

Early quant models in the 1970s and 1980s relied on basic statistical methods, such as linear regressions and time-series analyses, and focused primarily on fundamental indicators, such as price-earnings ratios and dividend yields.

In the 1990s, researchers identified key factors—such as value, momentum, size, and quality—that exhibited predictive power in explaining stock returns. Many quant managers began constructing portfolios based on these factors. While hedge funds have more sophisticated models, investors today can access the basic factor-driven strategies through dozens of exchange-traded funds.

As electronic trading gained traction, high-frequency trading became prevalent in the 2000s. Quant managers use algorithms to analyze market data and identify trading opportunities at a massive scale, and then leverage the stronger-than-ever computational power to execute trades—often based on predefined criteria—at lightning speed to exploit small, short-term price discrepancies.

Advertisement – Scroll to Continue

The 2010s witnessed the integration of machine learning into quant investing. Deep learning models, neural networks, and natural language processing algorithms reformed how investors extracted insights from vast and complex data sets. The proliferation of alternative data sources—including satellite imagery and social media sentiment—further expanded the tool kit of quant managers.

With ever more powerful hardware and technology advancement, quant strategies continue to evolve and adapt today. Quantum computing, blockchain technology, and artificial intelligence are poised to reshape the landscape once again.

Looking ahead, one thing remains clear: In an increasingly efficient and competitive market, the relentless pursuit of alpha will drive innovation in quantitative investing for years to come.

Write to Evie Liu at evie.liu@barrons.com