Nvidia stock’s single-day gain surpasses Reliance’s m-cap – Market News

The market capitalisation of Reliance Industries (RIL) at the end of Friday’s trading was Rs 20.2 trillion. That’s humongous, considering that the gap with the second-largest Indian company — Tata Consultancy Services — is over Rs 5.5 trillion.

But RIL

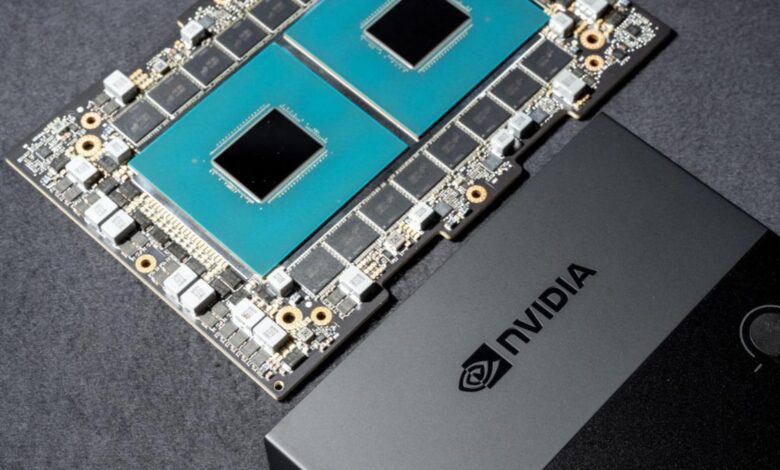

The one-day increase in the stock market value of Nvidia, which controls about 80% of the high-end AI chip market, was also the largest in Wall Street’s history, easily beating a record $196 billion gain by Meta Platforms on February 2 after the Facebook parent declared its first dividend and posted robust results.

Thursday’s dizzying rise of the stock catapulted Nvidia’s chief executive officer Jensen Huang to the 21st position on the Bloomberg Billionaires Index. His wealth jumped $9.6 billion to $69.2 billion. As recently as early last year, he was ranked 128th with a net worth of $13.5 billion.

The rise in Nvidia’s market value on Thursday eclipsed the entire value of Coca-Cola, at $265 billion. Its gain made Nvidia the US stock market

Nvidia reported a Q4 revenue jump of more than threefold from a year ago to $22.10 billion and beat all expectations. At least 17 brokerages raised their price targets after the results. Among the most bullish, Rosenblatt Securities raised its price target to $1,400 from $1,100, implying a $3.5 trillion stock market value, Reuters reported.

Nvidia’s stock has now climbed 58% in 2024, accounting for more than a quarter of the S&P 500’s increase year-to-date. That makes Nvidia’s outlook crucial not just for direct shareholders, but for owners of index funds widely held in retirement savings accounts.