Stocks Rise as Jobs Data Show US Is Powering Ahead: Markets Wrap

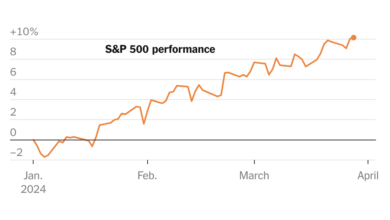

(Bloomberg) — The stock market is ending the week on a positive note after a blowout jobs report signaled the US economy will continue to power Corporate America — even if that means the potential for still elevated interest rates.

Most Read from Bloomberg

Equities climbed after a rough few days that put the S&P 500 on track for its worst week this year. Wall Street decided to look at the glass half full on Friday based on the premise that if the economy is still so strong, there would be no real urge for the Federal Reserve to ease policy.

That triggered another hawkish reprice in the bond market. Treasury yields climbed, with traders paring back bets of a cut in June or July — suggesting they see a greater chance of fewer than three reductions this year. The dollar rose against all of its developed-world counterparts.

Payrolls swelled by 303,000 in March, topping all estimates, government data showed Friday. The unemployment rate edged lower to 3.8%, wages grew at a solid clip, and workforce participation rose, underscoring the strength of a labor market that’s driving the economy.

The S&P 500 rose to around 5,180, while the tech-heavy Nasdaq 100 added almost 1%. Treasury 10-year yields advanced four basis points to 4.35%.

Wall Street’s Reaction to Jobs:

This morning’s blowout jobs numbers show that the economy isn’t showing any signs of slowing down and consumer spending should be able to hold up in the near term.

This good news is bad news for the bond market – it makes the Fed’s propensity to cut sooner and more often less likely and we may not see the first rate cut until July – but it could be good news for the stock market.

There is no weakness in the job market which would impel the Fed to quickly cut, but no tightness which would prohibit a cut either. Fed decisions in upcoming meetings will hinge mainly on the inflation data.

It’s a good report from a fundamental perspective. I do still think that the inflation number next week is the one that is pivotal.

I still forecast a rate cut in June, but I’m waiting for that Wednesday CPI report shows. From a basic policy perspective there’s very little need to start cutting rates because the economy is still so strong.

Oops, we did it again. Today’s employment report showed a labor market that was again ahead of expectations.

On the whole, this report doesn’t by itself alter the Fed’s rate cut plan, but along with other information could be used to argue for only 2 cuts in 2024, instead of the currently expected 3 cuts.

Another blowout payroll report suggests the economy is running strong and far from recession. On balance, this would push out any rate cuts by the Fed, but easing wage growth means we’re not in the middle of a labor-market induced inflation surge.

This is a strong labor economy that shows little sign of stalling in the near term. What’s it mean for interest rates? There’s even less reason for the Fed to feel any sense of urgency in announcing that much-anticipated first rate cut.

While a strong job print at the margin means less need for the Fed to cut, a cooperative wage picture limits how much impact this jobs report will likely have on the Fed’s thinking. Next week’s inflation data will likely be more important on that front.

There’s a lot to like in the March employment report. The economy continues to display remarkable resilience, defying high interest rates and fears of a substantial slowdown.

Federal Reserve officials can remain confident that they’re satisfying the maximum employment component of their dual mandate. The big question is when and if they can begin to cut interest rates in the battle against inflation.

Although the hotter-than-expected print raises questions about the timing for the Fed’s first interest rate cut, continued labor market strength remains encouraging for the economy. Additionally, wage pressure came in line with expectations, proving some comfort in a hot report.

Friday’s stronger-than-expected jobs report indicates that the economy remains resilient in 2024 even in the face of rising interest rates and a fading expectation of Federal Reserve rate cuts this year. The fact that the labor market is so strong shows that companies and the economy are adapting to high interest rates.

The economy is strong and getting stronger, consistent with some of the recent data. A June rate cut might be at risk, but next week’s CPI number will probably be a bigger litmus test for the Fed. The bears haven’t won yet.

The above expectation headline number of 300k+ shows that there is still strength in the labor market. That said, it is no longer overheating given average hourly earnings was in line and that participation rate ticked up slightly.

We still believe that the Fed will begin insurance cuts later this year to make the soft landing a reality. Especially given that some of the recent data away from payrolls has shown a decline in macro momentum.

Stop me if you’ve seen this headline before, but we have yet again another massive jobs beat. The reason for the beat at this point is irrelevant, the main take away is that once again the Fed is put in an impossible position. The rate cut lifeboats everyone was expecting have drifted further out to see and we are staying at the vast expanse of higher for longer.

Given the underlying economic strength, the Fed will likely need to reconsider its current stance of three rate cuts this year. But, the reason for this likely change in posture is bullish – the economy is doing well and is tolerating higher interest rates better than most had expected.

In the short term, this will fuel fears of further inflationary pressures leading the Fed to hike again. In the mid-term however, this is one more sign of a healthy economy that’s not showing signs of recession Another blockbuster NFP puts the doves on the back foot once more. When the job market so strong and inflation is resilient, why should the Fed cut at all?

While the jobs number came in stronger than expected, the unemployment rate and average hourly earnings came in line, so there hasn’t been much movement for rate cut expectations in June, which remain around 60%. Besides the good news from the jobs number, participation rose, and average hours worked rose which could help boost real income and spending in the economy without driving up inflation.

Today’s big upside surprise in the jobs report may not have closed the door on a June rate cut, but there’s a little less daylight coming through than there was a day ago. This will make next week’s CPI and PPI even more important. For months, the stock market has brushed off almost every troublesome bit of data that has come its way, but if those inflation numbers come in hotter than expected for a third month in a row, it could dent the market’s confidence about the Fed’s commitment to cutting rates some time in Q3.

Throughout 2024, the labor market has been resilient and today’s jobs report keeps that trend going. Even after the downward revisions to recent reports, this report underscores the strength of the job market within the broader context of a US economy that has continued to be largely resistant to the effects of higher rates.

The ongoing strength of the labor market, coupled with inflation persisting above the Fed’s 2% target, is likely to uphold Powell’s cautious approach to monetary easing.

Today’s jobs figures are stronger than expected, indicating that there is a high level of demand in the labor market. The Fed recently demonstrated its optimism surrounding employment by raising its longer-run expectation for the so-called neutral rate, which is the Goldilocks interest rate – low enough to avoid hurting the economy or increasing unemployment, but high enough to keep inflation at bay.

Incredibly strong jobs data puts the bond market in panic mode over Fed cuts being delayed. I keep scratching my head wondering why so many people are deciding to get jobs now when millions of job openings have been available for at least a couple of years. It’s not as though the economy suddenly produced these jobs. So people joining the workforce now must need the jobs. As a result, I’m cautious about how strong the jobs data really is for the economy.

We expect a quarter point cut in the third quarter and a half point cut in the fourth quarter.

Corporate Highlights:

-

Tesla Inc. is slashing prices of its best-selling vehicle in a bid to clear its biggest-ever stockpile.

-

The company is marking down Model Y sport utility vehicles it has in inventory, with the rear-wheel drive version going for $4,600 less than the cost to custom order the sport utility vehicle. Long-range and performance Model Ys are discounted by at least $5,000.

-

-

Johnson & Johnson agreed to acquire Shockwave Medical Inc. for about $13.1 billion in enterprise value to bolster its expansion into making medical devices to treat heart disease.

-

Apple Inc. laid off more than 600 employees in California as part of the decisions to end its car and smartwatch display projects, according to filings with the California Employment Development Department.

Some of the main moves in markets:

Stocks

-

The S&P 500 rose 0.6% as of 10:12 a.m. New York time

-

The Nasdaq 100 rose 0.8%

-

The Dow Jones Industrial Average rose 0.3%

-

The Stoxx Europe 600 fell 1%

-

The MSCI World index was little changed

Currencies

-

The Bloomberg Dollar Spot Index rose 0.2%

-

The euro fell 0.3% to $1.0808

-

The British pound fell 0.3% to $1.2603

-

The Japanese yen fell 0.1% to 151.54 per dollar

Cryptocurrencies

-

Bitcoin fell 0.1% to $67,865.29

-

Ether fell 0.8% to $3,299.9

Bonds

-

The yield on 10-year Treasuries advanced four basis points to 4.35%

-

Germany’s 10-year yield advanced one basis point to 2.37%

-

Britain’s 10-year yield advanced three basis points to 4.05%

Commodities

-

West Texas Intermediate crude was little changed

-

Spot gold rose 0.5% to $2,302.39 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Natalia Kniazhevich.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.