United States – Financial Services

The New York State Department of Financial Services (NYDFS) has instituted a new draft General Framework for Greenlisted Coins. This roadmap for approval of new coin listings shows how the draft guidance…

United States

Finance and Banking

To print this article, all you need is to be registered or login on Mondaq.com.

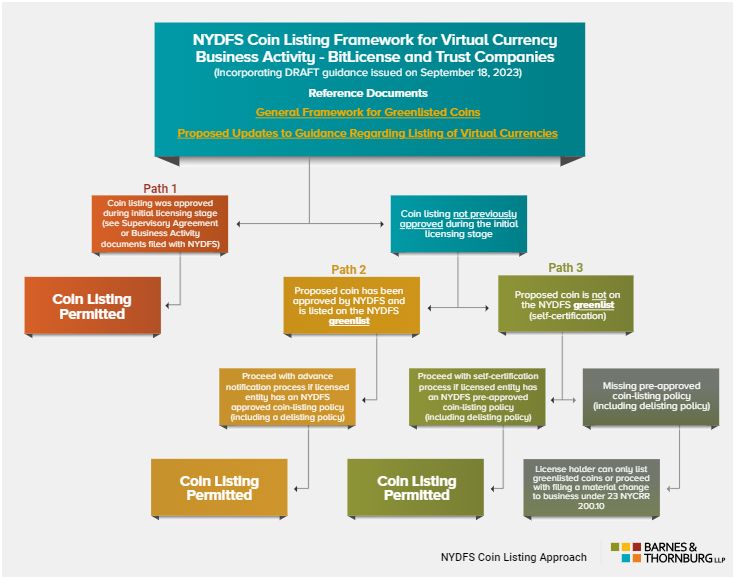

The New York State Department of Financial Services (NYDFS) has

instituted a new draft General Framework for Greenlisted Coins.

This roadmap for approval of new coin listings shows how the draft

guidance issued by NYDFS on Sept. 18 fits into the entire NYDFS

process. Public comments are due by Oct. 20, 2023, and should be

sent to innovation@dfs.ny.gov with “Proposed Coin-Listing

Policy Framework” in the subject line. A few observations:

- The listing process provides no certainty that any coin can

continue to be listed in New York nor any precise temporal

parameters for approval and de-listing events. Liquidity and volume

will suffer for NYDFS-regulated entities until due process

safeguards are in place protecting against NYDFS delisting

actions. - A well-designed regulatory process allows for straight through

processing, approval requests should not be held by supervisory

staff. Market intelligence indicates there has been a six- to

24-month waiting periods for staff to approve policies at NYDFS.

NYDFS should consider moving to a non-objection regime with a hard

outside date (e.g., 10 business days). - Knowledgeable supervisory staff is key to regulating this

market – financial services experience is a must. Otherwise,

supervisory staff is not in a position to ever say “yes”

(leading to chokepoints in the decision-making process) and will

focus on form rather than substance (because that’s what junior

people do). - NYDFS is telling entities to implement the draft guidance now,

prior to analysis and testing by industry participants, and without

assurance that required policies and procedures positively impact

the suitability, safety, and market appropriateness of listed

assets. This indicates either an unrealistic implementation period

after the draft is finalized or a fait accompli that renders the

comment period useless.

Transparency is key to confidence in our financial regulators

and the New York financial markets. Comments submitted to NYDFS are

not made public except possibly under a Freedom of Information Act

(FOIA) request. This allows market participants to speak freely

when submitting comments but also makes the process opaque (stay

tuned – more to come).

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.