Brokers Set Expectations for Avino Silver & Gold Mines Ltd.’s FY2024 Earnings (NYSE:ASM)

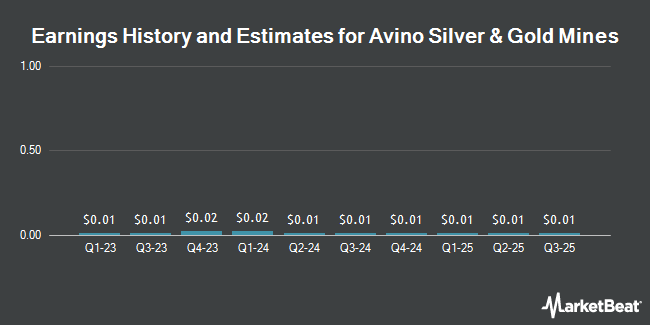

Avino Silver & Gold Mines Ltd. (NYSE:ASM – Free Report) – Investment analysts at Roth Capital upped their FY2024 earnings per share estimates for shares of Avino Silver & Gold Mines in a research report issued to clients and investors on Friday, May 10th. Roth Capital analyst J. Reagor now expects that the company will post earnings of $0.03 per share for the year, up from their prior forecast of $0.02. The consensus estimate for Avino Silver & Gold Mines’ current full-year earnings is $0.04 per share. Roth Capital also issued estimates for Avino Silver & Gold Mines’ Q4 2024 earnings at $0.01 EPS, Q1 2025 earnings at $0.01 EPS, Q2 2025 earnings at $0.01 EPS, Q3 2025 earnings at $0.01 EPS, Q4 2025 earnings at $0.01 EPS and FY2025 earnings at $0.03 EPS.

A number of other research firms have also commented on ASM. HC Wainwright decreased their price objective on shares of Avino Silver & Gold Mines from $1.60 to $1.50 and set a “buy” rating for the company in a research note on Thursday. StockNews.com upgraded Avino Silver & Gold Mines from a “sell” rating to a “hold” rating in a report on Friday. Finally, Roth Mkm reissued a “buy” rating and issued a $1.10 price target on shares of Avino Silver & Gold Mines in a research report on Tuesday, April 23rd.

Read Our Latest Research Report on ASM

Avino Silver & Gold Mines Price Performance

Shares of ASM opened at $0.80 on Monday. The stock has a 50-day moving average price of $0.75. The firm has a market capitalization of $105.84 million, a PE ratio of 16.06 and a beta of 2.02. The company has a debt-to-equity ratio of 0.01, a quick ratio of 1.07 and a current ratio of 1.77. Avino Silver & Gold Mines has a one year low of $0.40 and a one year high of $0.88.

Avino Silver & Gold Mines (NYSE:ASM – Get Free Report) last issued its quarterly earnings results on Wednesday, May 8th. The company reported $0.02 earnings per share for the quarter. Avino Silver & Gold Mines had a return on equity of 5.39% and a net margin of 3.21%. The firm had revenue of $12.39 million for the quarter, compared to analysts’ expectations of $10.70 million.

Institutional Trading of Avino Silver & Gold Mines

A hedge fund recently raised its stake in Avino Silver & Gold Mines stock. Perritt Capital Management Inc. grew its position in shares of Avino Silver & Gold Mines Ltd. (NYSE:ASM – Free Report) by 300.0% in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 800,000 shares of the company’s stock after buying an additional 600,000 shares during the quarter. Perritt Capital Management Inc. owned approximately 0.62% of Avino Silver & Gold Mines worth $419,000 as of its most recent filing with the Securities and Exchange Commission (SEC). 3.11% of the stock is owned by hedge funds and other institutional investors.

About Avino Silver & Gold Mines

Avino Silver & Gold Mines Ltd., together with its subsidiaries, engages in the acquisition, exploration, and advancement of mineral properties in Canada. It primarily explores for silver, gold, and copper deposits. The company owns interests in 42 mineral claims and four leased mineral claims, including Avino mine area property comprising four exploration concessions covering 154.4 hectares, 24 exploitation concessions covering 1,284.7 hectares, and one leased exploitation concession covering 98.83 hectares; Gomez Palacio property consists of nine exploration concessions covering 2,549 hectares; and Unification La Platosa properties, which include three leased concessions located in the state of Durango, Mexico.

Featured Articles

Receive News & Ratings for Avino Silver & Gold Mines Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Avino Silver & Gold Mines and related companies with MarketBeat.com’s FREE daily email newsletter.