Creekmur Asset Management LLC Acquires Shares of 67,837 Wheaton Precious Metals Corp. (NYSE:WPM)

Creekmur Asset Management LLC acquired a new position in shares of Wheaton Precious Metals Corp. (NYSE:WPM – Free Report) in the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm acquired 67,837 shares of the company’s stock, valued at approximately $3,347,000. Wheaton Precious Metals comprises approximately 1.0% of Creekmur Asset Management LLC’s portfolio, making the stock its 20th biggest holding.

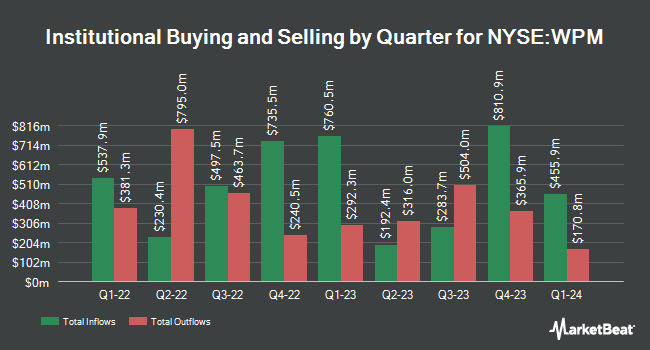

A number of other hedge funds also recently made changes to their positions in WPM. CVA Family Office LLC bought a new stake in Wheaton Precious Metals in the fourth quarter worth approximately $26,000. McGlone Suttner Wealth Management Inc. purchased a new position in shares of Wheaton Precious Metals during the fourth quarter valued at approximately $31,000. Principal Securities Inc. purchased a new position in shares of Wheaton Precious Metals during the fourth quarter valued at approximately $39,000. Fifth Third Bancorp boosted its position in shares of Wheaton Precious Metals by 230.7% during the fourth quarter. Fifth Third Bancorp now owns 863 shares of the company’s stock valued at $43,000 after buying an additional 602 shares during the last quarter. Finally, Western Pacific Wealth Management LP boosted its position in Wheaton Precious Metals by 47.6% in the fourth quarter. Western Pacific Wealth Management LP now owns 1,113 shares of the company’s stock worth $55,000 after purchasing an additional 359 shares during the last quarter. 70.34% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

Several research analysts have weighed in on WPM shares. Raymond James cut their price objective on Wheaton Precious Metals from $60.00 to $58.00 and set a “market perform” rating on the stock in a research report on Thursday, February 22nd. TD Securities raised Wheaton Precious Metals from a “hold” rating to a “buy” rating and boosted their price objective for the stock from $51.00 to $53.00 in a research report on Monday, March 18th. Jefferies Financial Group boosted their target price on Wheaton Precious Metals from $52.00 to $61.00 and gave the company a “buy” rating in a research note on Monday, April 22nd. BMO Capital Markets boosted their target price on Wheaton Precious Metals from $59.00 to $61.00 and gave the company an “outperform” rating in a research note on Tuesday, May 21st. Finally, CIBC boosted their target price on Wheaton Precious Metals from $70.00 to $75.00 and gave the company an “outperform” rating in a research note on Wednesday, May 22nd. Three investment analysts have rated the stock with a hold rating and six have assigned a buy rating to the company. Based on data from MarketBeat, Wheaton Precious Metals currently has an average rating of “Moderate Buy” and a consensus price target of $61.33.

Check Out Our Latest Research Report on WPM

Wheaton Precious Metals Trading Up 0.1 %

Shares of WPM traded up $0.06 during midday trading on Friday, reaching $52.94. The stock had a trading volume of 965,840 shares, compared to its average volume of 1,527,462. The company’s 50-day moving average is $53.98 and its 200 day moving average is $49.07. Wheaton Precious Metals Corp. has a 12-month low of $38.37 and a 12-month high of $57.87. The company has a market capitalization of $24.00 billion, a price-to-earnings ratio of 40.72, a price-to-earnings-growth ratio of 1.91 and a beta of 0.78.

Wheaton Precious Metals (NYSE:WPM – Get Free Report) last posted its quarterly earnings data on Thursday, May 9th. The company reported $0.36 earnings per share (EPS) for the quarter, topping analysts’ consensus estimates of $0.29 by $0.07. Wheaton Precious Metals had a return on equity of 8.53% and a net margin of 53.74%. The firm had revenue of $296.80 million during the quarter, compared to analysts’ expectations of $278.95 million. During the same period in the prior year, the business earned $0.23 EPS. The company’s revenue for the quarter was up 38.7% compared to the same quarter last year. Research analysts forecast that Wheaton Precious Metals Corp. will post 1.29 EPS for the current fiscal year.

Wheaton Precious Metals Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Tuesday, June 11th. Stockholders of record on Wednesday, May 29th were issued a $0.155 dividend. This represents a $0.62 dividend on an annualized basis and a dividend yield of 1.17%. The ex-dividend date of this dividend was Wednesday, May 29th. Wheaton Precious Metals’s payout ratio is currently 47.69%.

Wheaton Precious Metals Company Profile

Wheaton Precious Metals Corp. primarily sells precious metals in North America, Europe, and South America. It produces and sells gold, silver, palladium, and cobalt deposits. The company was formerly known as Silver Wheaton Corp. and changed its name to Wheaton Precious Metals Corp. in May 2017. Wheaton Precious Metals Corp.

Recommended Stories

Before you consider Wheaton Precious Metals, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Wheaton Precious Metals wasn’t on the list.

While Wheaton Precious Metals currently has a “Moderate Buy” rating among analysts, top-rated analysts believe these five stocks are better buys.

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.