Returning lustre: ‘Silver to da moon’

Continuing inflation may be crippling consumers but it is doing wonders for giving silver back its lustre, with the precious metal gaining over 34% in the past six months.

In late May, silver hit its highest point in 12 years, climbing to a 2024 high of US$32.42 ($48.81) an ounce.

Maria Smirnova, senior portfolio manager and chief investment officer for Sprott Asset Management, says silver has been playing catch up to gold’s rally.

While gold has been running for longer, in terms of percentage gains the safehaven metal has only advanced 17.6% in 2024, to a peak of US$2443.25 in May.

Smirnova says both metals have been buoyed by the prospect of easing monetary policy in the US, rising geopolitical turmoil in the Middle East and central bank buying, particularly from China.

“Silver faced several headwinds in 2023, most notably rising interest rates and slower economic growth in both the US and China,” she says.

“While the physical silver market was robust in 2023, Western investment demand was tepid, with silver bullion ETFs [exchange traded funds] shedding approximately 50 million ounces during the year and representing more than 6% of holdings.

“Looking ahead, we expect silver prices to continue to improve, driven by low interest rates, more robust physical, ETF purchases and increased industrial demand.”

The Silver Institute sees silver demand rising 2% this year because of its dual purpose as a key element in the clean energy transition.

An anticipated 20% increase in the solar photovoltaic market is forecast to drive industrial fabrication to yet another all time high in 2024, with a further 9% gain anticipated.

Silver’s high conductivity, thermal efficiency and optical reflectivity make it an ideal product to use in solar panels, which convert sunlight into electrons for energy. Silver’s role is to either channel these electrons into storage or out for immediate consumption.

BloombergNEF sees the global solar industry climbing 32% in 2024.

The Silver Institute’s estimates suggest demand from this sector could rise as much as 170% by 2030.

Silver demand in jewellery and silverware fabrication is predicted to rise by 4% and 7%, respectively, but bar and coin demand is forecast to contract by 13%, according to The Silver Institute.

Later this year, however, a delayed monsoon season in India could impact silver demand, according to German technology group Heraeus.

This is because rainfall is critical to agriculture and delayed rainfall may negatively impact rural incomes. Heraeus says rural communities are an important buyer of precious metals.

According to figures from the Silver Institute, last year India accounted for 3,771 tonnes of silver demand in jewellery and silverware, or 46.9% of global demand in these two sectors.

“If rural disposable incomes are negatively impacted, silverware and silver jewellery demand could be hit, as well as demand for gold,” Heraeus says.

“If Indian silverware fabrication declines by 10% this year, demand is at risk of falling below 1,000 tonnes for the first time in three years.”

Historically, Sprott says, half of silver demand has been industrial, with the remainder coming from investment and “investment-like” categories such as jewellery, silverware, bars and coins.

Smirnova says that in recent years, however, the balance has been shifting in favour of industrial demand, which now represents 55% of the total demand for silver.

“This category has been growing steadily, and estimates are that it hit a record high of 654 million ounces last year in a 1.2-billion-ounce market. This represents an 11% jump from 2022,” she says.

Supply cliff

At the same time, supply is predicted to witness a modest 1% drop, but that is only set to widen the supply-demand gap further to 215.3 million ounces – the second largest market deficit in more than two decades.

The Silver Institute also notes that silver will become an “indispensable” material as artificial intelligence evolves. This includes in the areas of transportation, nanotechnology, biotechnology, healthcare, consumer wearables, computing, and energy in data centres.

Meanwhile, Smirnova says the silver market deficit is expected to grow by 17% in 2024 as supply stagnates and industrial demand posts another record.

“We have already seen a decline of ~480 million ounces of silver held on the major exchanges since February 2021,” she says.

“We believe the global energy transition will be highly positive for silver, leading to much higher prices for silver bullion and equities.”

Mike Jones, Managing Director of Impact Minerals (ASX:IPT) – which has two Australian silver projects in its portfolio, tells Mining.com.au the silver price has increased sixfold since 2000 but is much more volatile than gold, having peaked at US$45 per ounce in 2011.

“It’s a buy-and-hold investment together with gold,” he says.

“There is increasing talk of ‘silver-to-da-moon’ as there appears to be an emerging silver supply deficit and so it is likely that the price will continue to rise erratically over the next few years.”

Pure-play versus byproduct

Silver is largely produced as a byproduct of other metals like copper, lead, zinc and gold. Only 28.3% of mines that produce the precious metal are primary silver mines, according to The Silver Institute’s World Silver Survey 2024 report.

Smirnova says silver mine production is prone to disruptions and unforeseen events, which have culminated in the current supply shortage.

Impact Minerals is primarily focused on bringing its flagship Lake Hope High Purity Alumina Project in Western Australia into production, but also has two non-core projects, with “very high silver grades” in its portfolio.

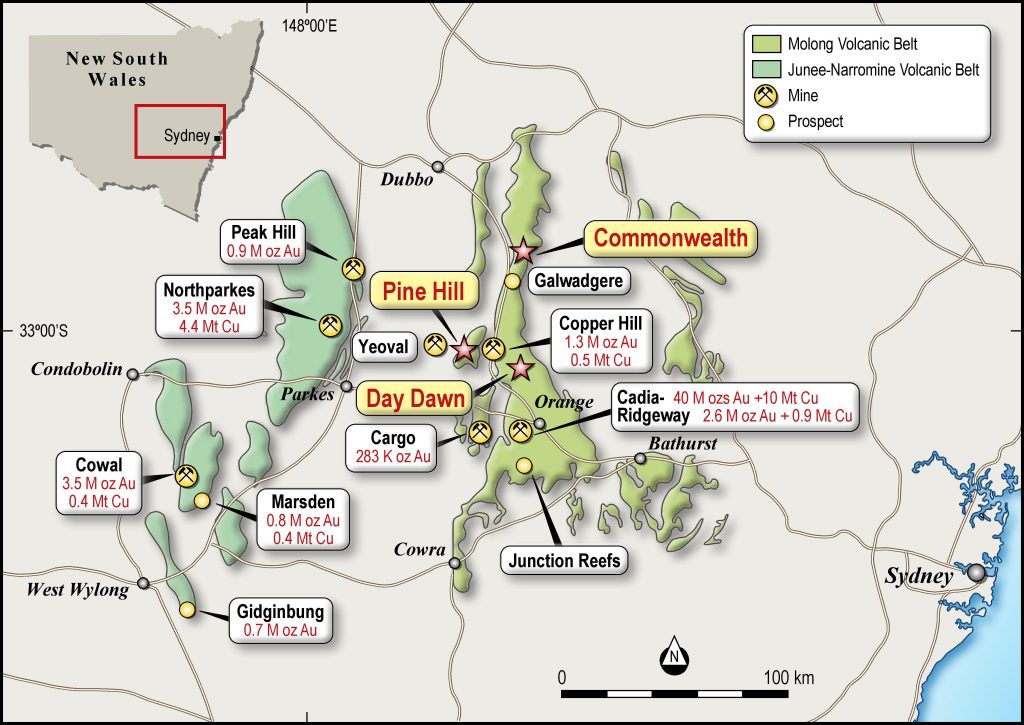

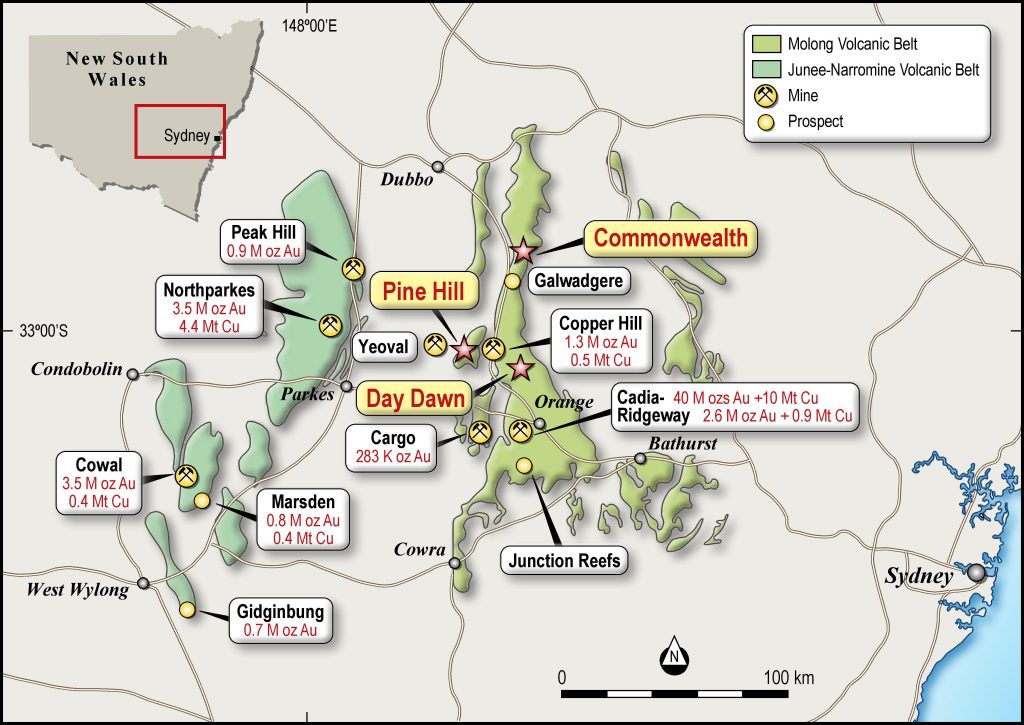

The company has defined a 3-million-ounce resource at its Commonwealth Gold-Silver-Base Metals Project in the mineral-rich Lachlan Fold Belt in New South Wales.

Jones says individual grades intersected during drilling at the Silica Hill prospect reached over 1,000 grams per tonne.

“There is still considerable potential at depth at Silica Hill and a private company, Burrendong Minerals, has an option to earn a 75% interest in the project after an IPO late this year,” he tells this news service.

Impact also has an extensive ground holding at Broken Hill in NSW, where high-grade silver, lead, zinc and copper were uncovered at Dora East.

However, the junior explorer is looking for joint venture partners for that project.

“Impact is always looking for outstanding opportunities. However silver’s volatility makes it difficult to ride through the market cycles and maintain investor enthusiasm,” Jones says.

Gavin Wendt, resources analyst and founding director of MineLife, told Mining.com.au in April that many pure-play silver hopefuls would have operating costs around US$25 per ounce, which means their operations would not be profitable through the cycle.

Therefore junior explorers find it much more enticing to retain exposure to silver via joint ventures and non-core projects, or as byproduct credits.

“We aim to keep exposure to silver through our non-core assets as we have great confidence in their long-term potential to deliver a major discovery,” Jones says.

Write to Angela East at Mining.com.au

Images: Sprott, The Silver Institute & Impact Minerals