Sprott Gold Miners ETF (NYSEARCA:SGDM) Shares Sold by Wealthcare Advisory Partners LLC

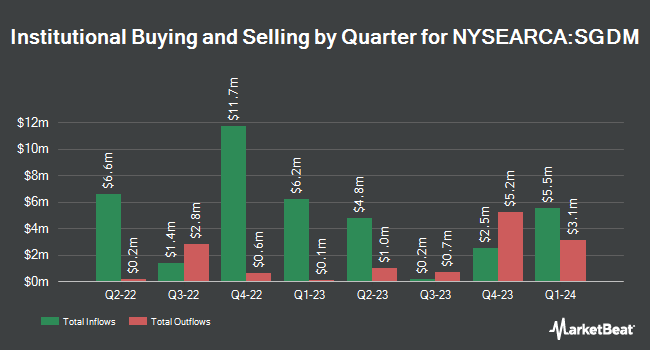

Wealthcare Advisory Partners LLC reduced its position in shares of Sprott Gold Miners ETF (NYSEARCA:SGDM – Free Report) by 30.5% during the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 10,217 shares of the company’s stock after selling 4,489 shares during the period. Wealthcare Advisory Partners LLC owned about 0.11% of Sprott Gold Miners ETF worth $259,000 at the end of the most recent reporting period.

Wealthcare Advisory Partners LLC reduced its position in shares of Sprott Gold Miners ETF (NYSEARCA:SGDM – Free Report) by 30.5% during the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 10,217 shares of the company’s stock after selling 4,489 shares during the period. Wealthcare Advisory Partners LLC owned about 0.11% of Sprott Gold Miners ETF worth $259,000 at the end of the most recent reporting period.

Several other institutional investors and hedge funds have also made changes to their positions in the company. ORG Partners LLC acquired a new stake in Sprott Gold Miners ETF in the fourth quarter worth $57,000. Geneos Wealth Management Inc. increased its position in Sprott Gold Miners ETF by 10.3% in the fourth quarter. Geneos Wealth Management Inc. now owns 5,700 shares of the company’s stock worth $142,000 after buying an additional 530 shares during the period. Creekmur Asset Management LLC acquired a new stake in Sprott Gold Miners ETF in the fourth quarter worth $215,000. Optimum Investment Advisors increased its position in Sprott Gold Miners ETF by 8.1% in the fourth quarter. Optimum Investment Advisors now owns 8,700 shares of the company’s stock worth $217,000 after buying an additional 650 shares during the period. Finally, Raymond James & Associates increased its position in Sprott Gold Miners ETF by 191.8% in the fourth quarter. Raymond James & Associates now owns 34,155 shares of the company’s stock worth $853,000 after buying an additional 22,450 shares during the period.

Sprott Gold Miners ETF Price Performance

Shares of NYSEARCA SGDM opened at $26.52 on Tuesday. Sprott Gold Miners ETF has a 1-year low of $20.72 and a 1-year high of $29.46. The business’s fifty day moving average price is $27.14 and its two-hundred day moving average price is $25.04. The firm has a market capitalization of $238.95 million, a PE ratio of 24.90 and a beta of 0.70.

About Sprott Gold Miners ETF

The Sprott Gold Miners ETF (SGDM) is an exchange-traded fund that mostly invests in materials equity. The fund tracks an equity index of gold mining firms. Firms with higher revenue growth, lower debt to equity and higher free cash flow yield receive more weight. SGDM was launched on Jul 15, 2014 and is managed by Sprott.

Featured Articles

Receive News & Ratings for Sprott Gold Miners ETF Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Sprott Gold Miners ETF and related companies with MarketBeat.com’s FREE daily email newsletter.