HSBC’s Deal With RBC Upends Canada’s Foreign Investment Data

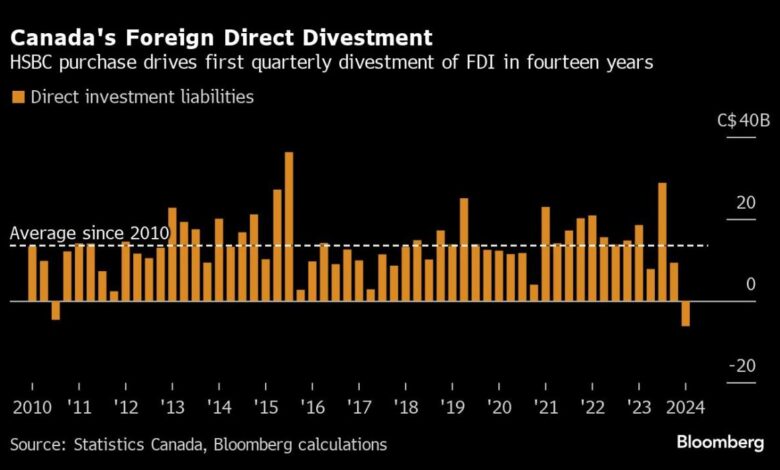

(Bloomberg) — Royal Bank of Canada’s landmark deal to acquire HSBC Holdings Plc’s Canadian division led to the country’s first decrease in foreign direct investment in 14 years.

Most Read from Bloomberg

Foreigners withdrew C$6.2 billion ($4.5 billion) in direct investment funds in the first quarter, Statistics Canada reported Thursday from Ottawa. That’s the first such outflow since 2010.

The number was driven by a divestment of C$11.1 billion in assets from foreign investors via merger and acquisition activities, the agency said. At the end of March, Royal Bank closed its purchase of HSBC’s Canadian assets for more than C$13 billion. That’s recorded in the current account data as foreign direct investors selling existing assets back to Canadian investors.

The impact of such a large transaction suggests the outflow of foreign direct investment is likely to be temporary. That’s important, since foreign money has proved an important source of capital that’s helped with the country’s funding needs in recent decades.

Foreign companies reinvested C$7.3 billion in earnings in Canada in the first quarter, up 6.8% from the previous quarter, the statistics agency said.

Canadian companies sent C$29.8 billion in direct investment to other countries in the first quarter, the data show. Since 2014, Canadian companies have been deploying more direct investment abroad than foreign companies have invested in Canada by an average of C$11.3 billion each quarter.

“Weak foreign investment patterns highlight concerns around the attractiveness of doing business in Canada,” Shelly Kaushik, an economist with the Bank of Montreal, wrote in a report to investors.

Canada’s current account deficit widened to C$5.4 billion in the first quarter, and foreign appetite for Canadian debt remains strong amid expectations of falling interest rates. Investors acquired C$57.9 billion in Canadian bonds in the first three months of the year, the most since the first quarter of 2022.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.