PGA Tour says new $3bn investment from Strategic Sports Group ‘allows’ for deal with Saudi Arabian PIF | Golf News

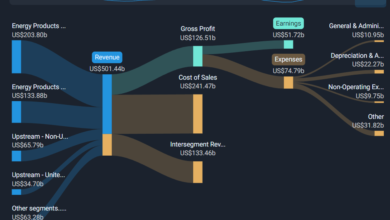

The PGA Tour says a new $3bn partnership with Strategic Sports Group will not prevent an “ultimate agreement” being reached with the Saudi Arabian Public Investment Fund.

The deal, which includes an initial contribution of $1.5bn from the group led by Liverpool owners Fenway Sports Group, has funded the launch of PGA Tour Enterprises, a new commercial venture designed to give players the opportunity to become equity holders in the tour.

The agreement has been made as negotiations continue with the Saudi backers of the LIV Golf League, the competing series that has offered huge sums of money to convince the likes of Masters champion Jon Rahm to depart the PGA Tour.

“Today the PGA Tour confirmed progress in its ongoing negotiations with PIF on a potential future investment and both parties are working towards an ultimate agreement,” a PGA Tour statement confirming the deal with SSG said.

“SSG has consented to an investment by PIF, subject to any necessary regulatory review and approvals.”

Rory McIlroy admits he has changed his tune by saying returning LIV Golf players should not be punished

A Framework Agreement between the PGA Tour and PIF, which stunned the world of men’s professional golf, was announced on June 6, but an end-of-year deadline for a deal to be concluded had to be extended as no agreement was reached.

With Tyrrell Hatton having earlier this week become the latest European Ryder Cup player to join LIV, it remains to be seen what sort of agreement can be reached between the PGA Tour and PIF to ensure the stars of the game can compete with each other on a regular basis.

The PGA Tour added that its strategic alliance with the DP World Tour “remains a focus” and that it is continuing “active discussions on how to best work together for the continued benefit of all”.

Rich Beem believes PGA Tour’s partnership with Strategic Sports Group is a ‘positive step’ in helping players feel like they are part of the tour

How will the investment benefit PGA Tour players?

Having already made changes, including greater prize funds and scheduling alterations to ensure the top players compete more often, this move is the most significant thus far by the PGA in its attempts to prevent more players from departing.

The new venture, which the PGA describes as the first of its kind, gives its near 200 members the opportunity to collectively access over $1.5bn in equity.

The tour said that the amount of money that players will be able to access will be “based on career accomplishments, recent achievements, future participation and services and PGA Tour membership status, and grants are only available to qualified PGA Tour players”.

Justin Thomas wishes Tyrrell Hatton was not moving to LIV Golf and hopes he has ‘done his research’

The statement also added that PGA Tour Enterprises is “considering” participation for future PGA Tour players “that would allow them to benefit from the business’s commercial growth”.

“Today marks an important moment for the PGA Tour and fans of golf across the world,” said PGA Tour commissioner Jay Monahan, who is also the chief executive of the new venture. “By making PGA Tour members owners of their league, we strengthen the collective investment of our players in the success of the PGA Tour.

“Fans win when we all work to deliver the best in sports entertainment and return the focus to the incredible – and unmatched – competitive atmosphere created by our players, tournaments and partners.

“And partnering with SSG – a group with extensive experience and investment across sports, media and entertainment – will enhance our organisation’s ability to make the sport more rewarding for players, tournaments, fans and partners.”

The deal was also backed by the PGA Tour player directors, a group that includes Tiger Woods, Jordan Spieth and Patrick Cantlay.

McIlroy hopes to see a framework in golf where at the very top level is a Champions League style tour where the very best can compete

“We were proud to vote in unanimous support of this historic partnership between PGA Tour Enterprises and SSG,” the group said. “It was incredibly important for us to create opportunities for the players of today and in the future to be more invested in their organisation, both financially and strategically.

“This not only further strengthens the Tour from a business perspective, but it also encourages the players to be fully invested in continuing to deliver – and further enhance – the best in golf to our fans. We are looking forward to this next chapter and an even brighter future.”

The investment group, which is being led by Fenway Sports Group boss John Henry, also includes Arthur Blank, owner of the NFL’s Atlanta Falcons, and Steven Cohen, owner of the New York Mets baseball team.

“We greatly appreciate the opportunity to join PGA Tour players in this important next phase of the PGA Tour’s evolution,” Henry said.

“Our enthusiasm for this new venture stems from a very deep respect for this remarkable game and a firm belief in the expansive growth potential of the PGA Tour. We are proud to partner with this historic institution and are eager to work with the PGA Tour and its many members to grow and strengthen the game of golf globally.”

‘Huge boost for PGA Tour, but what next?’

Sky Sports News reporter Jamie Weir assesses the implications of the PGA Tour’s new deal with Strategic Sports Group:

This is a huge boost for the PGA Tour themselves, who for the last 18 months have been having to dip into their slush funds, go cap in hand to existing sponsors, and ask for more money to up their prize funds in a desperate attempt to try to compete with the oodles of cash that LIV can offer.

It’s also a big boost for those players who stayed loyal to the PGA Tour instead of jumping ship for LIV because this new deal gives them a chance to have equity in that new entity.

However, the enormous elephant that remains in the room is what does it mean for the PGA Tour and LIV on the Saudi Public Investment Fund going forward?

It hasn’t, in the PGA Tour’s own words, ‘eliminated a competitor off the table’. The threat from LIV remains, and there’s two real ways of looking at today’s deal with SSG. One, is it a way of disengaging with the Saudi Public Investment Fund altogether? Or two, and I think this is the more likely scenario, is it step one, in finally thrashing through a deal with the Saudi Public Investment Fund?

I think it’s in everybody’s interest for that to happen. I think all parties now realise that this ongoing division in the game of golf doesn’t suit anybody at all, that there needs to be some form of unification, some form of coming together. Talks will continue between the PIF and the PGA Tour to try to get a deal done.

However, remember it was June 6 last year that they announced this framework agreement. December 31 last year was the deadline to get that agreement done. That can continues to get kicked down the road and these questions will only intensify of what next now between the PGA Tour and the Saudi Public Investment Fund.

The Saudis aren’t going anywhere. Their end game in all of this was to have a foot in the door and be involved in the game of golf. The PGA Tour realise that as well, and whilst this injection of $3bn from the Strategic Sports Group will be hugely welcome. The question is what now between the PGA Tour and PIF?

Get Sky Sports on WhatsApp!

You can now start receiving messages and alerts for the latest breaking sports news, analysis, in-depth features and videos from our dedicated WhatsApp channel!