The Trump trade

Unlock the US Election Countdown newsletter for free

The stories that matter on money and politics in the race for the White House

Good morning. My beloved Celtics win an NBA championship and then, weeks later, they are up for sale. I consider myself a capitalist red in tooth and claw, but I bleed green. A bad owner can sink a franchise fast. Send reassuring thoughts: robert.armstrong@ft.com.

Is there a Trump trade?

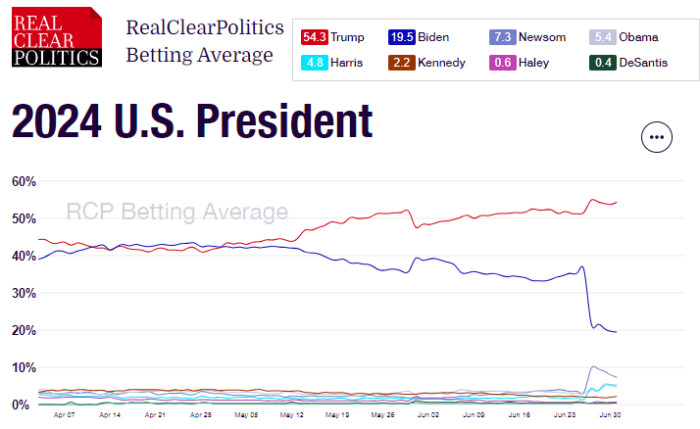

If there is a right moment to trade the US presidential election — a proposition, I should say at the outset, I am quite sceptical about — that moment may be approaching. After President Joe Biden’s scattered and shaky performance in the debate last Thursday, betting markets (more scepticism) have shifted their chips pretty decisively. Here for example is RealClearPolitics’ betting average, which aggregates the results from various markets:

I’m no political scientist, but it is interesting that the odds of Biden winning have fallen by more than 15 percentage points, but Trump only gained a few points, with the rest of the distribution going to a grab-bag of third possibilities. But the polls, not just the betting markets, look very bad for Biden now. Trump has to be an unambiguous favourite. So what’s the trade?

Calvin Tse, head of macro strategy at BNP Paribas, thinks it is clear enough:

The Trump trade is a US rates curve steepener. Trump’s policies are largely inflationary (tariffs, looser fiscal), while at the same time, he will probably appoint a more dovish-leaning Fed chair. After the debate last week the curve steepened both on Friday and Monday — likely as a reflection of Trump’s probabilities of winning having gone up.

Here is what Tse is talking about:

The idea that Trump will be a very inflationary president is getting a lot of play, notably in a letter from 16 Nobel laureates in economics which argued that: “Many Americans are concerned about inflation, which has come down remarkably fast. There is rightly a worry that Donald Trump will reignite this inflation, with his fiscally irresponsible budgets.”

I am a bit sceptical about these arguments, for two reasons. First, if we have learned anything about inflation over the past few years, it is that while we might understand it, no one is any good at predicting it. Second, the fiscal approach of a Trump administration is bound to be pretty hard to predict, as well. The policy portion of his website contains a lot of broad promises, including tax cuts and trade policies that will make America into a “manufacturing superpower”. Who knows how this will translate in office. Anyone who talks with any confidence about the path of inflation under Trump as opposed to Biden is probably letting partisanship get the better of them.

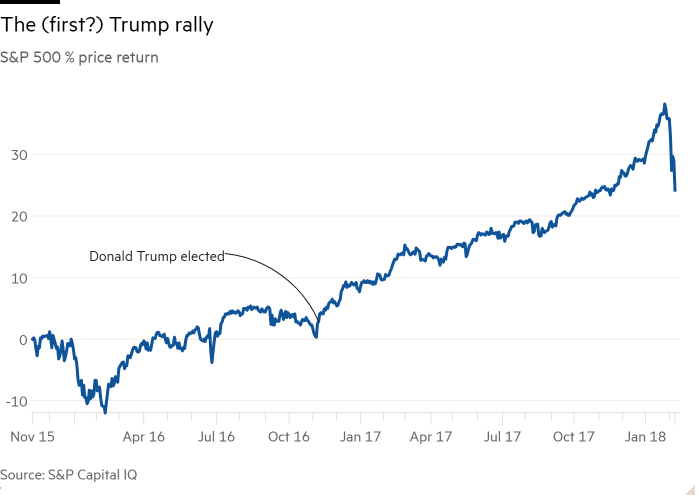

But we have seen this movie before. What happened the first time? Trump’s 2016 election triggered, or at the very least coincided with, a rally that lasted until early 2018:

Part of this had to do with the expectation that Trump would cut corporate tax rates, as he did with the 2017 Tax Cuts and Jobs Act. But it is also interesting to look at which particular sectors did well. This chart covers the first three months after Trump’s victory:

Finance was the clear winner, on the expectation of deregulation. Trump delivered on that expectation when he signed Senator Mike Crapo’s Economic Growth, Regulatory Relief, and Consumer Protection Act in 2018, which loosened bank regulation and capital requirements. Scott Chronert, US equity strategist at Citigroup, thinks that financials would once again be the biggest beneficiary of Trump’s deregulatory tendency. With the final implementation of the Basel III global banking standards still up in the air, that seems like a good bet.

But keep in mind that the economic and market context is very, very different than it was eight years ago. In November 2016 the S&P 500 was a market in a lumpy sideways trend trading at 17 times forward earnings. The market today has been rallying hard almost without interruption for eight months and trades at 22 times. Of course (all together now!) valuation is useless for market timing, and valuations can always become more extreme. But it is just easier for an unloved market to rise sharply.

On the other hand, the Federal Reserve was increasing interest rates all through 2017. It is possible that a Trump election this time around would closely coincide with the start of a rate-cutting cycle. The example of 2017 shows it is never as simple as rate cuts being good for markets and rate increases bad. But that said, things are different this time.

This leads us to the most important point of all. The most powerful influence on markets in recent years, I believe, has not been interest rate policy but huge fiscal deficits. The key question for markets is whether the next administration will maintain these deficits, as both Biden and Trump would likely prefer to do, or be forced by legislative or bond market vigilantes to narrow them. Events, not just policy intentions, will be decisive.

There is more to be said on this topic. If there are particularly important points I have missed, email me.

One good read

The Taliban’s mines.

FT Unhedged podcast

Can’t get enough of Unhedged? Listen to our new podcast, for a 15-minute dive into the latest markets news and financial headlines, twice a week. Catch up on past editions of the newsletter here.