RBA to hold rates next week ahead of easing cycle

By Gareth Aird, head of Australian economics at CBA:

Key Points:

- We expect the RBA will leave the cash rate unchanged next week in a straight forward decision.

- The Q4 23 national accounts were probably a touch softer than the RBA anticipated, but not sufficiently so for the RBA to change their communication strategy.

- As such, we anticipate the Board will retain a mild tightening bias, but the risk sits with the removal of the hiking bias.

- RBA Governor Bullock will hold a press conference at 3.30pm on Tuesday – an hour after the decision is handed down. This is now a regular feature after each Board meeting.

- We continue to expect an easing cycle commencing in September (we have 75bp of rate cuts in our profile in late 2024 and a further 75bp of easing in H1 25, which would take the cash rate to 2.85%).

- The recent run of domestic economic data leaves us feeling increasingly comfortable with our base case, but the upcoming Federal Budget is a risk to our RBA call if the Government injects any non-trivial stimulus into the economy.

A straight forward decision once again:

The RBA Board meets next week for the second time this year. We expect the cash rate will be left on hold in what should be a very straight forward decision.

Advertisement

The case to hike rates further is weak given economic growth is well below trend, the unemployment rate is on a firm upward trend and inflation continues to fall.

The job of course is not yet done on the inflation front. But monetary policy is clearly in restrictive territory based on recent outcomes for both GDP and unemployment.

Advertisement

Any further tightening from this juncture simply runs the risk of a ‘hard landing’ – something the RBA has wanted to avoid through their tightening cycle.

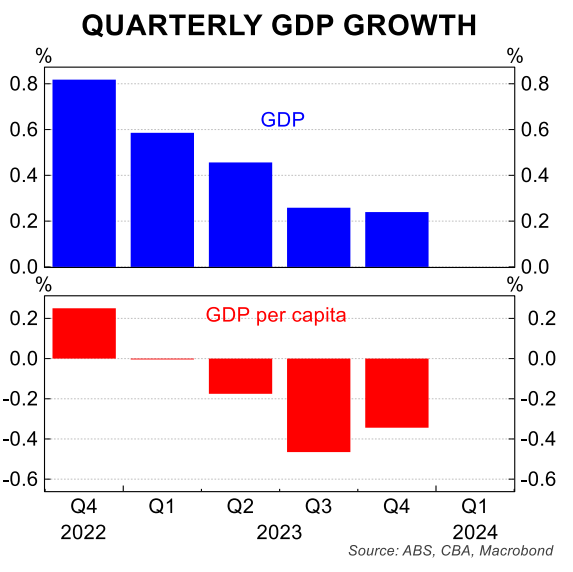

The run of key domestic economic data since the February Board meeting has been soft. Real GDP rose by a weak 0.2%/qtr in Q4 23 to be up 1.5% on year ago levels. But the annual rate of growth overstates the quarterly momentum.

Advertisement

We noted in our report on the national accounts last week the quarterly changes in real GDP over 2023 now read 0.6%, 0.5%, 0.3% and 0.2%.

Economic growth therefore on a six-month annualised basis fell to 1.0% in the December quarter. This compares with population growth of ~2.5%/yr.

The upshot is that the economy has gone backwards a lot in per capita terms over H2 23.

Advertisement

The annual rate of GDP growth in Q4 23 was in line with the RBA’s forecasts from the February Statement on Monetary Policy (SMP). But the consumer has been a lot weaker than the RBA anticipated over the past six months.

In November 2023 the RBA forecast household consumption to be 1.1%/yr in Q4 23. That number was revised down to 0.4%/yr in February 2024. The Q4 23 national accounts indicated the actual outcome was just 0.1%/yr.

The upshot is that the RBA will be somewhat surprised at the lack of growth in household consumption.

Advertisement

The RBA February Board Minutes noted that, “there was a risk that inflation proves more persistent but there was also a risk that consumer spending weakens more sharply than it had to date”.

So far the evidence indicates that the balance of risks for the RBA should be shifting to consumer spending surprising further to the downside rather than inflation proving more persistent.

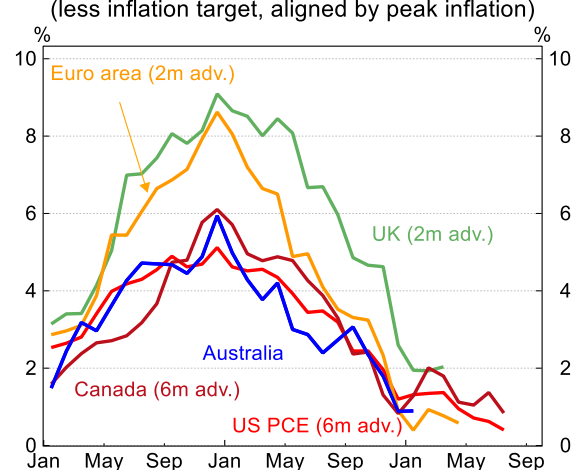

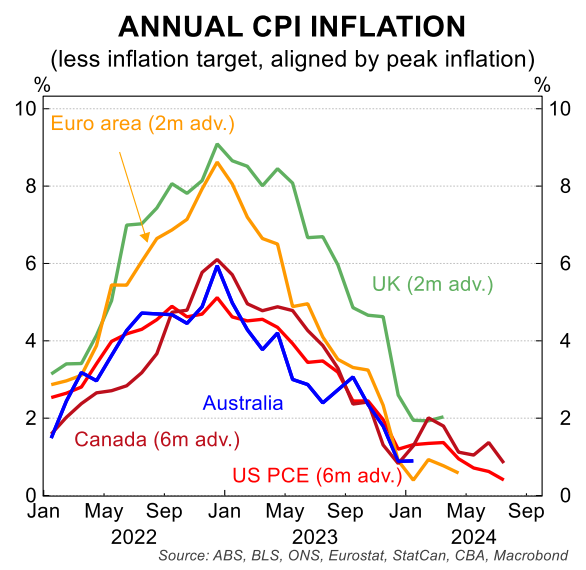

Indeed the news on the inflation front is encouraging.

Advertisement

Trimmed mean CPI of 0.8%/qtr came in below the RBA’s expectations in Q4 23 (the print was just before the February Board meeting).

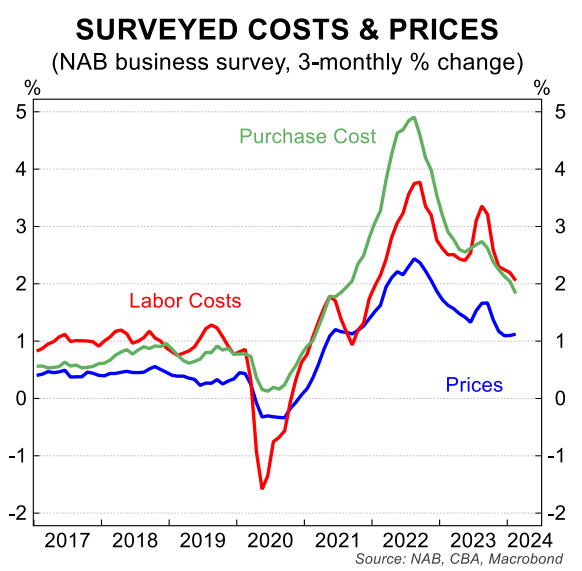

And the various public and private surveys so far released in the March quarter point to a similar outcome in Q1 24 (CBA current forecast is for trimmed mean CPI of 0.8%/qtr in the March quarter).

If the inflation data prints in line with our expectations, six-month annualised inflation will be 3.2% in Q1 24 – just a touch above the RBA’s 2-3% target band.

Advertisement

That does not mean the job of returning inflation to target is done. But the central bank will be close. When we arrive at that juncture we believe the uptrend in the unemployment rate will garner more focus.

Hiking bias likely to be retained, but it’s a close call:

The RBA Board retained a tightening bias in February as we anticipated, though the language shifted a little to, “a further increase in interest rates cannot be ruled out”.

Advertisement

Some market commentators were surprised that the RBA retained a tightening bias in February.

But for us, the soft hiking bias is an intended part of the Bank’s communication strategy until they are willing to declare the job is done on inflation fighting. Indeed it makes a lot of sense.

The RBA Board do not just communicate with market participants. They communicate with households, businesses and policymakers (i.e. government).

Advertisement

Maintaining a tightening bias signals to the fiscal authorities that it’s too early to declare the inflation fight over. The RBA would not wish to see fiscal settings loosened in a non-trivial way until further progress on inflation has been made towards the target band.

Further progress on bringing inflation back to target will be in the Q1 24 CPI, which prints on 24 April. But there is no need for the RBA’s communication strategy to pivot before the Board sees the hard data.

As such, we favour the Board once again retaining a mild tightening bias at the March meeting.

Advertisement

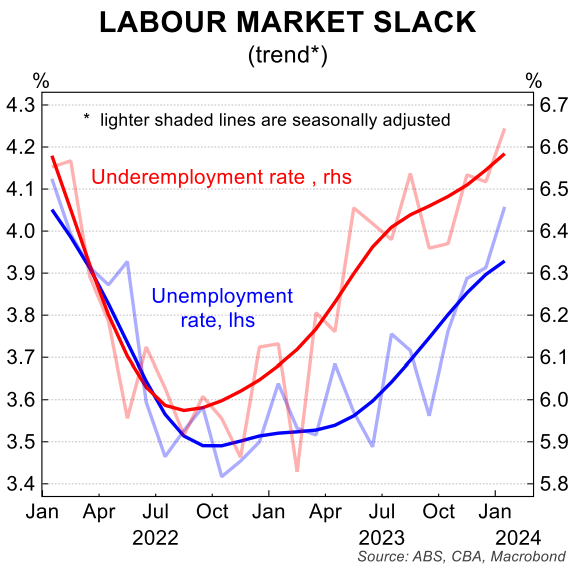

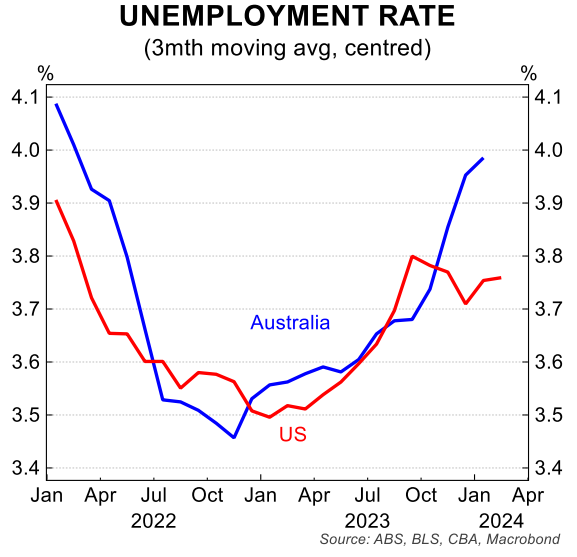

The Board’s assessment of the labour market in the March Statement will also warrant close scrutiny. Our view for some time has been that the labour market will loosen a little more quickly than the RBA is expecting.

The unemployment rate has increased by 0.5ppts over just four months (from September 2023 to January 2024). That said, the January data was clouded by a changing seasonal dynamic within the labour market around the time people started working after the summer holiday period.

Advertisement

The upshot is that the unemployment rate may tick down from 4.1% to 4.0% in February (that is our forecast – data released on 21 March).

The RBA will be aware of this potential statistical quirk. And given the February employment report prints after the March meeting the RBA may sound less concerned next week about the speed at which the labour market is loosening on a variety of measures.

Advertisement

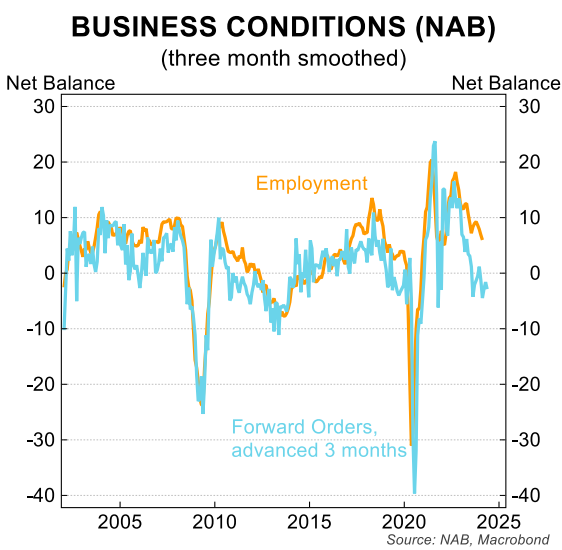

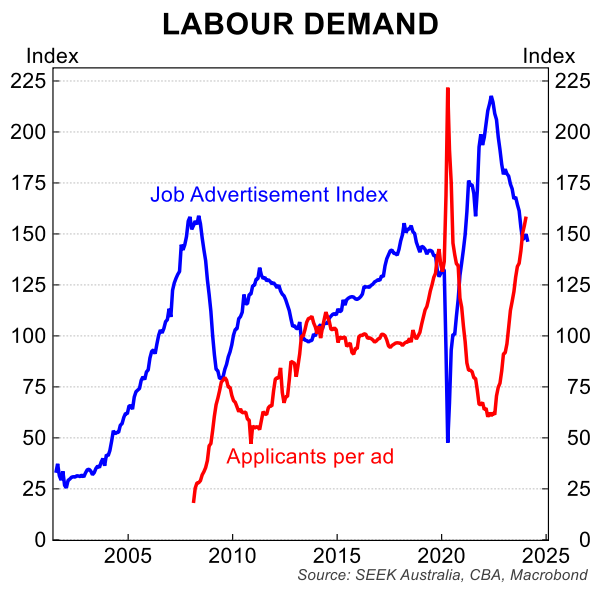

Forward orders for example in the NAB business survey point to a further softening in employment growth. And job ads are trending down at a swift pace.

Advertisement

Overall we expect a very similar message from the Board and Governor next week on how the economy is tracking to the communication we got in February.

With no Board meeting scheduled in April the RBA will have two employment reports ahead of the May meeting. And they will also be armed with the key Q1 24 inflation report.

At this stage we think the May Board meeting is the most likely one for the RBA to jettison its hiking bias. And our base case looks for a shift to an easing bias at the August meeting followed by the commencement of an easing cycle in September.

Advertisement