Brokers Offer Predictions for Ovintiv Inc.’s Q2 2024 Earnings (TSE:OVV)

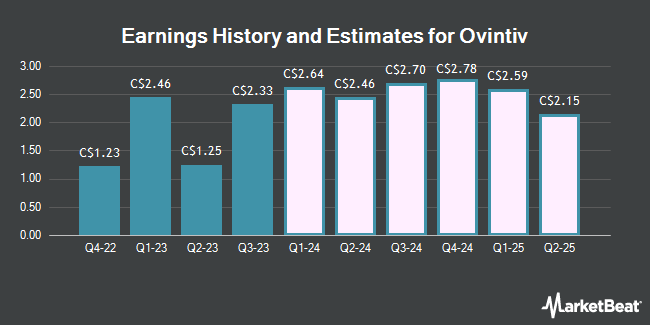

Ovintiv Inc. (TSE:OVV – Free Report) – Stock analysts at Zacks Research cut their Q2 2024 earnings estimates for shares of Ovintiv in a research note issued to investors on Wednesday, March 13th. Zacks Research analyst R. Department now anticipates that the company will post earnings of $1.50 per share for the quarter, down from their previous estimate of $2.16. The consensus estimate for Ovintiv’s current full-year earnings is $8.64 per share. Zacks Research also issued estimates for Ovintiv’s Q4 2024 earnings at $1.97 EPS, FY2024 earnings at $7.39 EPS, Q2 2025 earnings at $1.81 EPS, Q3 2025 earnings at $1.65 EPS, Q4 2025 earnings at $2.43 EPS and FY2025 earnings at $8.16 EPS.

Separately, Royal Bank of Canada boosted their target price on shares of Ovintiv from C$48.00 to C$49.00 and gave the stock a “sector perform” rating in a research report on Thursday, February 29th.

Ovintiv Price Performance

Shares of TSE OVV opened at C$68.36 on Monday. The firm has a market capitalization of C$18.42 billion, a P/E ratio of 6.43, a PEG ratio of 0.05 and a beta of 2.67. Ovintiv has a one year low of C$43.23 and a one year high of C$70.61. The company’s fifty day moving average is C$60.06 and its two-hundred day moving average is C$61.49. The company has a debt-to-equity ratio of 64.45, a quick ratio of 0.51 and a current ratio of 0.60.

Ovintiv Cuts Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Thursday, March 28th. Investors of record on Thursday, March 28th will be given a $0.403 dividend. The ex-dividend date is Thursday, March 14th. This represents a $1.61 annualized dividend and a dividend yield of 2.36%. Ovintiv’s dividend payout ratio is presently 15.24%.

About Ovintiv

Ovintiv Inc, together with its subsidiaries, explores, develops, produces, and markets natural gas, oil, and natural gas liquids in the United States and Canada. It operates through USA Operations, Canadian Operations, and Market Optimization segments. The company’s principal assets include Permian in west Texas and Anadarko in west-central Oklahoma; and Montney in northeast British Columbia and northwest Alberta.

See Also

Receive News & Ratings for Ovintiv Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Ovintiv and related companies with MarketBeat.com’s FREE daily email newsletter.