Brokers Set Expectations for BankUnited, Inc.’s Q1 2025 Earnings (NYSE:BKU)

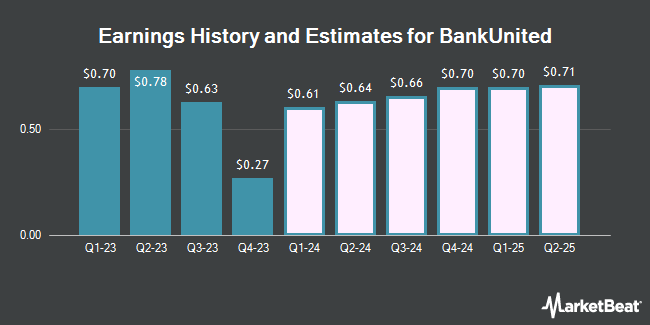

BankUnited, Inc. (NYSE:BKU – Free Report) – Stock analysts at Wedbush issued their Q1 2025 earnings per share estimates for shares of BankUnited in a research report issued to clients and investors on Wednesday, March 27th. Wedbush analyst D. Chiaverini anticipates that the financial services provider will earn $0.69 per share for the quarter. Wedbush currently has a “Neutral” rating and a $31.00 target price on the stock. The consensus estimate for BankUnited’s current full-year earnings is $2.72 per share. Wedbush also issued estimates for BankUnited’s Q2 2025 earnings at $0.71 EPS, Q3 2025 earnings at $0.73 EPS and Q4 2025 earnings at $0.72 EPS.

BKU has been the topic of several other reports. The Goldman Sachs Group boosted their price objective on BankUnited from $26.00 to $29.00 and gave the stock a “sell” rating in a research note on Monday, December 18th. Citigroup reduced their price objective on BankUnited from $34.00 to $33.00 and set a “neutral” rating on the stock in a research note on Monday, January 29th. Barclays started coverage on BankUnited in a research note on Friday, March 8th. They set an “equal weight” rating and a $29.00 price objective on the stock. Wells Fargo & Company upped their target price on BankUnited from $26.00 to $28.00 and gave the company an “equal weight” rating in a research note on Monday, January 29th. Finally, StockNews.com cut BankUnited from a “hold” rating to a “sell” rating in a research note on Friday, February 16th. Three equities research analysts have rated the stock with a sell rating and seven have given a hold rating to the stock. According to data from MarketBeat, BankUnited presently has an average rating of “Hold” and an average price target of $30.33.

Read Our Latest Analysis on BKU

BankUnited Trading Down 0.6 %

Shares of NYSE BKU opened at $28.00 on Thursday. The business’s 50 day moving average is $27.33 and its two-hundred day moving average is $26.66. The company has a debt-to-equity ratio of 1.98, a current ratio of 0.92 and a quick ratio of 0.92. BankUnited has a 1-year low of $15.83 and a 1-year high of $34.22. The stock has a market capitalization of $2.08 billion, a P/E ratio of 11.76 and a beta of 1.35.

BankUnited (NYSE:BKU – Get Free Report) last issued its quarterly earnings data on Friday, January 26th. The financial services provider reported $0.27 EPS for the quarter, missing analysts’ consensus estimates of $0.69 by ($0.42). The business had revenue of $500.30 million during the quarter, compared to analysts’ expectations of $244.11 million. BankUnited had a return on equity of 8.38% and a net margin of 9.19%. During the same period in the previous year, the business earned $0.82 earnings per share.

BankUnited Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Tuesday, April 30th. Investors of record on Friday, April 12th will be issued a $0.29 dividend. This is a positive change from BankUnited’s previous quarterly dividend of $0.27. The ex-dividend date of this dividend is Thursday, April 11th. This represents a $1.16 dividend on an annualized basis and a dividend yield of 4.14%. BankUnited’s payout ratio is presently 45.38%.

Insider Activity at BankUnited

In related news, insider Kevin A. Malcolm sold 2,285 shares of the business’s stock in a transaction that occurred on Tuesday, March 5th. The stock was sold at an average price of $27.18, for a total value of $62,106.30. Following the completion of the sale, the insider now owns 11,750 shares in the company, valued at $319,365. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. 1.09% of the stock is owned by company insiders.

Institutional Trading of BankUnited

Hedge funds have recently bought and sold shares of the stock. Nordea Investment Management AB lifted its holdings in BankUnited by 24.6% during the fourth quarter. Nordea Investment Management AB now owns 124,072 shares of the financial services provider’s stock worth $4,042,000 after buying an additional 24,498 shares during the period. FMR LLC lifted its holdings in shares of BankUnited by 23.2% during the 3rd quarter. FMR LLC now owns 1,539,176 shares of the financial services provider’s stock valued at $34,939,000 after purchasing an additional 290,232 shares during the last quarter. Schonfeld Strategic Advisors LLC lifted its holdings in shares of BankUnited by 84.6% during the 3rd quarter. Schonfeld Strategic Advisors LLC now owns 262,741 shares of the financial services provider’s stock valued at $5,964,000 after purchasing an additional 120,441 shares during the last quarter. O Shaughnessy Asset Management LLC lifted its holdings in shares of BankUnited by 129.1% during the 3rd quarter. O Shaughnessy Asset Management LLC now owns 70,116 shares of the financial services provider’s stock valued at $1,592,000 after purchasing an additional 39,507 shares during the last quarter. Finally, Graham Capital Management L.P. lifted its holdings in shares of BankUnited by 272.2% during the 3rd quarter. Graham Capital Management L.P. now owns 132,681 shares of the financial services provider’s stock valued at $3,012,000 after purchasing an additional 97,034 shares during the last quarter. Hedge funds and other institutional investors own 99.70% of the company’s stock.

About BankUnited

BankUnited, Inc operates as the bank holding company for BankUnited, a national banking association that provides a range of banking services in the United States. The company offers deposit products, such as checking, money market deposit, and savings accounts; certificates of deposit; and treasury, commercial payment, and cash management services.

Featured Stories

Receive News & Ratings for BankUnited Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for BankUnited and related companies with MarketBeat.com’s FREE daily email newsletter.