Brokers Set Expectations for Milestone Pharmaceuticals Inc.’s Q2 2024 Earnings (NASDAQ:MIST)

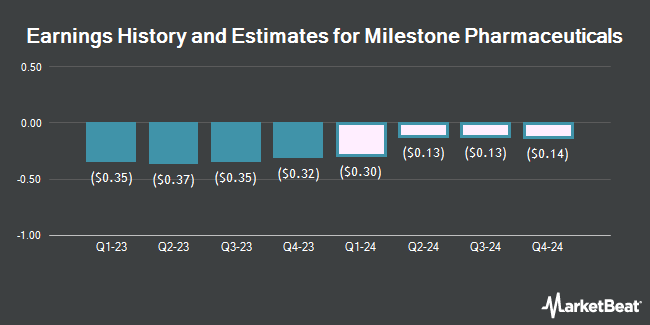

Milestone Pharmaceuticals Inc. (NASDAQ:MIST – Free Report) – Investment analysts at HC Wainwright boosted their Q2 2024 earnings per share (EPS) estimates for Milestone Pharmaceuticals in a report released on Thursday, May 16th. HC Wainwright analyst P. Trucchio now anticipates that the company will post earnings per share of ($0.13) for the quarter, up from their prior forecast of ($0.21). HC Wainwright currently has a “Buy” rating and a $25.00 target price on the stock. The consensus estimate for Milestone Pharmaceuticals’ current full-year earnings is ($0.79) per share. HC Wainwright also issued estimates for Milestone Pharmaceuticals’ Q3 2024 earnings at ($0.13) EPS, Q4 2024 earnings at ($0.14) EPS, FY2024 earnings at ($0.59) EPS, FY2025 earnings at ($0.70) EPS, FY2026 earnings at ($0.45) EPS, FY2027 earnings at $0.56 EPS and FY2028 earnings at $1.67 EPS.

Milestone Pharmaceuticals (NASDAQ:MIST – Get Free Report) last posted its quarterly earnings data on Thursday, March 21st. The company reported ($0.32) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.30) by ($0.02).

Separately, Piper Sandler lowered their price target on Milestone Pharmaceuticals from $6.00 to $5.00 and set an “overweight” rating on the stock in a research report on Tuesday, March 5th.

Get Our Latest Analysis on MIST

Milestone Pharmaceuticals Price Performance

NASDAQ:MIST opened at $1.74 on Monday. The stock has a fifty day moving average of $1.67 and a 200 day moving average of $1.96. Milestone Pharmaceuticals has a 52-week low of $1.33 and a 52-week high of $4.39. The company has a debt-to-equity ratio of 1.27, a quick ratio of 10.11 and a current ratio of 22.75. The firm has a market capitalization of $92.67 million, a price-to-earnings ratio of -1.39 and a beta of 1.77.

Institutional Inflows and Outflows

A hedge fund recently raised its stake in Milestone Pharmaceuticals stock. BML Capital Management LLC lifted its stake in Milestone Pharmaceuticals Inc. (NASDAQ:MIST – Free Report) by 37.0% during the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 606,145 shares of the company’s stock after buying an additional 163,793 shares during the period. Milestone Pharmaceuticals makes up approximately 0.7% of BML Capital Management LLC’s holdings, making the stock its 21st largest holding. BML Capital Management LLC owned about 1.14% of Milestone Pharmaceuticals worth $1,085,000 as of its most recent SEC filing. Institutional investors and hedge funds own 86.18% of the company’s stock.

About Milestone Pharmaceuticals

Milestone Pharmaceuticals Inc, a biopharmaceutical company, focuses on the development and commercialization of cardiovascular medicines. The company’s lead product candidate is etripamil, a novel and potent calcium channel blocker, which is in Phase III clinical trial for the treatment of paroxysmal supraventricular tachycardia in the United States and Canada; and Phase II clinical trial for the treatment of atrial fibrillation and rapid ventricular rate.

Featured Articles

Receive News & Ratings for Milestone Pharmaceuticals Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Milestone Pharmaceuticals and related companies with MarketBeat.com’s FREE daily email newsletter.