Brokers Issue Forecasts for Wells Fargo & Company’s Q2 2024 Earnings (NYSE:WFC)

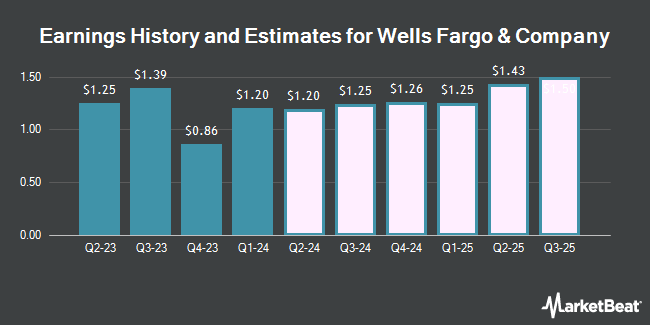

Wells Fargo & Company (NYSE:WFC – Free Report) – Stock analysts at Seaport Res Ptn reduced their Q2 2024 earnings per share estimates for Wells Fargo & Company in a report issued on Sunday, April 14th. Seaport Res Ptn analyst J. Mitchell now expects that the financial services provider will earn $1.32 per share for the quarter, down from their previous estimate of $1.36. The consensus estimate for Wells Fargo & Company’s current full-year earnings is $4.86 per share. Seaport Res Ptn also issued estimates for Wells Fargo & Company’s Q3 2024 earnings at $1.39 EPS and Q4 2025 earnings at $1.58 EPS.

Wells Fargo & Company (NYSE:WFC – Get Free Report) last announced its quarterly earnings data on Friday, April 12th. The financial services provider reported $1.20 earnings per share for the quarter, beating the consensus estimate of $1.10 by $0.10. Wells Fargo & Company had a return on equity of 12.30% and a net margin of 15.63%. The business had revenue of $20.86 billion during the quarter, compared to analyst estimates of $20.19 billion. During the same period in the prior year, the company earned $1.23 earnings per share. Wells Fargo & Company’s revenue was up .6% compared to the same quarter last year.

A number of other research firms have also commented on WFC. Jefferies Financial Group raised their price target on Wells Fargo & Company from $52.00 to $60.00 and gave the stock a “hold” rating in a report on Monday, April 8th. Argus raised their price target on Wells Fargo & Company from $57.00 to $66.00 and gave the stock a “buy” rating in a report on Monday. The Goldman Sachs Group raised their price target on Wells Fargo & Company from $57.00 to $65.00 and gave the stock a “buy” rating in a report on Monday, April 1st. Piper Sandler lowered their price objective on Wells Fargo & Company from $51.00 to $50.00 and set a “neutral” rating on the stock in a research report on Tuesday, January 16th. Finally, Oppenheimer reiterated a “market perform” rating on shares of Wells Fargo & Company in a research report on Monday. Thirteen investment analysts have rated the stock with a hold rating, six have given a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat, the stock has an average rating of “Hold” and a consensus price target of $58.85.

Get Our Latest Analysis on WFC

Wells Fargo & Company Price Performance

Shares of NYSE WFC opened at $57.18 on Wednesday. Wells Fargo & Company has a 1-year low of $36.40 and a 1-year high of $58.44. The stock has a fifty day simple moving average of $55.42 and a two-hundred day simple moving average of $48.61. The company has a current ratio of 0.87, a quick ratio of 0.86 and a debt-to-equity ratio of 1.14. The firm has a market cap of $202.44 billion, a price-to-earnings ratio of 11.94, a price-to-earnings-growth ratio of 1.15 and a beta of 1.19.

Wells Fargo & Company Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Friday, March 1st. Investors of record on Friday, February 2nd were paid a $0.35 dividend. The ex-dividend date was Thursday, February 1st. This represents a $1.40 annualized dividend and a dividend yield of 2.45%. Wells Fargo & Company’s payout ratio is presently 29.23%.

Institutional Trading of Wells Fargo & Company

Several large investors have recently modified their holdings of the business. Lazari Capital Management Inc. increased its position in shares of Wells Fargo & Company by 0.9% during the fourth quarter. Lazari Capital Management Inc. now owns 22,804 shares of the financial services provider’s stock worth $1,122,000 after acquiring an additional 202 shares during the period. Webster Bank N. A. boosted its stake in shares of Wells Fargo & Company by 2.0% during the first quarter. Webster Bank N. A. now owns 10,153 shares of the financial services provider’s stock valued at $588,000 after purchasing an additional 202 shares in the last quarter. First Financial Corp IN boosted its stake in shares of Wells Fargo & Company by 4.9% during the fourth quarter. First Financial Corp IN now owns 4,595 shares of the financial services provider’s stock valued at $226,000 after purchasing an additional 214 shares in the last quarter. CX Institutional boosted its stake in shares of Wells Fargo & Company by 1.1% during the fourth quarter. CX Institutional now owns 20,280 shares of the financial services provider’s stock valued at $998,000 after purchasing an additional 217 shares in the last quarter. Finally, Cape Investment Advisory Inc. boosted its stake in shares of Wells Fargo & Company by 3.4% during the fourth quarter. Cape Investment Advisory Inc. now owns 6,746 shares of the financial services provider’s stock valued at $332,000 after purchasing an additional 219 shares in the last quarter. 75.90% of the stock is owned by institutional investors.

Wells Fargo & Company Company Profile

Wells Fargo & Company, a financial services company, provides diversified banking, investment, mortgage, and consumer and commercial finance products and services in the United States and internationally. The company operates through four segments: Consumer Banking and Lending; Commercial Banking; Corporate and Investment Banking; and Wealth and Investment Management.

See Also

Receive News & Ratings for Wells Fargo & Company Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Wells Fargo & Company and related companies with MarketBeat.com’s FREE daily email newsletter.