Aligns with EPS Projections, Surpasses …

-

Earnings Per Share (EPS): Reported GAAP diluted EPS of $1.61 and adjusted EPS of $1.64, aligning closely with analyst estimates of $1.63.

-

Revenue: Reported GAAP net revenues of $1,203 million and adjusted net revenues of $1,216 million, surpassing the estimated $1,204.63 million.

-

Net Income: Net income available for common stockholders stood at $175 million, up from $148 million in the year-ago quarter.

-

Dividend: Quarterly dividend increased from $0.10 to $0.25 per share.

-

Balance Sheet Strength: Total assets rose to $132,238 million as of March 31, 2024, from $128,423 million at the end of 2023.

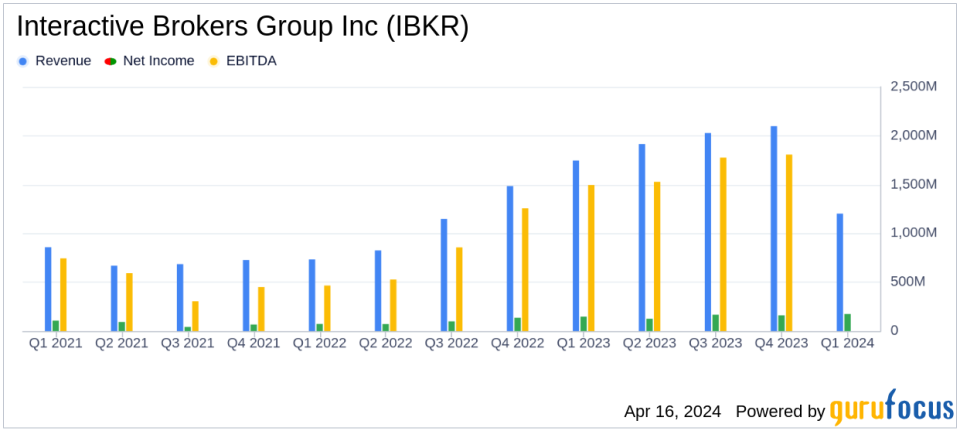

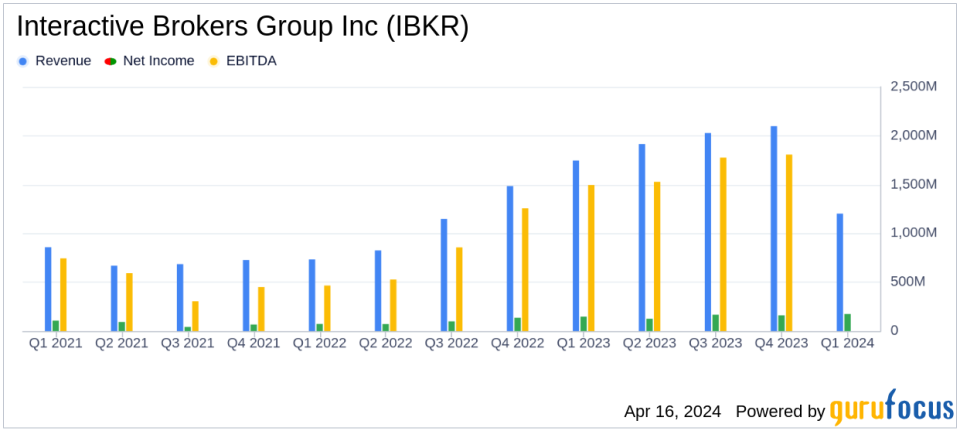

On April 16, 2024, Interactive Brokers Group Inc (NASDAQ:IBKR) released its 8-K filing, announcing its financial results for the first quarter ended March 31, 2024. The company, a leading automated global electronic broker, reported a GAAP diluted EPS of $1.61 and adjusted EPS of $1.64, which is consistent with analyst expectations. The revenue figures exceeded analyst forecasts, with GAAP net revenues at $1,203 million and adjusted net revenues reaching $1,216 million.

Interactive Brokers operates primarily through generating trading commissions, net interest income from client cash balances, and fees from ancillary services. With about 70% of its net revenue derived from the U.S. market and 30% internationally, the company has maintained a robust financial position. This quarter also saw a significant increase in the quarterly dividend to $0.25 per share, payable on June 14, 2024, to shareholders of record as of May 31, 2024.

Financial Performance and Strategic Highlights

The company’s performance this quarter reflects a solid increase in net income and revenues compared to the same period last year. The net income available for common stockholders increased from $148 million in Q1 2023 to $175 million in Q1 2024. This growth is underpinned by a substantial rise in both interest income and non-interest income, highlighting the company’s diversified revenue streams.

Interactive Brokers continues to enhance its platform and services, focusing on providing sophisticated trading and risk management tools, research facilities, and investment products at competitive prices. This strategy not only supports client engagement and satisfaction but also drives financial growth.

Challenges and Forward Outlook

Despite the positive financial outcomes, the company faced a $104 million decrease in comprehensive earnings due to its currency diversification strategy, affected by a 0.73% decrease in the U.S. dollar value of the GLOBAL basket. This highlights the risks associated with currency fluctuations in a globally diversified portfolio.

Looking ahead, Interactive Brokers remains committed to leveraging its technology-driven platform to sustain growth and improve operational efficiencies. The increase in executed order volumes, as evidenced by a 19% rise in customer orders and a 16% increase in principal orders from the previous quarter, indicates a strong market presence and the potential for further revenue growth.

For more detailed financial information and future updates, investors and interested parties are encouraged to attend the company’s conference call or access the webcast through the Interactive Brokers investor relations website.

Explore the complete 8-K earnings release (here) from Interactive Brokers Group Inc for further details.

This article first appeared on GuruFocus.