Taylor Swift could help avoid Australia recession

As recession risks in Australia mount, one unexpected factor could deliver a boost to the economy just when it’s under maximum pressure from the Reserve Bank’s aggressive interest-rate increases: Taylor Swift.

The pop icon recently added Australia to her Eras tour, bringing it to a total of 106 shows worldwide before bowing out in London in mid-2024. The tour is touted as the biggest ever, with the potential to generate more than $1 billion.

Swift’s Australia leg runs Feb. 16-25 and includes three performances in Sydney and two in Melbourne. The limited schedule suggests Swifties are likely to travel from other states and potentially New Zealand to see the shows.

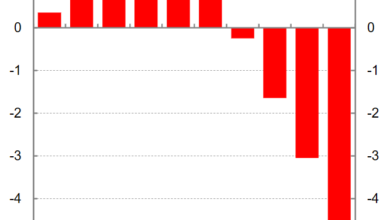

The timing may prove fortuitous as Australia’s economy is seen slowing to a crawl in the period ahead. The household savings ratio slid to 3.7% in the first quarter — highlighting an income squeeze — from a peak of 23.6% in mid-2020.

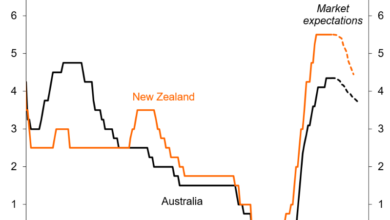

“The pull of mega acts might be enough to help some consumers overcome subdued confidence and spend,” said James McIntyre at Bloomberg Economics. “That could be a good thing for the economy, with the potential uptick in services spending in the first quarter of 2024 helping boost GDP at a time when the full force of the RBA’s 2022 and 2023 rate hikes are curbing demand.”

Economists highlighted that spending on air tickets and hotels is likely to be staggered between now and year’s end, making it difficult to quantify the impact on consumption. They also see a substitution in spending for concert tickets and associated services rather than additional outlays.

AMP Capital Markets holds the consensus view that the chances of a recession in Australia’s A$2.3 trillion ($1.5 billion) economy are about one-in-two.

“If Taylor Swift can prevent an Australian recession then she is an even bigger queen than I thought,” said Diana Mousina, deputy chief economist at AMP.

“If her concert happened right now you’d probably see a bit of a Taylor-effect, but because it’s happening in February, there’s a good chance we’ll already be in a recession.”

Beyoncé’s tour of Sweden produced an inflation blip in May as the superstar drew more than 80,000 concert-goers over two nights in Stockholm. Mousina said such an impact is unlikely to be replicated in Australia.

“We saw the Beyonce effect on Swedish inflation because it lifted demand for accommodation and eating out at a time when you are already seeing pretty solid services spending,” she said. “But February is quite a long time away and I think the landscape of Australia’s economy will look quite different then.”

Australia reports May inflation on Wednesday and economists forecast it eased to 6.1% from 6.8% a month earlier.

The Midnights songstress’ most expensive package in Sydney and Melbourne sets fans back A$1,249. For that, Swifties will receive an “unforgettable A-Reserve floor ticket” and “exclusive VIP merchandise.” A simple seat in A-Reserve is listed at A$379.90, declining to A$79.90 for G Reserve.

A search of Sydney hotels on travel aggregator booking.com for the weekend of Feb. 23 showed only four for under A$200 a night, compared with 13 on the prior weekend. That suggests accommodation-price inflation in anticipation.

“With interest rates going up and where the economy is likely to be at that time we don’t think will this spending will provide a boost,” said Pat Bustamante at St. George. “If anything, you could have substitution expenditure toward show tickets and travel.”

Prime Minister Anthony Albanese, a self-proclaimed Swiftie, said he hopes to secure a ticket to see the star. There’s “very old footage of me DJing with Tay-Tay,” he told a Queensland FM radio station on Tuesday.

“The Tay-Tay fever is here. It will be here for many months leading up to the gig so I’m just hoping I can get a ticket.”